It looks like we’re going to do this again.

Economists estimate the US will reach the debt ceiling of $16.7 trillion at some point in late October or early November. (Update: Treasury secretary Jack Lew now says it will be in mid-October.) But before that, a new budget or an extended resolution allowing the US government to keep the lights on will have to be cobbled together before the start of the 2014 fiscal year, which starts Oct. 1. In short: We’re about to enter another silly season in Washington.

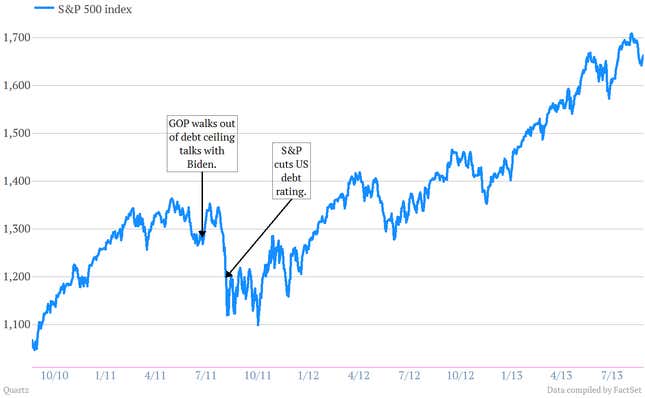

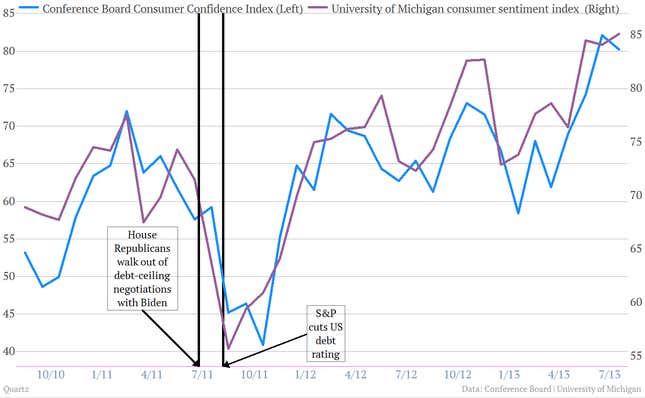

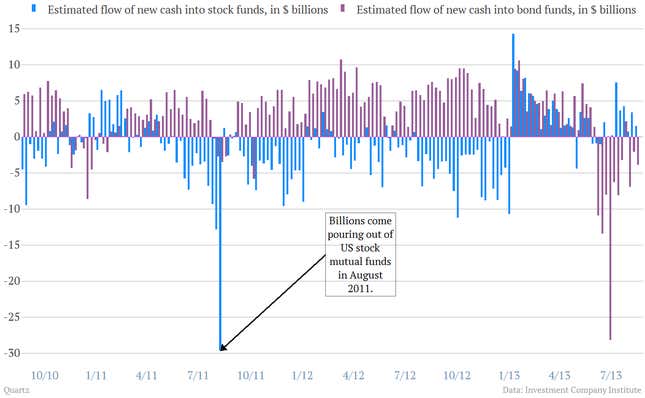

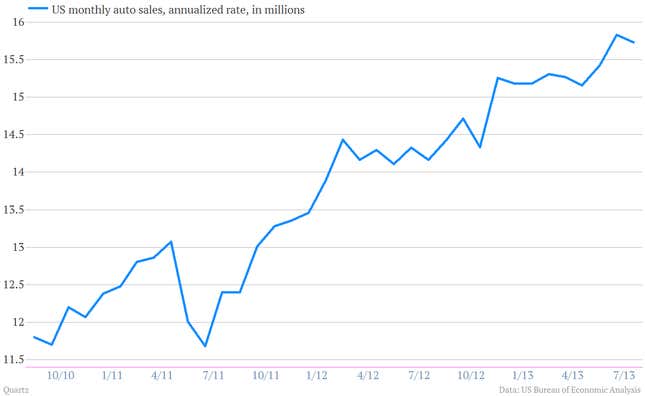

Wrangling over US fiscal policy is more than political theater. It has real implications for the US economy. To remind us of that fact, let’s look at how the brinksmanship of August 2011, which ultimately led to the downgrade of the US sovereign debt rating by Standard & Poor’s in Aug. 5 of that year, left a clear and deep dent in US economic and market data.

It clearly spooked the stock market…

It hammered consumer confidence…

And prompted investors to yank huge amounts of cash out of the stock markets…

And it spread from the financial markets to the real economy as auto sales sputtered…

In the end, the US finally got back on its feet after the debt ceiling debacle in 2011. (It still faced ongoing issues related to it. For instance, the so-called fiscal cliff drama at the end of 2012 was a direct result of the 2011 budget fight.) But it probably set the recovery back a good bit.

After all, in the US, the consumer essentially is the economy, accounting for roughly 70% of GDP. So if Washington really wants to try to derail a not-so-spectacular recovery, spooking consumers is just about the best way to do it.