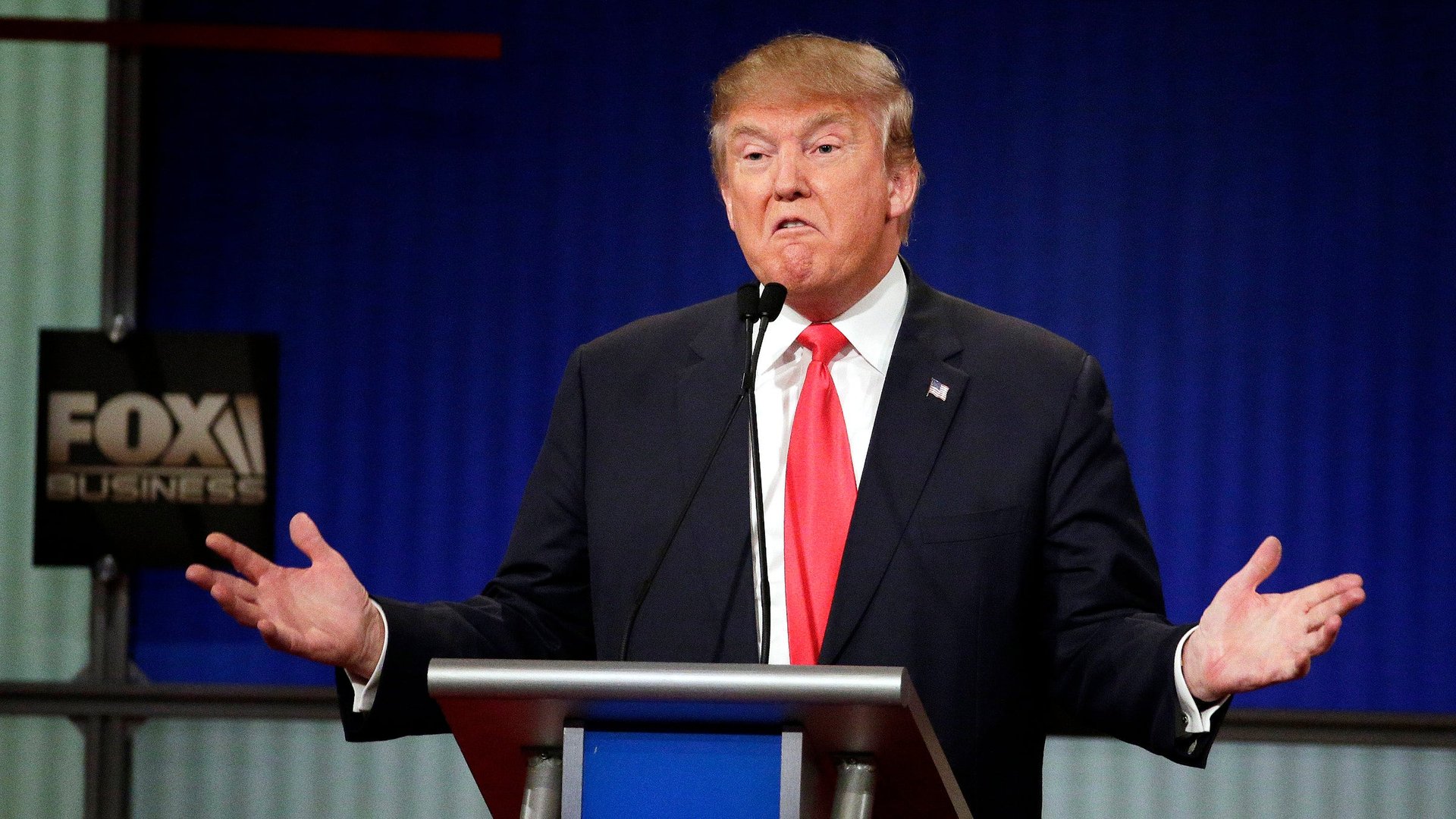

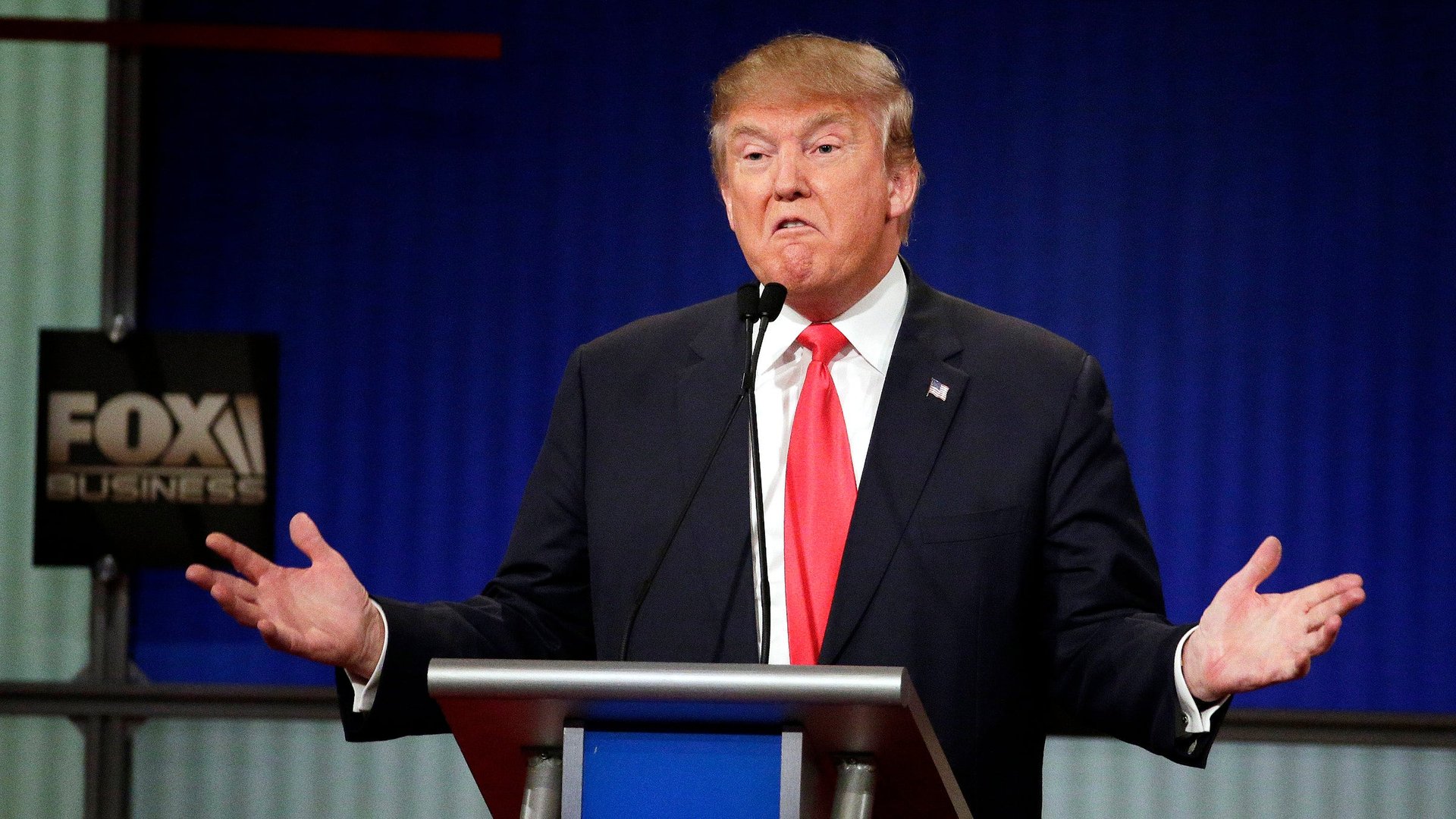

Trump is caught lying about his China tariff proposal—and it would hurt his supporters the most

Like the changing of the tides, it was inevitable that Donald Trump would brazenly misrepresent himself in last night’s Republican presidential debate.

Like the changing of the tides, it was inevitable that Donald Trump would brazenly misrepresent himself in last night’s Republican presidential debate.

Asked if about his plan to raise a tariff on imported Chinese goods to 45%, reported by the New York Times, Trump said, “That’s wrong. They were wrong. It’s the New York Times, they are always wrong.”

The New York Times, always wrong or not, is equipped with audio recorders, and the paper quickly produced this transcript of Trump’s meeting with the newspaper’s editorial board:

I would tax China coming in—products coming in. I would do a tariff. And they do it to us. We have to be smart. I’m a free trader. I’m a free trader. And some of the people would say, ‘Oh, it’s terrible.’ I’m a free trader. I love free trade. But it’s got to be reasonably fair. I would do a tax, and the tax—let me tell you what the tax should be. The tax should be 45 percent.

Trump concluded that if China continued what he sees as unfair trade practices, “I would certainly start taxing goods that come in from China.”

What would that mean to his supporters, which include many middle-class Americans frustrated by their inability to get ahead in the economy?

They certainly are feeling the affects of international trade, which appears to be one of the main causes of stagnant wages in the US. China’s attempts to keep its currency at artificially low levels, Trump’s bogeyman here, was once part of the picture, but that’s old news—China has been doing the opposite lately.

Ultimately, imposing a massive tariff on Chinese goods would not necessarily improve the US economy. Among the consequences economists would expect:

Prices rising for consumers

