The public shame of soaring US student debt

Everybody knows that US student debt is rising sharply. (We’ve covered it quite a bit.)

Everybody knows that US student debt is rising sharply. (We’ve covered it quite a bit.)

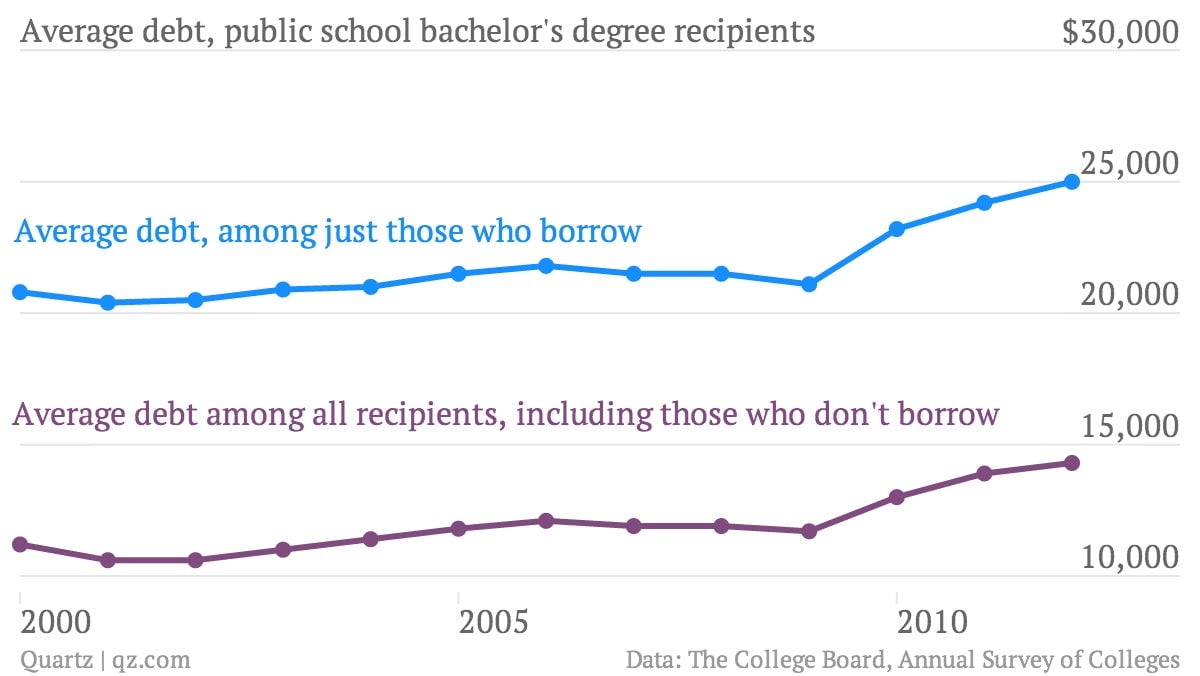

But it’s worth pointing out that it’s not just the posh, private colleges and universities that are leaving students heavily in hock.

The trend also extends to those who make the seemingly prudent decision to go to more affordable US public colleges and universities.

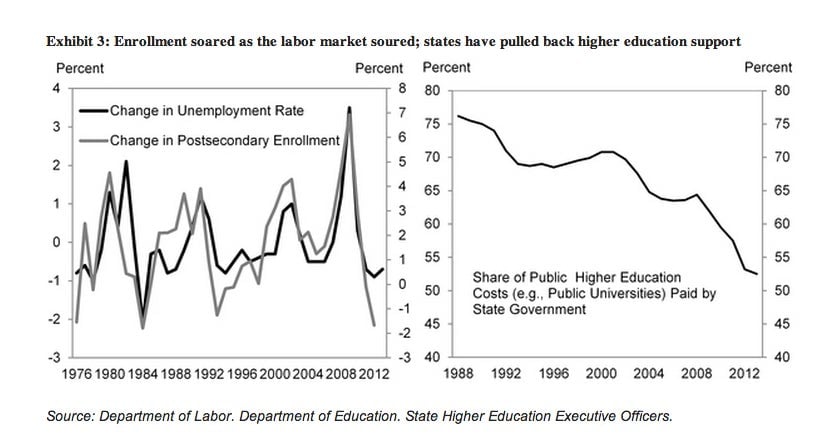

And there’s a simple reason. Public financial support for public colleges and universities has dropped off sharply in recent years, amid a spike in interest in going back to school. Goldman Sachs analysts just sent out this chart recently, which makes the case pretty clearly.

Some of this is to be expected. With state governments stressed over the last few years, cutbacks at public universities were to be expected. But as you can see from the chart above, the decline of public support for public colleges and universities is nothing new. States have been backing away from funding their colleges and universities for decades, and that means that student debt loads are likely to keep climbing. As Goldman Sachs notes:

While there is certainly a cyclical element to the decline in the share of education expenses covered by the public sector, there has been a general downward trend in the share of the cost of public universities funded by state governments, leaving a greater share to be covered by students (Exhibit 3, right panel). Second, with such a high share of students from higher-income families attending college already, incremental enrollment will come from students from lower-income families who are more likely to borrow (though they will usually also qualify for greater financial assistance). If incremental enrollment comes from students with fewer resources, it seems likely that the share of students borrowing will continue to rise.