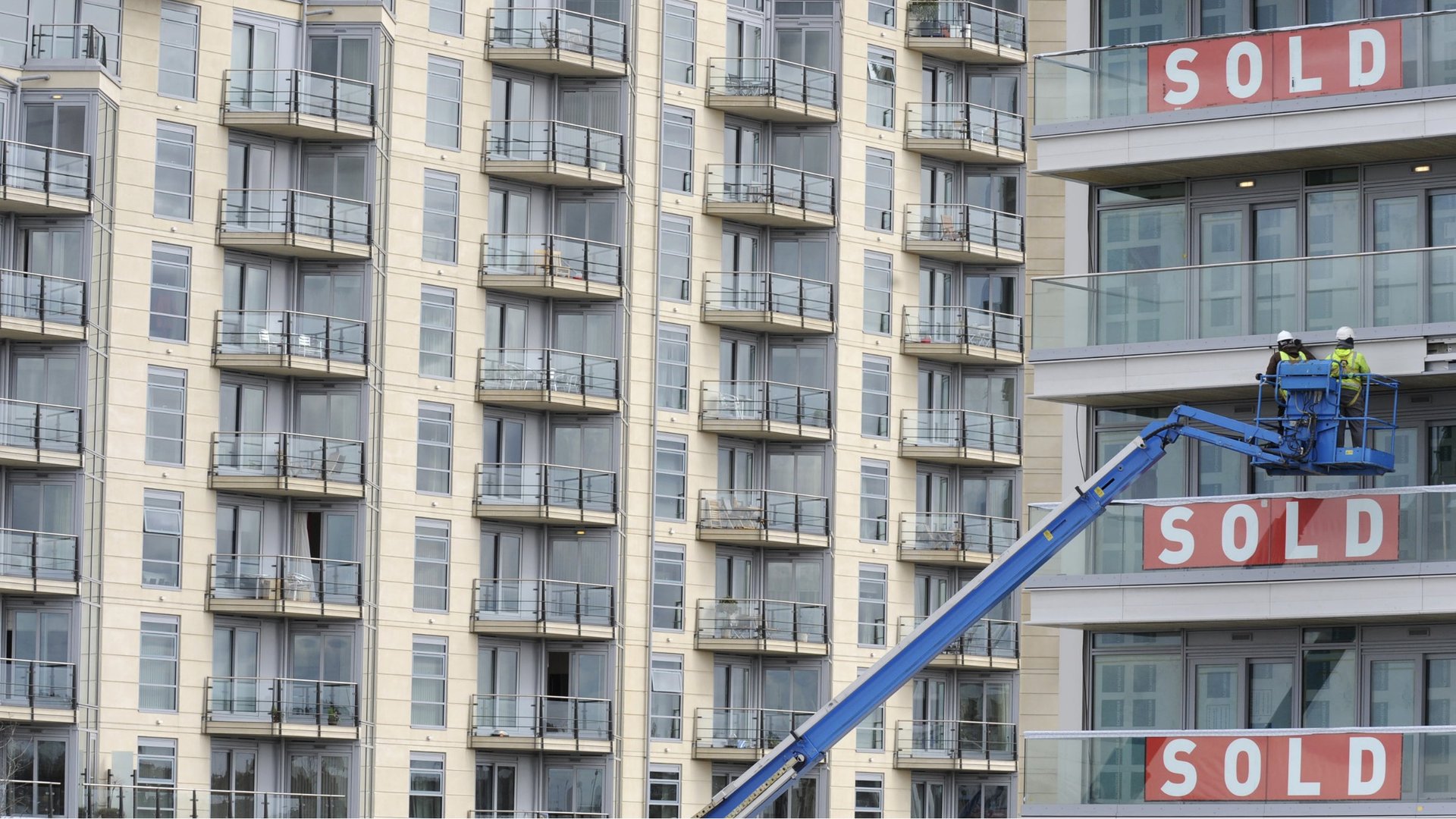

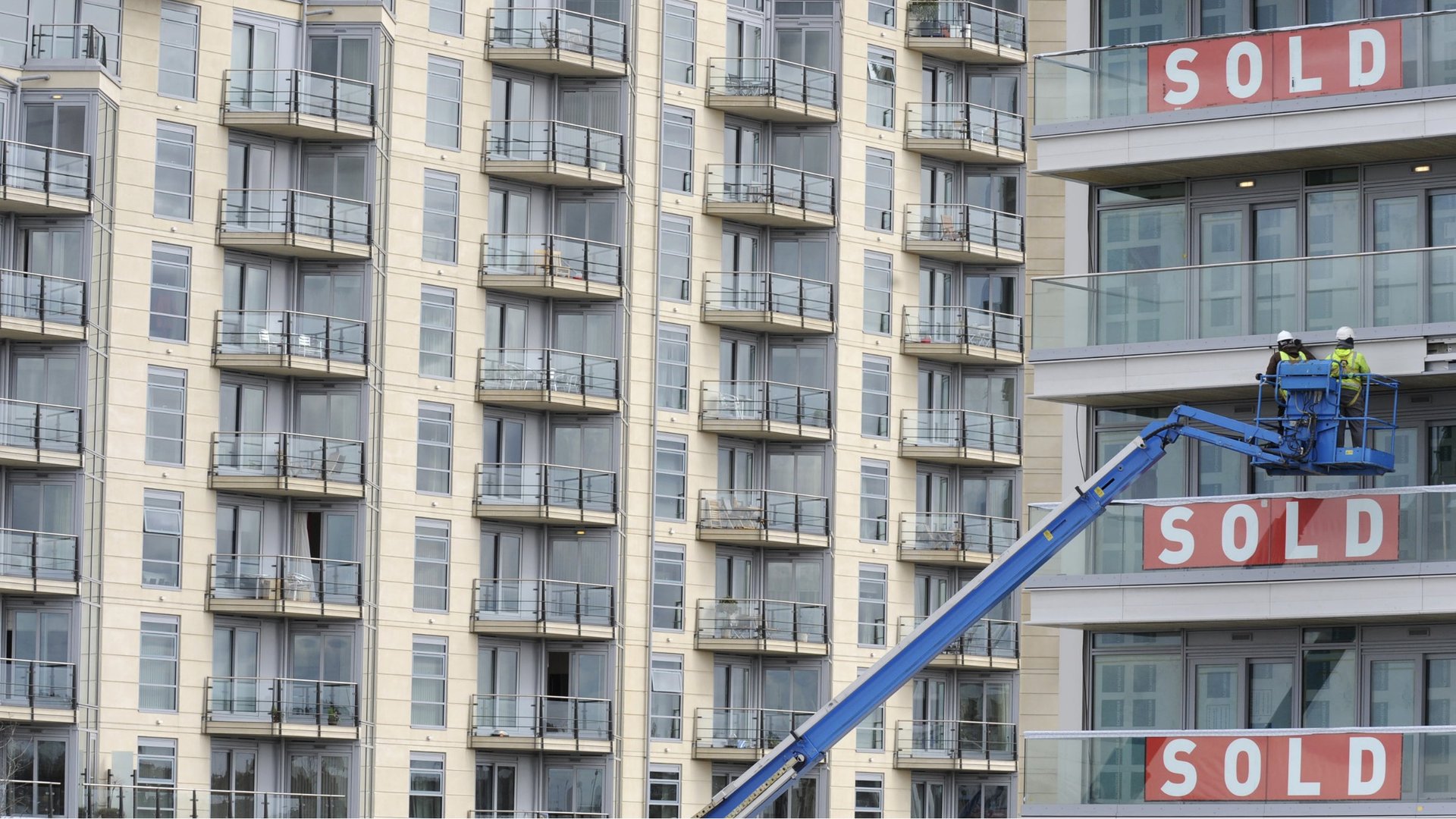

Chinese investors are buying more than a quarter of London’s new homes

London property prices have surged this year—up 8.1% in June, compared with the same month in 2012. That’s enough to invite “bubble” talk among economists.

London property prices have surged this year—up 8.1% in June, compared with the same month in 2012. That’s enough to invite “bubble” talk among economists.

One cause of rising prices: Chinese investors. They bought 27% of new homes sold in London (link in Chinese) in 2012, according to a report by Chinese Weekly, a UK-based paper, quoting data from Savills, a UK-based estate broker. Chinese demand for new housing amounted to about 17% of total residential real estate transaction value last year, says the report.

That trend is growing. Chinese nationals bought about £170 million ($266 million) of residential property in the first half of 2013, according to data from Knight Frank, a property consultancy, that was cited in the report. Gary Kwok, CEO of iNewHome, a UK property developer, said Chinese buyers are mainly invested in properties worth £1 million or more.

And while prominent investments in commercial real estate by Ping An Insurance, China Investment Corp (paywall), a Chinese sovereign wealth fund, and other government-backed foreign exchange funds have grabbed headlines in the last year or so, individuals are snapping up those properties, as well. Chinese mainlanders bought £1.5 billion worth of such properties in downtown London, though the period of time for that figure is unclear.

