How China’s poorest regions are going to save its growth rate

China is undergoing a dramatic shift in its economic geography. In 2001, Chinese coastal residents on average had an income that was 2.4 times that of their inland brethren. By 2011 this ratio fell to only 1.9 times. Analyzing this collapsing income gap between the interior and the coast paints a much more optimistic picture of the sustainability of China’s investment and growth.

China is undergoing a dramatic shift in its economic geography. In 2001, Chinese coastal residents on average had an income that was 2.4 times that of their inland brethren. By 2011 this ratio fell to only 1.9 times. Analyzing this collapsing income gap between the interior and the coast paints a much more optimistic picture of the sustainability of China’s investment and growth.

From 2001 to 2011, the Chinese economy grew at an average annual rate of 11.6% percent, whereas the US economy grew at only 1.8%. Does this mean that the Chinese system is “better” at delivering growth? Not really. The primary reason for this difference is because China is still so poor. As former World Bank chief economist Justin Lin has noted, China’s relative backwardness in technology means it can grow through “imitation, import, and/or integration of existing technologies and industries.” At this stage, the Chinese economy does not need to invent—it needs only to build. As a result, China is enjoying a period of accelerated growth as it catches up with the West—a process that economists call convergence.

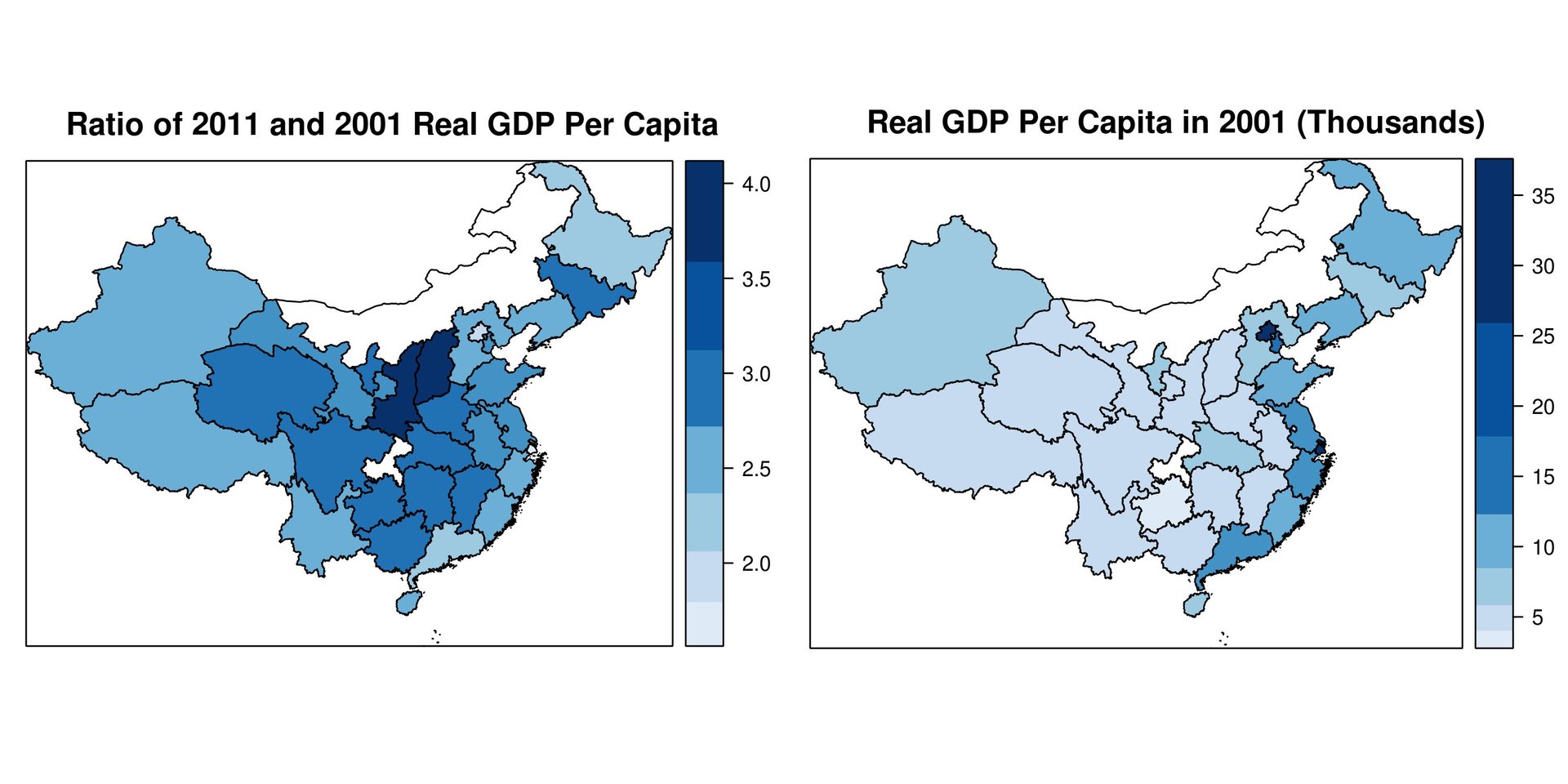

But what is true for China relative to the world is also true for Chinese provinces relative to each other. As seen in the maps above, the highest provincial growth rates from 2001 to 2011 have occurred among the inland Chinese provinces, which were also the poorest. As an example of this phenomenon, consider the decision by many manufacturing companies to move production inland. “Henan and Sichuan have always been the largest sources of migrant workers. That was why we moved to both of these provinces to tap their labor pool,” says Foxconn spokesman Louis Woo. As a result of this inland growth, in the span of 10 years, inland Chinese residents have on average seen their incomes rise by a factor of 3.2, whereas coastal residents have had their incomes rise by only a factor of 2.6. Therefore income levels in inland provinces are catching up to those on the coast.

