All the major Wall Street investment firms have reported earnings, and now it’s time to decide who deserves the bragging rights. Although not all of the big investment banks that report stats on trading do it exactly the same way, we can more or less figure out which of the big five Wall Street investment banks (the sixth, Wells Fargo, doesn’t break down trading revenue) did the best last quarter. In this case, we’re only concerned with the total, unadjusted revenues from the banks’ fixed income, commodities, and currency execution (FICC) and equities trading teams.

In the second quarter of the year, traders saw dramatic ups and downs. The market started off on a roll; in mid-May, junk bond yields fell to record lows (i.e. demand made those bonds expensive) and the S&P 500 hit a record high of 1,669. But after that, weakness in Asia and the US erased many of those gains. (Both bond and equities markets have since staged recoveries.)

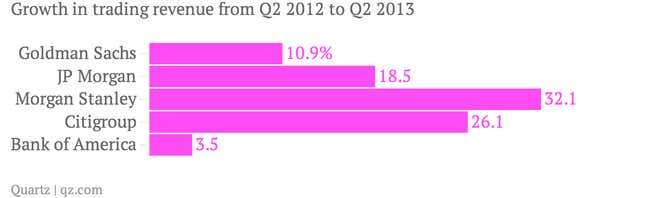

Who was caught on the wrong side of the trade? If the numbers are any indication, it wasn’t Morgan Stanley. The bank was the only one of the big five Wall Street firms to report positive quarter-over-quarter growth in total trading revenue (FICC plus equities). Morgan Stanley also deserves the title of most-improved from a year ago; as the chart below shows, total trading revenues were 32.1% higher in the second quarter of 2013 than they were a year earlier.

But Morgan Stanley lags behind all the other banks in total trading revenue. The firm recently announced plans to cut down its FICC team (paywall) despite its successes over the last year: FICC revenue at Morgan Stanley declined 5% in the second quarter of 2013, less than any of its rivals. It also did much better on the equity side, but even then, the bank’s focus has been moving away from investment banking and trading.

Instead, JP Morgan is still well ahead of its competitors in terms of absolute revenue, thanks to FICC. Its equities team ranks third in revenue, behind Morgan Stanley and Goldman Sachs.