April’s rush leaves Hong Kong jewelry stores bare for Golden Week

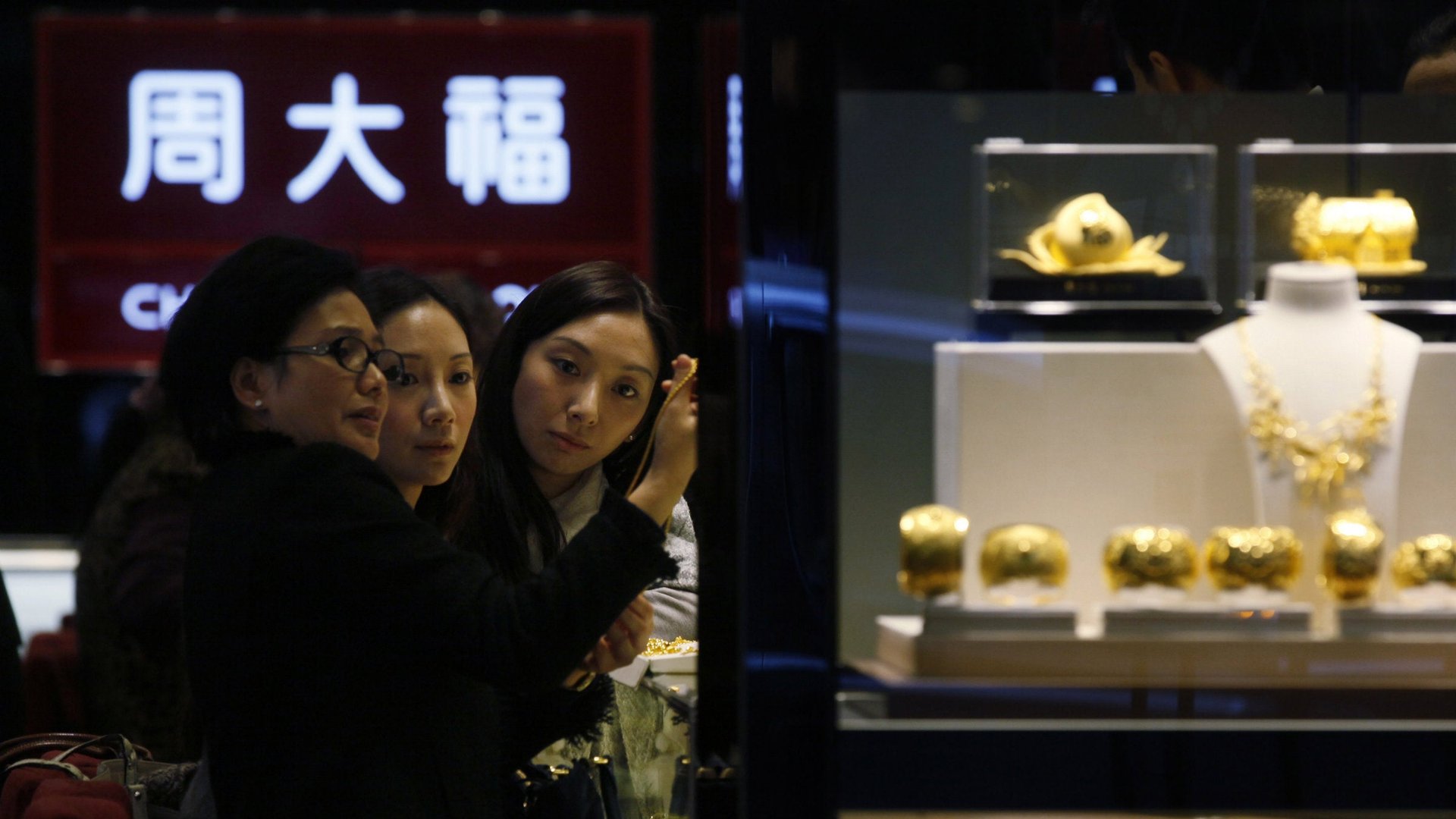

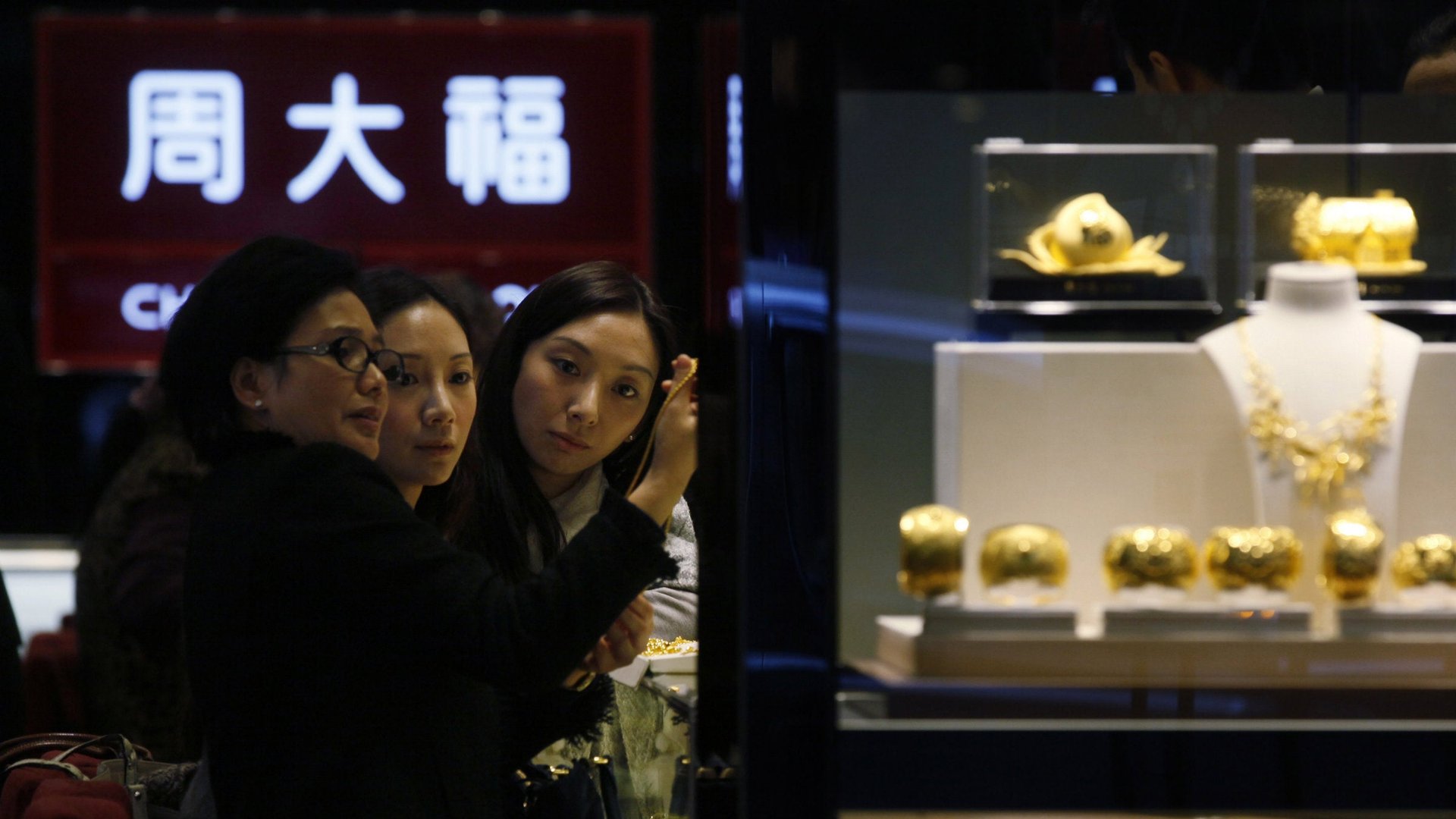

Golden Week came early this year in Hong Kong. The Labour Day holiday during the week of May 1 has traditionally been one of three national holidays when mainland Chinese tourists flock to the tax-free Special Administrative Region to load up on all kinds of luxury goods—especially gold jewelry.

Golden Week came early this year in Hong Kong. The Labour Day holiday during the week of May 1 has traditionally been one of three national holidays when mainland Chinese tourists flock to the tax-free Special Administrative Region to load up on all kinds of luxury goods—especially gold jewelry.

But this year a plunge in gold prices in mid-April sent many shoppers rushing to the stores ahead of time. Gold futures fell 9 percent to $1,361 per ounce on April 15, part of a steady slide from a $1,900 per ounce peak in August 2011. The dramatic drop triggered a buying frenzy. Some Chinese news outlets equated the atmosphere at jewelry stores to “buying bok choi,” an inexpensive vegetable that grocery shoppers would purchase without concern for haggling.

In Hong Kong, many of the most highly sought items—bulky gold wedding bands and necklaces, even gold bars—have been sold out for more than a week.

“This is something I’ve never seen in over thirty years working in this industry,” said Haywood Cheung, president of Hong Kong’s Chinese Gold and Silver Exchange Society. “Normally people would look at a major collapse of gold price and they would at least wait a day or two to make sure that the gold prices will be steady. In this case they didn’t care. They just came in to buy, buy, buy.”