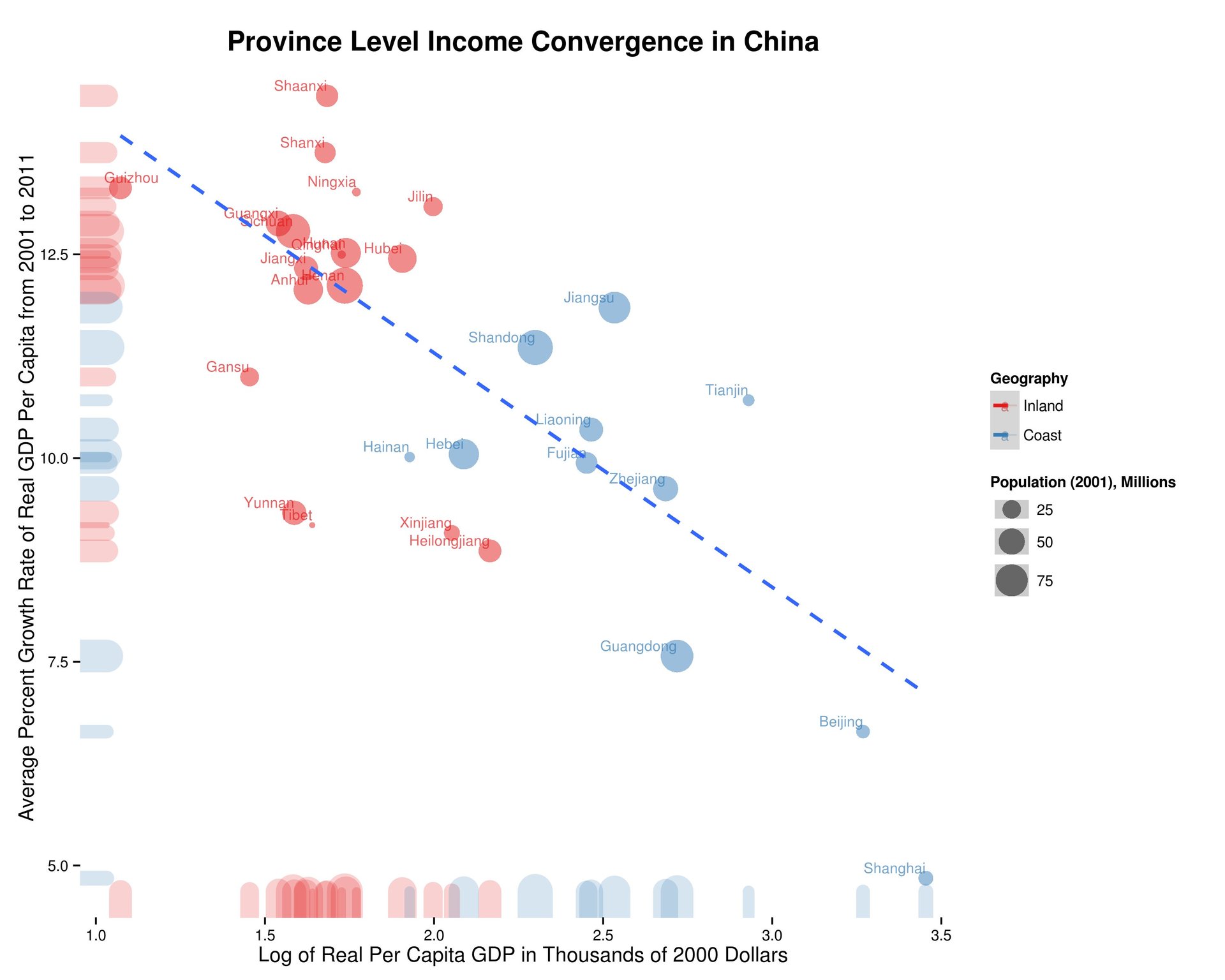

Another way of visualizing this convergence is to consider the relationship between a province’s initial income level in 2001 and its growth rate over the subsequent decade. As seen in the plot below, there was a significant negative correlation between the two. In fact, it explains over 50% of the variation in growth rates in this sample. The negative relationship means that poorer provinces have tended to grow faster than rich ones. On average, a doubling of a province’s initial per capita income in 2001 lowered its average growth rate in the subsequent decade by about 2%. So even as the coast slows down, inland China picks up and incomes converge.

This change in Chinese economic geography has a wide range of implications for both the short and long term.

First, regional convergence makes a sudden stop in Chinese growth implausible. If growth were to fall to 4%, that would demand that growth in inland provinces be substantially worse than the growth rates of coastal China 10 years prior. But why should the Hubei of 2011 be unable to attain growth rates comparable to Guangdong when it was at the same income level 10 years ago? As discussed above, manufacturing, the previous engine of coastal growth, is moving inland. This suggests that the coastal model of growth may still be applicable for inland China.

Others have raised the argument that inland China’s institutions are worse than those of coastal China (sign up required), and therefore inland China’s growth will fail to be as fast. But even if inland China suffers from more extractive institutions right now, there’s nothing intrinsic to those provinces that should keep them stay that way. In fact, strong growth can spark a virtuous cycle of institutional reform and help inland China follow the growth path previously blazed by the coast.

