Growth is slowing sharply in emerging markets like China, India and Brazil. Europe is still ensnared in a recession. Japan is only now taking baby steps forward after a decades-long duel with deflation. When it comes to growth, the US’s consumer-driven economy now stands out as the world’s best bet.

That’s right, American consumers are being asked to carry the global economy forward—again.

That seems worrisome. Just five years ago, America’s real-estate-centered spending binge—and banking system—collapsed under the weight of the debts that fueled it. The financial crisis and deep recession that followed was the equivalent of an economic heart attack.

Afterward, the US swore it would change its ways, cut down on junky consumption and rebuild economic muscle—for instance, in its export sector—that had long gone flabby. A China chastened by its reliance on the unhealthy US was supposed to tilt its economy away from exporting the cheap merchandise Americans found so irresistible and towards domestic consumers.

The process, dubbed rebalancing, seemed an elegant answer to the problems presented by the Great Recession. It’s been a cornerstone of conventional wisdom among the economic establishment for years, featuring prominently in G-20 communiqués, International Monetary Fund assessments and World Trade Organization pronouncements about the global economy.

There’s just one problem. It never really happened. And we doubt it will.

The US backslides

Despite all the hand-wringing during the hangover from the US housing boom, consumer spending is still the engine of the US economy. Personal consumption accounts for roughly 69% of GDP. That’s actually up slightly since the Great Recession.

Meanwhile, Americans also seem to be fast losing their inclination to save. The US savings rate—which jumped to more than 8% in the aftermath of the crisis—is now back down to just 4.4%. True, that’s better than during the frothiest periods of the pre-crisis boom. (Savings fell to 2% in July 2005, the lowest level on record.) But it’s going in the wrong direction.

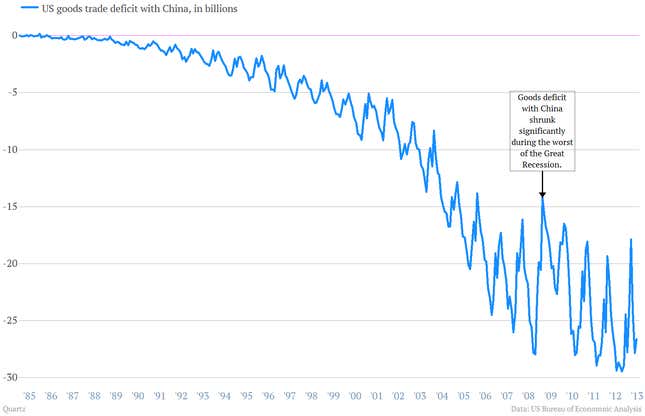

Case in point. Let’s look at the US goods trade deficit with China. It shrank significantly during the worst of the financial crisis. But that didn’t last. Take a look.

China’s unfinished rotation

Over in China, the powers that be have taken concrete—albeit incremental—steps towards reshaping the country’s economy. They’ve let the yuan rise by about 10% against the dollar since the end of 2009. That makes Chinese exports slightly more expensive for foreigners and has lessened China’s over-reliance on exports. (They’re down to an estimated 24.6% of GDP in 2013, versus 31.7% in 2008.)

But cutting down on exports is only part of the job. Boosting Chinese consumption is the other. And that hasn’t happened. (Though some suspect that official numbers may be undercounting some kinds of consumption such as buying abroad or online.)

So rather than consumption, the growth driver in China has been investment. A broad gauge of such investment, gross fixed capital formation, rose to more than 45.5% of GDP in 2011, up from 39% in 2007, according to the World Bank. The most recent data on both consumption and investment confirm that those trends remain intact.

There are a host of problems with this strategy. Investment dollars flow to unproductive industries with government ties. Look at backlogs of products such as aluminum that have been piling up for years, as China embarked on large-scale plans to boost production. The banks that invest in such unproductive projects—and the people that put their money in those banks—are starting to wonder how bad the losses on the loans are going to be, especially after Chinese policymakers have made moves to crack down on riskier lending lately. Investment spending seems set to slow, and with it, the Chinese economy.

Who you gonna call?

Given the uncertainty of China’s economic path forward, it would be tempting for the People’s Republic to return to the old well one more time: exports. And with China’s largest trading partner, the European Union, mired in ugliness, that means boosting sales to the US. Can American consumers pick up the slack by spending a bit more? Haven’t they spent the better part of the last five years flat on their backs?

True, outlandish levels of debt-fueled American spending helped cause the crash. But since then, through a combination of default and paying down debt, Americans are in a much better position to borrow and spend. Check out how quickly the burden of debt payments have come down for American consumers.

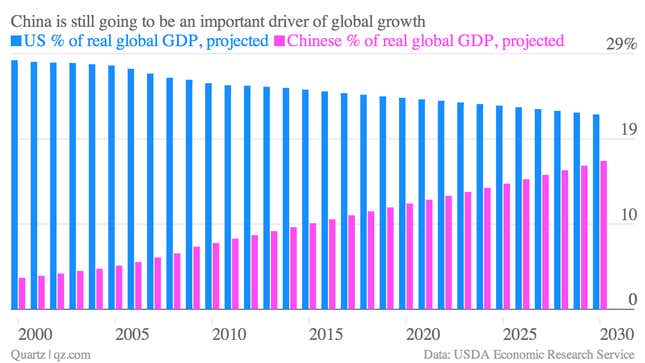

Don’t freak, China is still going to add to the global economy.

No. China might be grinding gears a bit as it tries to shift toward a more consumer-driven economy. But its share of real global GDP is going to continue growing in the coming decades.

But that’s the long view. Over the next few quarters, it looks like China and the rest of the global economy will be be leaning pretty heavily on US consumers. And American shoppers look ready to answer the call.