All Chinese citizens now have a score based on how well we live, and mine sucks

Chinese citizens share just as many cat photos and memes online as people do anywhere else. But in the past few weeks I began to notice a mysterious new trend. Numbers were popping up on my social media feeds as my friends and strangers on Weibo and WeChat began to share their 芝麻信用分, or “Sesame Credit scores.”

Chinese citizens share just as many cat photos and memes online as people do anywhere else. But in the past few weeks I began to notice a mysterious new trend. Numbers were popping up on my social media feeds as my friends and strangers on Weibo and WeChat began to share their 芝麻信用分, or “Sesame Credit scores.”

The score is created by Ant Financial, an Alibaba-affiliated company that also runs Alipay, China’s popular third-party payment app with over 350 million users. Ant Financial claims that it evaluates one’s purchasing and spending habits in order to derive a figure that shows how creditworthy someone is. Passing numerical benchmarks entitles one to certain perks, like small loans or waivers on deposits.

I was curious to see how I’d fare. I checked my score inside the Alipay app, which is done by tapping on a special tab. The result:

I received 588 points, which falls in the lower half of the 350-950 range. Sesame Credit politely tells me that it’s “middle-level credit.” In other words, it sucks. All it entitles me to is a five-day “SVIP membership” at an online dating app. Of course, I need to download the app and sign in before I have any idea just what the hell “SVIP membership” means.Twelve more points would get me a 100-yuan ($16) bonus when booking hotel rooms. Sixty-two more points would get me the privilege of renting a car without putting down a deposit, or applying for a loan with an unspecified limit and interest rate. And 162 more points would get me a visa to Luxembourg.

Various organizations, including the American Civil Liberties Union, have argued that Sesame Credit is more than just a meme or a game— it’s evidence that the Chinese government is enacting a scheme that will monitor citizens’ finances. More frighteningly, some have suggested, one’s political views or “morality” might raise or lower one’s score.

While it’s true that the Chinese government intends to create what it calls a “social credit system,” Sesame Credit and its competitors (of which there will soon be several) have little to do with such plans—at least for now.

How it actually works

Ant Financial tells Quartz that Sesame Credit is not a silly game, but the first system in China to incorporate online and offline data to generate credit scores. Scores go up or down based on five categories:

The first category takes into account purchases made using Alipay, and looks at purchasing volume, and the price of goods that are purchased. But the content of what one purchases won’t affect one’s score—in other words, your score will go up as long as you buy anything, whether it’s books or sex toys. “It’s basically the frequency that matters, it’s not what you buy that matters,” says an Ant Financial spokeswoman.

The second category involves personal information, like one’s job and hukou (household registration status). The company uses this information to better understand its users, and entering information results in a higher score, explains the spokeswoman. It wants this data because it helps the service be more comprehensive. But, she emphasizes, the scores won’t go up or down based on one’s profession. “Let’s say in China you have a Shanghai hukou. That doesn’t mean you have a better Sesame Credit score versus [someone in] Tibet. We don’t discriminate [based on] where you are from,” she says.

The third and fourth categories measure timely payments on bills and credit cards, respectively. Many Alipay users pay their bills through the mobile app and receive reminders through push notifications on their phones. Failing to pay a bill on time will cause one’s score to go down, and is probably the most important category, the spokeswoman implied: “We wouldn’t say that if you have a good career track or a bad one it will affect your score as much than as if you don’t pay your bills.”

Finally, when more friends join Sesame Credit, your score will go up. A score will not go up or down based on the scores or personal information of your friend group, though.

In addition to a numerical score, users can see via a diagram (below) roughly how well they did in the various categories. This is shown with a pentagon-shaped diagram. Going clockwise from the top, the categories are personal identity, contract payments (bills), credit card payments, social engagement, and shopping habits.

The diagram doesn’t display the exact score one gets for each category, or any details about how the scores were weighted (much less how the algorithm actually works). The best guess, it seems, is to assume that the most extended angle in the pentagram shows where one has been particularly successful in racking up points. So while my social network score looks pretty high, my bill-payment score is low. That makes sense, since I’ve never paid any bills using Alipay before.

You can also check the scores of your friends, but only if they grant you permission. My friend agreed to share her score with me, and I was surprised to see she had 655 points, even though she’s the same age and doesn’t have a good-paying job. She works at a state-owned foreign trade company that pays her around 4,000 yuan ($630) per month.

