The mysterious fund in the desert that manages Apple’s cash

Braeburn Capital sounds like a staid, run-of-the-mill asset management firm, and that’s probably the intention.

Braeburn Capital sounds like a staid, run-of-the-mill asset management firm, and that’s probably the intention.

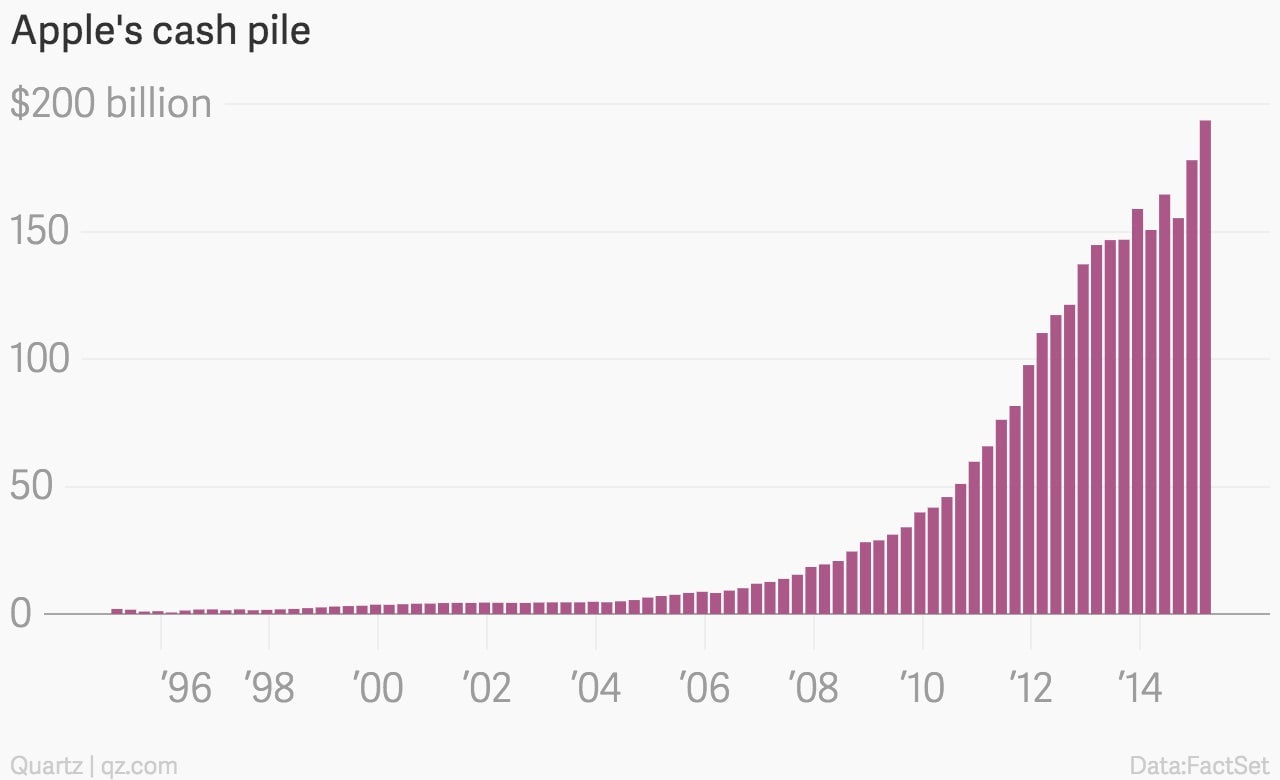

In reality, it is the secretive arm of the world’s biggest company, Apple, and was set up to manage the iconic device maker’s giant cash pile. On April 27, the company’s total cash hoard was revealed to have hit a new peak of $194 billion—more than the foreign reserves of Germany! Enough to buy all sorts of things!—meaning Braeburn probably has plenty of work to do.

Not much is known about Braeburn, besides that it is named after a type of apple. Apple the company, in addition to being clever with nomenclature, is secretive about most things, and especially so when it comes to its investment division. It has not responded to questions from Quartz about the operation.

Apple’s latest annual report mentions Braeburn once, noting only that it is incorporated in Nevada (presumably for tax reasons). A search through the investment database S&P Capital IQ doesn’t reveal much beyond Braeburn’s address, and the company has never commented on the unit during investor conference calls, according to an analysis of transcripts in FactSet.

The New York Times revealed some details (paywall) about the set-up in 2012, arguing it plays a key role in Apple’s tax-minimization strategy. It’s worth noting that a sizable chunk of Apple’s cash (that which it earned abroad) is actually stored offshore to avoid US government taxes. It is thought to be technically owned by the company’s Ireland operation, also something of an obscure entity, but managed, at least in part, by Braeburn.

For all the excitement about what Apple could do with its enormous cash reserves the reality has so far proven much more boring. Last year’s annual report outlined Apple’s rigid investment policy, which presumably also applies to its secretive subsidiary. It says it only invests in “highly rated securities”—think government bonds from rich, stable countries, and debt issued by companies with very solid finances. The overarching objective is “minimizing the potential risk of principal loss,” which means it’s safe to assume that Apple is not operating a secret investment casino in the Nevada desert.

In any case, it’s not clear exactly how much of Apple’s $194 billion in cash Braeburn actually gets to play with. The annual report notes that Apple ”uses a combination of internal and external management to execute its investment strategy and achieve its investment objectives.”

The company made its biggest acquisition ever last year, spending $3 billion on Beats Electronics. More acquisitions may or may not happen, speculation about them will probably persist. Regardless, Apple shareholders are going to see more of its cash going forward. The company said yesterday that it would lift both its quarterly dividend and the amount of stock it can buy back over the next couple of years (in practice Apple borrows money to fund this, because a lot its cash is stuck offshore). By March 2017, it expects to have spent a staggering $200 billion on capital returns.