If you shop at Wal-Mart, you’re getting a lot of cheap goods from China. Critics of China’s trade policy argue that the company’s imports—an estimated $49 billion in 2013—cost the US 400,000 jobs over a twelve years, though they rely on labor cost estimates from 2001 which may inflate that figure. (For perspective, the US created 2.9 million jobs in 2015). But imagine if Wal-Mart suddenly had to pay an extra 45% on its imported goods: The company would have to raise prices and look for new cheaper sources of goods. But it wouldn’t go looking in the US, where labor costs are high—it would more likely opt for low-cost labor markets like Vietnam.

Not that many new jobs

We have a natural experiment about the effect of Chinese tariffs. In 2009, the US slapped China with a tariff of 35% on tires after the World Trade Organization ruled that China was overwhelming US tire manufacturers with an influx of subsidized imports. After tariffs went up, economists looked at the results (pdf), and found that while the US added 1,200 jobs, it cost US consumers $1.1 billion to purchase more expensive tires, for a cost per job of $900,000—little of which actually went to the workers themselves. China also retaliated by increasing duties on US chicken imports, which cost US exporters about $1 billion, and leading us to our next consequence:

A trade war

The other thing about this plan is it’s not exactly legal. You could expect China to challenge it in the WTO and possibly win, but it would certainly retaliate by closing its markets to US firms through higher tariffs of its own or outright bans. China is the third-largest market for US exports after Mexico and Canada, and falling sales there would punish US companies at home, including big employers like GM, GE, Caterpillar and Boeing.

All in all, this doesn’t look like an amazing plan to improve the outlook for low-skill US workers and others threatened by global economic forces. It’s easy to promise punishment for your enemies, but it’s problematic when your ostensible enemy is also, in economic terms, one of your most productive friends.