But actually, looking at her shopping habits, it makes sense that she got a 655 and I’m stuck at 588. My friend tells me that she spends around 5,000 to 8,000 yuan ($787 to $1,260) per month to buy books, makeup, clothes, food, snacks, and “other useless stuff” using Alipay Wallet. Someone must be funding her shopping habits. And she says she has transferred a total of around 190,000 yuan (nearly $30,000) via the app. That makes her a far more loyal Alipay user than I am.

Sesame Credit, then, works more like a loyalty program than a credit rating system. But it is possible that as its user base (36 million people so far) grows, the scope of its financial impact will extend.

Sesame Credit is not the government’s “social credit system”—yet

Now that Sesame Credit is tracking and rating one’s purchases and bill payments, is it possible that it will start tracking more? Will it move scores up or down based on one’s social media profile? The answer is more complicated than one might think.

Sesame Credit’s origins lie in China’s once-barren consumer finance industry. Compared to the United States, China’s financial institutions have done little to serve consumers and small businesses. The People’s Bank of China— the central bank—runs the country’s only official credit rating system, and as of 2014 it serves only about 300 million people. That’s less than 25% of the total population. In the US, by contrast, 89% of the adult population has a credit score (pdf, pg 24). As a result, many Chinese consumers have been saving rather than borrowing or investing. That in turn stunts domestic consumption, a worrying factor amid China’s slowing economy.

The government and private companies have jumped into the void. Beijing has given 10 private companies hoping to launch internet-based credit ranking systems the green light, including Ant Financial and Tencent (paywall).

Sesame Credit’s release in January followed a government directive last summer calling for the establishment of a “social credit system.” The directive is riddled with political jargon and offers little in the way of specific details. What’s clear amid the muddled language is the government’s merging of politics and finance. It’s possible that the government might at some point alter one’s credit rating based on their “morality” or social status. In other words, while Sesame Credit doesn’t care if you buy sex toys instead of books, the government’s credit system might.

“The government wants to build a platform that leverages things like big data, mobile internet, and cloud computing to measure and evaluate different levels of people’s lives in order to create a gamified nudging for people to behave better,” says Rogier Creemer, who researches Chinese law and media at the University of Oxford. ”In China, we know that will happen in finance, but the documents also include things like your driving record, and also your professional evaluation, like how good a lawyer your customers think you are.”