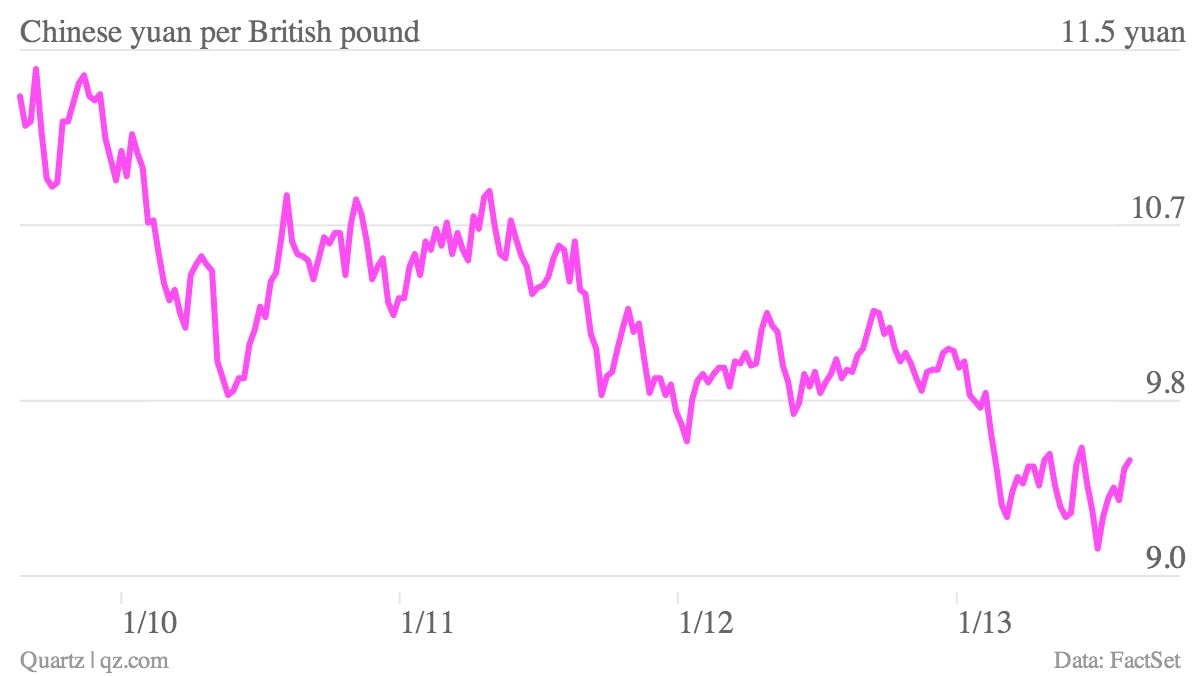

This is, of course, significant for any Londoners trying to buy a home right now. More broadly, though, it signals the ongoing capital flight out of China, as those with means of getting money beyond the barriers of China’s closed financial system seek to diversify their savings out of the country. The strengthening of the yuan against the pound only makes this more inviting:

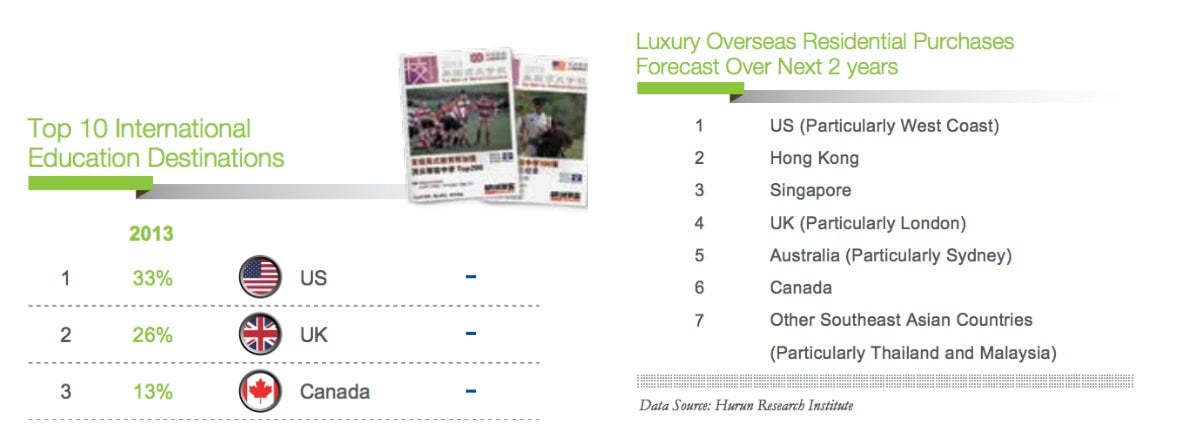

This isn’t entirely about financial gain; while a staff member at Savills told Chinese Weekly that while 60% was for investment purposes, the rest was for personal residence. In many cases, that’s not for the investor himself—it’s for his child. Recent research from the Hurun Institute, which surveys the wealth of Chinese citizens, links the appeal of the UK’s educational pedigrees with that of its property:

Whatever the motivation, it’s likely only to continue. In the first half of the year, at least eight London real estate agencies opened offices in Hong Kong, Shanghai, Beijing, or elsewhere in China, says Chinese Weekly, making property investments even more accessible to mainlanders. Then there’s the return on investment in Chinese properties. Data from last month show that prices in cities like Beijing and Shanghai have surged nearly 20% on July 2012.