Key GOP senator warns of bond-market backlash if Trump fires Powell

Concerns have flared among Republicans that Trump could set off a bond-market meltdown if he tries installing an acolyte before Powell's term ends

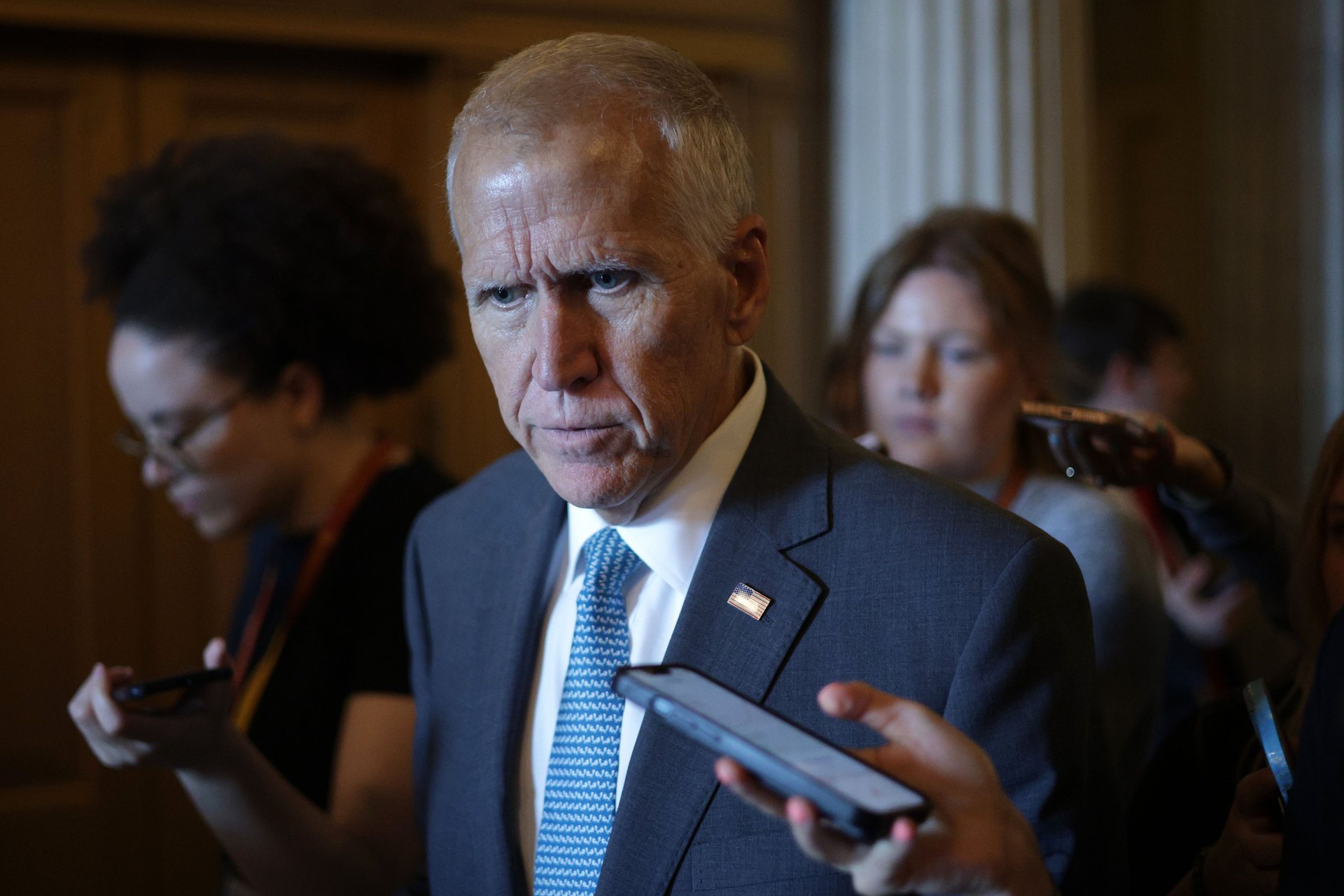

GOP Sen. Thom Tillis of North Carolina speaks to reporters at the U.S. Capitol. (Alex Wong/Getty Images)

One prominent Republican senator mounted a vigorous defense of the Federal Reserve's independence on Thursday, arguing that bond markets would go haywire if President Donald Trump tried firing Fed Chair Jerome Powell as he's flirted with recently.

Suggested Reading

Earlier this week, Trump privately told a group of House conservatives that he was leaning toward ousting Powell in what would amount to an extraordinary escalation in his scorched-earth campaign for lower interest rates. He publicly downplayed the possibility on Wednesday.

Related Content

But concerns have flared among Republicans that Trump could set off a bond-market meltdown in the event he tries installing an acolyte before Powell's term ends in May 2026.

"Terminating Chairman Powell risks a protracted legal battle with potential economic consequences like the disruptions we briefly saw in U.S. Treasury and dollar markets yesterday," Sen. Thom Tillis of North Carolina, a senior member of the Senate Banking Committee, posted on X. "These impacts will only threaten the foundation for long-term economic growth, including all the economic progress made by President Trump over the last six months."

Investors in early April offloaded their U.S. government bonds after Trump launched his trade war with a fusillade of tariffs worldwide. Days later, surging yields for 10 and 30-year government bonds led Trump to pause his campaign, at least temporarily until he started anew this month. Those bonds — which determine what borrowers pay for mortgages, auto loans, and business credit — briefly jumped again on Wednesday.

Tillis, who announced his retirement earlier this month, wasn't the only GOP senator defending Powell. Senate Majority Leader John Thune backed up Fed independence as well on Wednesday.

"I think the markets want an independent Federal Reserve," Thune said in a Fox News interview. "I think they want a central bank that isn't subject to the whims of politics."

Those arguments don't appear be resonating with the White House, which isn't letting up in its intense campaign against Powell. Trump has repeatedly demanded Powell lower interest rates by at least two basis points, even though the decision isn't solely up to him.

The Office of Management and Budget director Russell Vought said Thursday that he is working to set up a visit to the site of the $2.5 billion renovation of the Fed's century-old headquarters near the National Mall. Federal Housing Finance Agency director Bill Pulte has also expressed interest in visiting.

“This is an institution that has no accountability, and so a little bit of accountability to ask questions, a two-page letter, and allow a site visit so we can get to the bottom of this and have the National Planning Commission ask questions is not too much to ask,” Vought told reporters outside the White House.

A Federal Reserve spokesperson declined to comment. Powell has maintained he will serve out the last nine months of his term, and recently requested the new Fed inspector general Michael Horowitz to review the project.