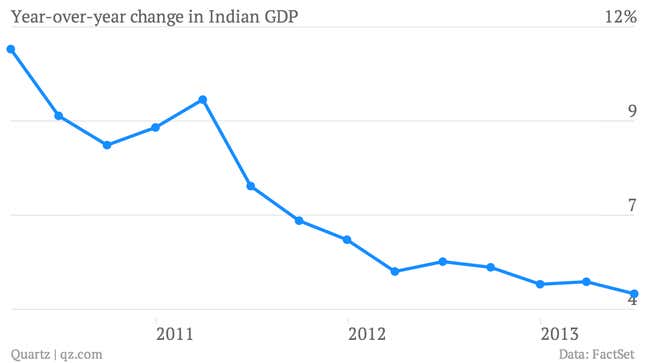

The Indian rupee’s nightmarish run is set to get a lot worse. Official figures released today (Aug. 30) revealed that India’s GDP expanded by 4.4% year-on-year in the April-June quarter, falling well short of analysts’ already muted forecasts of 4.7% growth. It’s the weakest pace of growth since the global financial crisis and a far cry from the 8-9% growth that India grew accustomed to in the boom years.

The data also highlighted the deterioration in the government’s balance sheet, as spending outpaced tax receipts. The fiscal deficit has already reached 62.8% of the target for the fiscal year, which ends in March 2014. Rating agencies have warned that India risks a rating downgrade if it fails to stick to the 4.8% fiscal deficit target that that the finance minister set in the annual budget. That severely hampers the government’s ability to stimulate growth.

And that’s not all. Rising oil prices and the $20 billion food subsidy scheme recently passed could force the government to reduce other spending, depriving the economy of crucial funds.

The central bank’s hands too are tied. It will be forced to keep interest rates high to support the rupee, which has fallen 19% since May, and fight inflation, which is hovering around the 6% mark. The fall in the rupee has been negating the marginal pickup in exports and keeping the current-account deficit high.

In short, it’s all going wrong at once. Slowing growth, high inflation, squeezed budget, widening current-account deficit, and global investors bearish on emerging markets. It looks like there’s more pain in store for the rupee.