The Arab world’s largest stock exchange has moved one step closer to welcoming foreign investors. Over the weekend, Saudi Arabia’s Capital Market Authority (CMA) outlined strict disclosure rules for companies listed on the stock market.

These rules will make the market more transparent and bring it more in line with other emerging markets. In June, Saudi Arabia also moved to a Friday-Saturday weekend that other markets in the region follow, making it easier for foreign investors to invest there. And in February it appointed Mohammed bin Abdulmalik Al Sheikh, a former World Bank executive regarded by observers as more open to foreign investors than his predecessor, as the head of the CMA.

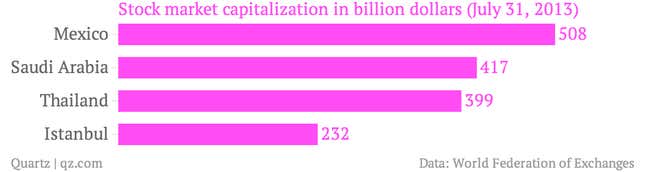

Saudi Arabia currently allows foreigners who aren’t citizens of the Gulf countries to invest through equity swaps and exchange-traded funds. But the higher commission costs and need to deal through intermediaries has meant foreign ownership remains under 5%. If giving foreigners direct access raised that level to what’s considered a relatively modest 15%, it would attract $40 billion of inflows. Trading on the Saudi bourse, the Tadawul, represents 80% of the volumes in the Gulf region, and its market capitalization is in the same league as emerging-market favorites like Mexico and Thailand.

The exchange is the region’s most liquid market, with $1.3 billion in daily trades, and 90% of that is by retail investors. The Tadawul is heavily reliant on petrochemical firms and the finance industry, which together account for around 70% of the market cap on the index. Retail, construction, real estate, and insurance are the other main sectors.

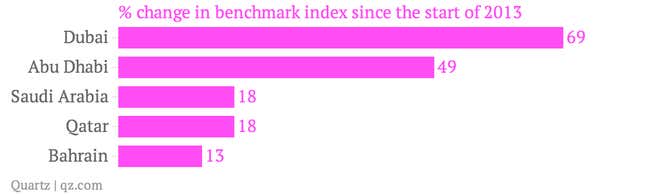

Investor interest in Saudi Arabia has been on the rise ever since the administration said it will spend $500 billion by 2020 to boost its non-oil economy. The market has rallied over 18% this year, despite the fact that Saudi Arabia is not even considered a “frontier market”, the lowest ranking issued by influential index compiler MSCI. In comparison, regional peers Qatar and Dubai were elevated from frontier market to “emerging market” status in June, a move that opened them up to hundreds of millions of dollars from funds that don’t invest in the highest-risk markets.