A similar buying frenzy took place in India. International gold prices have since rebounded slightly to about $1,470 per ounce.

Cheung said many Hong Kong companies had to replenish stock of gold bars and bullion sold-off to customers, ordering them from Zurich and London: “All of these physical goldsmiths are expecting goods delivered sometimes on Wednesday (May 1). By then, I think the supply of gold should be steady.”

Some members of the exchange were only taking orders for Labor Day; for clunky gold bracelets, they have delayed orders by 40 days. Nancy Wong, executive director of Lukfook Group, said her jewelers allow customers to place orders for out-of-stock items at the spot gold price because of the huge demand.

Chinese “people view the recent gold price as a good opportunity to purchase gold for investment and wedding purpose,” Wong said. Chinese wedding customs require parents to adorn daughters with gold bracelets and necklaces as a dowry.

On Monday, the mood inside jewelry stores along Nathan Road seemed notably subdued compared to the frenzy earlier in the month. Almost all customers were tourists from the mainland, speaking on the phone with family members back home, asking what they wanted, how big, and what style based on the limited merchandise available. Instead of recklessly “buying bok choi,” most were complaining about that prices were not much cheaper than jewelry available across the border.

At a Chow Sang Sang jewelry store in Mong Kok, a saleswoman urged on a customer who was evaluating two gold bracelets: “It doesn’t matter if you don’t need it now. You can hold onto it until she’s ready to marry.” The customer’s five-year-old daughter sat in a nearby chair.