When Jeb Bush formally announced his candidacy for US president yesterday (June 16), he used his record as Florida’s governor to set a big economic marker for the country under a new Bush administration: 4% economic growth each year.

From his prepared remarks:

So many challenges could be overcome if we just get this economy growing at full strength. There is not a reason in the world why we cannot grow at a rate of four percent a year.

And that will be my goal as president–four percent growth, and the 19 million new jobs that come with it

…It’s possible. It can be done. We made Florida number one in job creation and number one in small business creation. 1.3 million new jobs, 4.4 percent growth, higher family income, eight balanced budgets, and tax cuts eight years in a row that saved our people and businesses 19 billion dollars.

So how realistic is the record, and the promise?

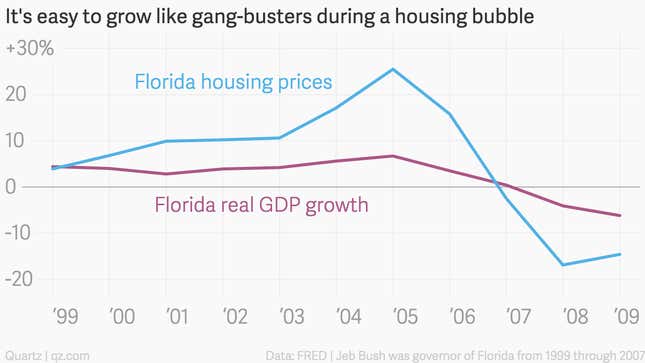

As Florida’s governor from 1999 to 2007, Bush presided over some amazing economic growth. But much of it was driven by a massive housing bubble that occurred nationwide and was deeply felt in Florida, where housing speculation is part of the DNA. It’s not too hard to generate a GDP growth rate as high as 6.7% when the average home has increased in value by 25.5% in the same year:

After Bush left office due to term limits, the housing bubble popped—and with it, Florida’s economy. After two years of recession, Florida has returned to growth, but nowhere near as high as the days when a developer could attempt to build the country’s most expensive home.

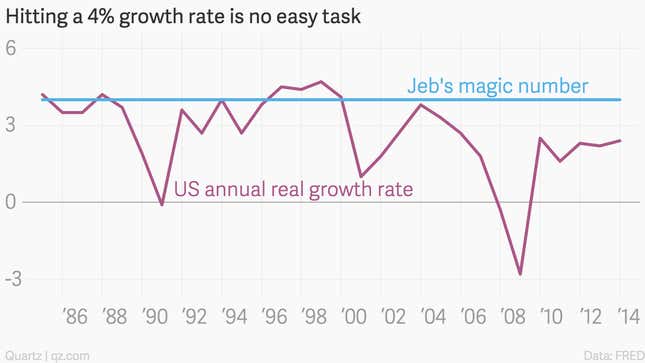

Meeting a 4% growth goal nationally will be difficult without the kind of help Bush got in Florida from the housing market. In the past 30 years, the US has only hit that number during the late 1980s, after a major tax overhaul and a boost from the Savings & Loan bubble, and during the late 1990s, during the height of the tech bubble:

Former US Treasury secretary Larry Summers, analyzing these trends (pdf), has despaired about reaching growth levels of this kind again without bubbles that lead to the inevitable crash. The factors that make for big growth—more hours worked, more productivity, and more capital investment—all appear to be trending downward in the wake of the recession and as the US population ages. While not everyone agrees with Summers, it’s the rare economist who thinks that such large annual growth rates will come easily in advanced economies.

Nonetheless, policy prescriptions abound: Structural reforms to the tax code or the US immigration system could do wonders to boost investment and the labor force, and trade deals could help boost growth on the margins. You would expect a hypothetical Bush administration to pursue all three, but finding effective results would be no easy task. Another option might be public investment in infrastructure and research, but it’s hard to see more funding directed that way by a Bush administration.

At least we can say the Republican field has moderated a little since the last election cycle, when former Minnesota governor Tim Pawlenty promised 5% growth during his failed 2012 presidential bid.