Second, any worries about impending social unrest as the result of slowing growth are likely overblown. Because social unrest in China is typically local, focusing on national GDP growth is very misleading. Instead, it’s provincial level growth that matters. On this point, the data is quite optimistic. From 2011 to 2012, the average per capita income growth rate in inland provinces was around 11%, whereas the average for coastal provinces was only 7%. Although the coastal provinces may have suffered lower rates of growth, they already have relatively high incomes. Therefore no matter what, income levels and growth rates should be high enough to placate any mass scale social unrest.

Third, regional convergence means that China’s long-run growth rates will still be quite high for the next decade. Because provinces such as Anhui, Hubei, and Sichuan are still very poor, there is room for them to catch up. So with the assumption that growth in the provinces for the next 10 years follows the same relationship between income and growth observed from 2001 to 2011, then China will still be able to maintain a growth rate of 7.7%. This makes the recent 7.5% target set by Lin (paywall) seem quite moderate and grounded on long term fundamentals.

While this growth prediction may seem high in light of recent bearishness towards China, it is actually more likely to be an underestimate of China’s real growth potential. If the provinces were to follow the same convergence path as in 2001 to 2011, that would imply that the only remaining factor in Chinese economic growth is for provinces to accumulate capital, and that advances in technology will no longer play a role. But as discussed above, China is still very far from the frontier of technology development. This means that by adopting more western technology, the Chinese government still has the potential to further propel growth beyond 7.7%.