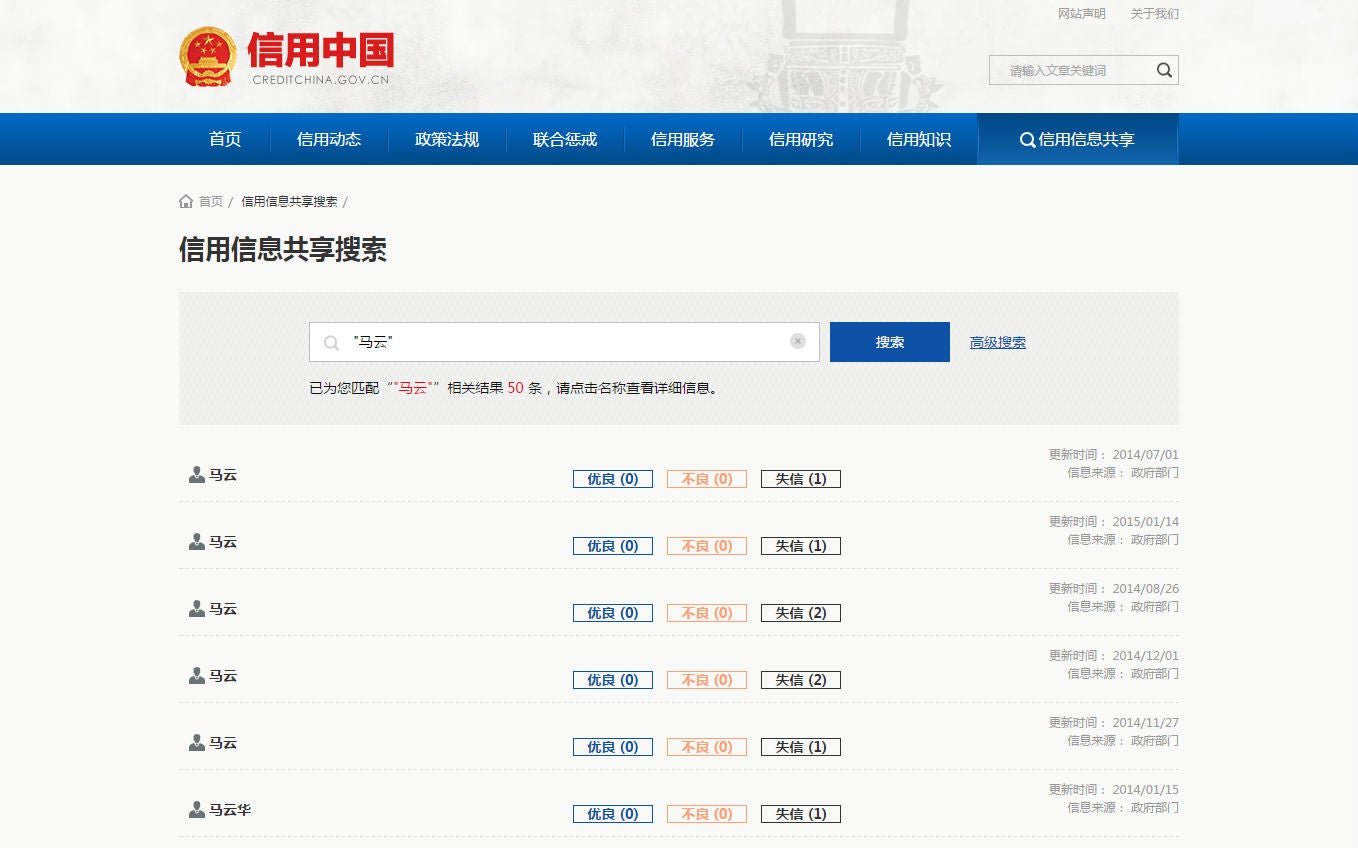

Despite the directive, not much has come in the way of implementation. On June 1, the State Information Center introduced a website where people can search for the credit histories of individuals and enterprises, along with information on who has dodged taxes and failed to follow court rulings. The website, called Credit China (link in Chinese), introduces itself as a window for the government to “praise honesty [and] punish dishonesty.” China’s central bank and top planning agency are behind it. Tech giant Baidu, which runs the country’s most popular search engine, is in charge of the technical support and maintenance.

But so far Credit China hasn’t compiled enough data to serve as a useful reference in most cases. Searching the site reveals mostly small businesses and random individuals, but it’s not clear how many. Clicking on the name of an individual or business reveals two categories titled “positive record,” and “negative record,” but all of the fields were empty for every business and name we examined.

Ant Financial tells Quartz that Sesame Credit operates independently from the government’s social credit system. That looks to be the case right now—for example, my friend and I are both Sesame Credit users, but we’re nowhere to be found on the government database. If Ant Financial is to be trusted, the content of one’s purchases—books or sex toys?—won’t impact one’s ability to get a car loan. Creemers says that such a system is unlikely to emerge.

“Alibaba is essentially an online mall. Commercialism and consumerism is something that the government really likes. You don’t have a lot of political agitation there,” he tells Quartz.

But just because Sesame Credit operates independently from the government doesn’t mean the government won’t find a way to use it as a monitoring tool. Instead of building out a homegrown social credit system, the Chinese government might simply wait for Ant Financial and its competitors to build out massive pools of user data, and then continue to take that data whenever it wants to. Creemers says that the political significance of Sesame Credit lies in this unique arrangement—private internet companies mine data to make money, but the government can readily access this data when it decides to snoop.

“Traditionally the Chinese internet was described as a panopticon,” says Creemers. “You had all of these people, and there was someone in the middle who could observe what they do. Now it’s more a panspectron. It’s no longer up to the central sensing device to capture information. Rather, information is increasingly being generated by sensing devices that are located all around us, on our phones.”

And as for me? Even if my crappy credit score doesn’t mean much now, it’s in my best interest I suppose to make sure it doesn’t go too low. So—why not?—I’ll start buying more stuff on Taobao. Hmm, perhaps this book: Xi Jinping: The Governance of China. Collected speeches by the president? Can’t go wrong with that.

Additional reporting by Josh Horwitz