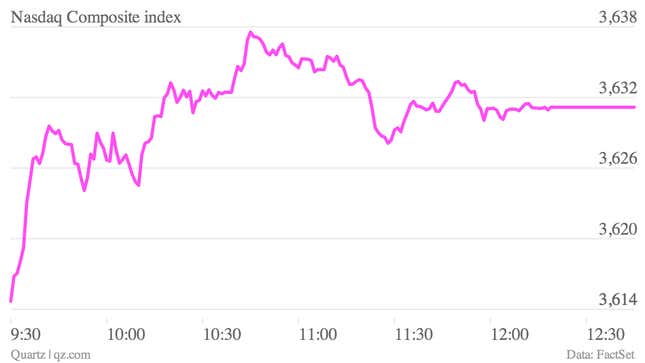

Amazingly, the electronic exchange known as the Nasdaq seems to be completely dead in the water. Citing technical issues, the Nasdaq announced a halt to trading at 12:15 p.m., according to the Wall Street Journal. Bloomberg adds that trading on Nasdaq’s options markets has also been halted. Here’s a look at the bizarre flat-line the Nasdaq has been forming since around 12:15 p.m.

Technical snafus seem to becoming more and more of a regular presence in the financial markets in recent years. Perhaps most notably the May 6 “Flash Crash” of 2010 or the Knight Capital debacle of 2012 and the BATS IPO catastrophe. And in a way, that’s odd. After all electronic trading has been a steadily growing part of the financial markets since the early 1970s, and it was the Nasdaq that really started the revolution. Trading on the Nasdaq started in February 1971. It was originally devised by the National Association of Securities Dealers, a self-regulatory group, as a way to automate trading in unlisted stocks.

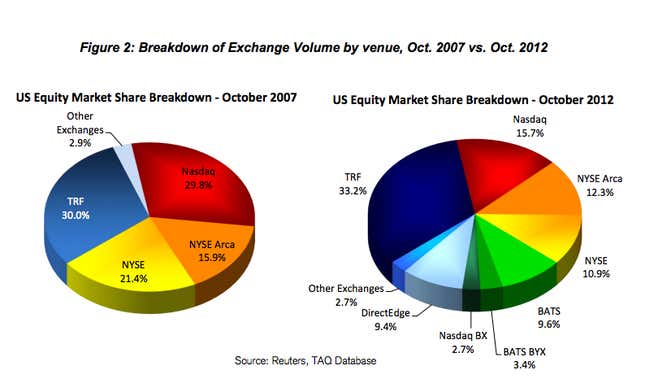

But over the years, the lower costs and faster trading of electronic exchanges, grew to eclipse the tradition trading floor embodied by the New York Stock Exchange. The NYSE adjusted, boosted its own electronic offerings. But in recent years both the Nasdaq and the NYSE have been losing market share to new electronic entries such as BATS and Direct Edge. Check out this chart, from a Credit Suisse executive who testified before the US Senate last year.

Todays’ Nasdaq freeze is definitely a titanic screwup. And you’re likely the hear plenty of traders on television screaming about why it would never happen in the good old days, when their commissions were significantly higher. But for most people who don’t do a lot of trading the rise of electronic trading has been a good thing. According to testimony from financial markets technology group ITG, total equity trading costs have fallen 70% over the last 12 years.