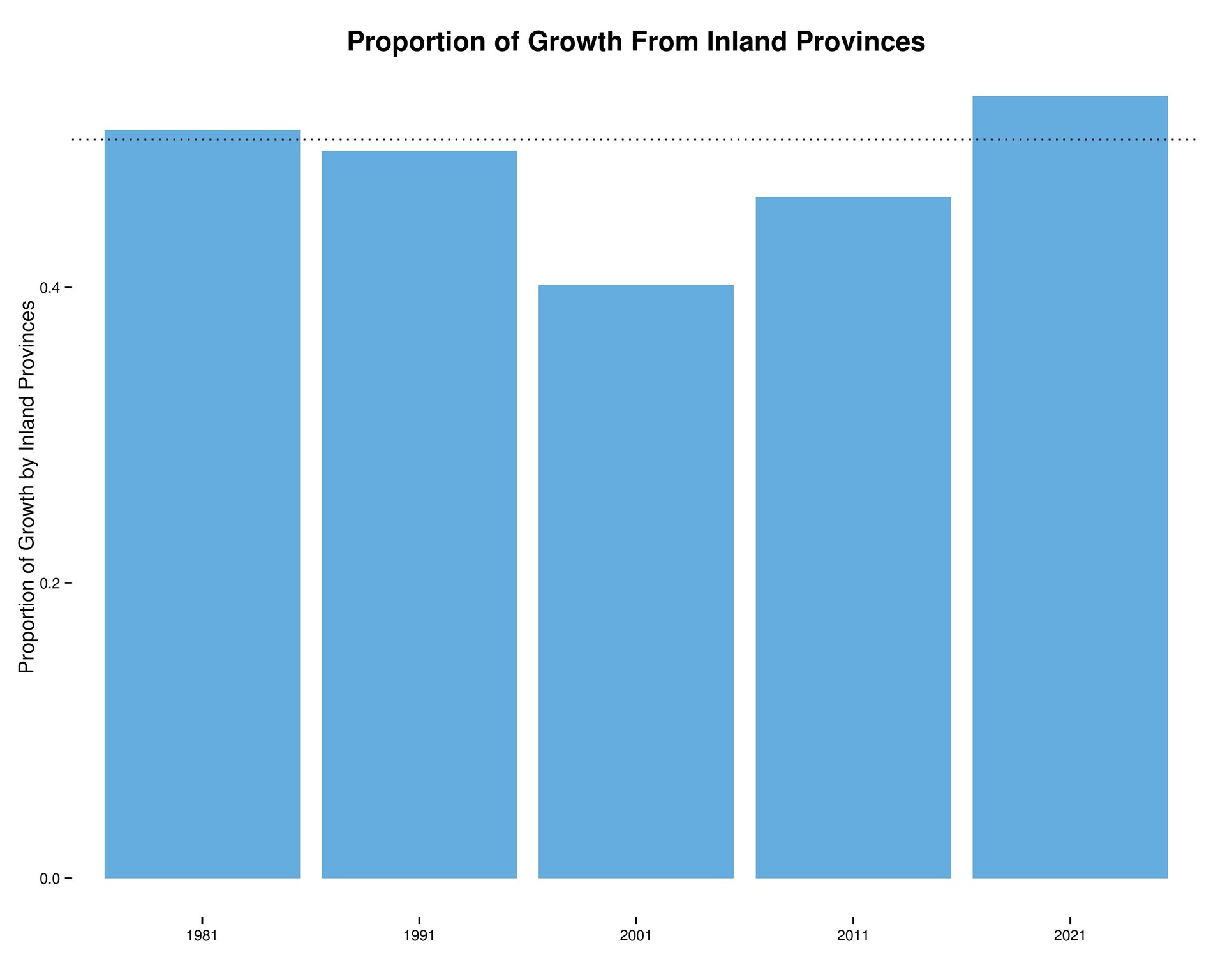

Moreover, as China’s economic center of gravity moves inland, the inland provinces will be able to contribute more to GDP growth. Just as emerging markets are starting to make a larger contribution to global growth, inland provinces are starting to make a larger contribution to Chinese growth. From 2001 to 2011, inland China contributed to 46% of the growth in real GDP, compared to 40% over the previous 10 year period. If Chinese provinces converge as described above, this proportion will rise to 54% by 2021. Because inland provinces now make up a larger share of GDP, their relatively high growth rates will take up a larger proportion of total Chinese growth. Therefore so long as the inland provinces can maintain their current growth path, China’s national growth rate will not collapse.

Fourth, convergence makes claims of excessive investment in inland provinces (pdf), much less credible. Recently, there has been concern that China’s real estate investment, particularly in the inland provinces, has created too much excess capacity. But since China’s inland population of over 700 million will roughly double its income over the next 10 years, growth will create the demand for much of the new housing being built in those areas. Therefore the much maligned ghost cities may soon be crowded by a rising Chinese middle class.

Similarly, the increase in wealth will put transportation infrastructure under greater pressure and the “overinvested” white elephants in the inland provinces may turn brown in the dust of growth. A recent video of a Beijing subway transfer line during rush hour serves as a reminder of just how much infrastructure will still be needed in the inland provinces as their incomes converge to those on the coast. The bottom line is that China, with its high growth rates, can “grow into” its capital stock. While this policy may have hurt Chinese households by denying them many years of more consumption, strong growth trends mean that the foundations for growth are still there and there is no reason for all of the accumulated investment and capacity to go to waste.

So when Paul Krugman boldly declares that China will suffer from a sudden drop in growth, the first question that should be asked is “which China?” Because economic conditions differ so widely across provinces, to speak of a unified level of Chinese development obscures the underlying regional patterns of growth. These patterns lead to a different understanding of the economic data and a much brighter outlook for the Chinese economy. Even if growth in developing countries must eventually slow down, a look inland shows that the mini-countries we call Chinese provinces still have a long way to go.

(Note: Nominal GDP numbers for each province are from the University of Michigan China Data Center. To get real GDP values, the nominal GDP levels were deflated by the China national level GDP deflator as provided by the World Bank World Development Indicators.)