Americans hoping for a bigger paycheck got a jolt in the second quarter.

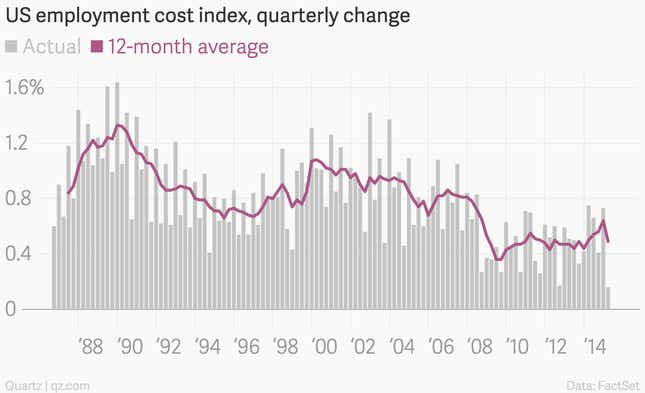

The employment cost index, a quarterly Bureau of Labor Statistics survey on wages, rose 0.2% in the second quarter, way lower than expectations (0.6%). It was the lowest quarterly increase going back to 1982, when the bureau started tracking the data.

It was a serious fall off from the 0.7% growth in the first quarter, which had been a pretty encouraging reading. Shorter-term US Treasury debt rallied a bit after the data came out, suggesting the economic update made the markets less convinced that the Federal Reserve will raise interest rates later this year.

However, others viewed the lousy reading as an anomaly driven by one-off factors. “[W]e believe that this report does not reflect a germane deterioration in underlying inflation dynamics, and will have little bearing on the Fed’s deliberation on policy,” wrote Millan Mulraine, deputy head of US strategy at TD Securities, in a note to investors.