The world’s largest online coupon marketplace by the number of visitors, RetaileMeNot, has set a $20 to $22 a share range for its upcoming IPO, according to a US government filing submitted today. It will be interesting to see how the market reacts to the company’s public offering, given the disappointing performance of another online coupons firm, Groupon.

Groupon went public amid lots of buzz as a hot IPO in 2011. But increased competition, rapid expansion and other missteps caused its shares to fall by more than 55% since its IPO. Earlier this year, the board fired co-founder and former CEO Andrew Mason.

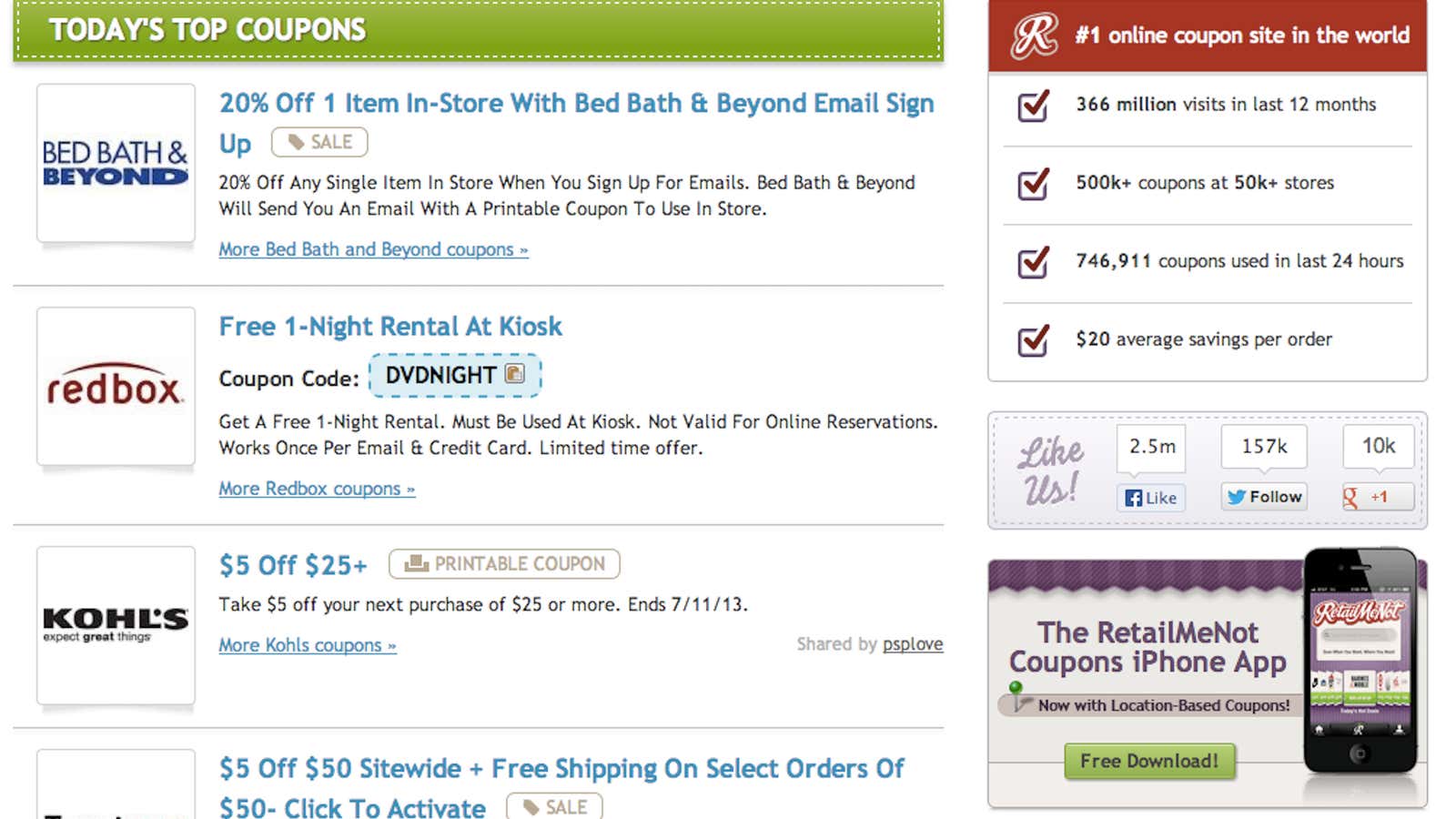

But the two businesses differ in many ways. Groupon’s main method, up until recently, was to offer its users a deal of the day, delivered by email, often from local merchants. RetailMeNot has emailed deals, too, but the main draw is a searchable database of coupons on its web site, including thousands of offers from many national stores, like Home Depot, amusement park chain Six Flags and clothing retailer Forever 21. It operates its namesake web site in the US, VoucherCodes.co.uk in Britain, and deals.com in Germany, among other sites.

Like Groupon, RetailMeNot has grown quickly. It posted a revenue of $16.9 million in 2010, a year after it got into the digital coupons space. Last year, its revenues grew to $144.7 million. At the same time, RetailMeNot has also made money, growing its net income from $2.3 million in 2010 to $26 million last year. It boasted more than 450 million visits last year and could be valued around $1 billion.

For the quarter that ended June 30, RetailMeNot expects to report revenues of at least $42 million, representing at least a 39.5% growth from the same period last year. However, its net income went down by some 15% in the same period to at least $4.3 million, which the company said it expected because it had invested more in its business. It’s expanding its mobile business and growing geographically; it just acquired French discount site Abcyne.

The recent decline in profits could be a warning sign to some investors, given that one cause of Groupon’s downfall was that it mismanaged its rapid growth. On the other hand, Groupon is now moving to become more like RetailMeNot, transforming into a coupons database that can be easily searched. Groupon is also expanding into digital payments.

A lot can happen to a company after an IPO, and Groupon is a good cautionary tale for RetailMeNot. Groupon has also shown how things can turn around. Since Mason was ousted, Groupon’s shares have roughly doubled in value.