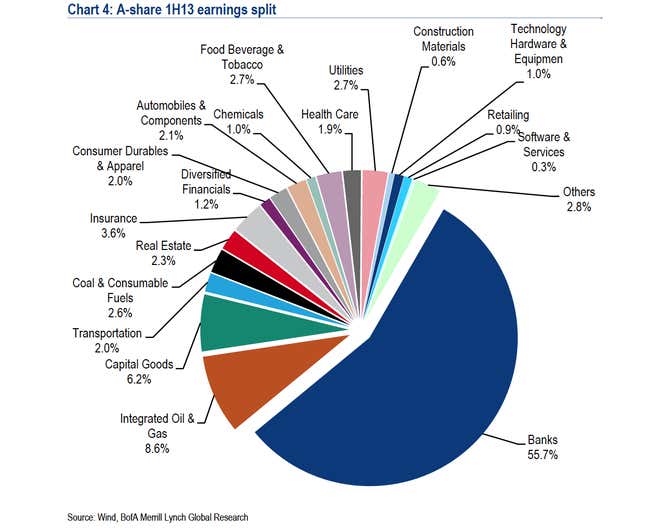

Considering China’s massive debt problem, investors might be wary of the country’s banking sector. But relax: Chinese banks are doing just peachy. In fact, as David Cui, China strategist at BofA Merrill Lynch, flags in a note today, “banks alone accounted for 56% of total market earnings” of mainland-listed companies. Here’s a look at that:

Cui doesn’t necessarily think this is a good thing. “This large and rising share is unhealthy,” he and the BofA Merrill Lynch China strategy team wrote in a related note.

More evidence of China’s engorged banking sector came out a few days ago, when the China Enterprise Confederation, an advocacy group for Chinese enterprises, reported that, of China’s top 500 service-sector companies, the country’s 39 leading banks generated 68% of profits so far in 2013.

The surge in banking profits helped China’s service sector eclipse that of the top 500 manufacturers for the first time in the history of CEC’s analysis. The profits of the 268 manufacturing companies among China’s top 500 companies fell nearly 18% in 2013, hitting 438 billion yuan ($71 billion) (link in Chinese) in H1 2013. That compares with the 39 top banks’ 1.04 trillion yuan in profits.

A stronger service sector is crucial to “rebalancing” the economy away from investment-fueled growth, but not if it’s driven by bad lending. The CEC’s vice president, Li Jianming, considers the trend a bad omen. He compares China’s ballooning banking sector to that of the US; America’s financial industry accounts for something like 30% of operating profits.

“The financial sector and manufacturing are symbiotic,” said Li, according to the People’s Daily (link in Chinese). “Excessive expansion of the banking industry makes it so that a large chunk of the capital that should be flowing into the real economy instead circulates among the banks themselves. That leads not only to a shortage of funds in the real economy, but it also creates asset bubbles and could even spark a financial crisis.”

Non-banks are also piling into the lending boom, as BofA’s Cui points out. “In the first half of the year, all the earnings growth in non-financials can be attributable to non-core earnings, we suspect mostly by borrowing cheap and lending high to others,” he says.

So let’s review: Banks are making a lot of money. A lot of those bank loans are whipping up profit for non-financial corporations, which are lending funds out to other (probably less credit-worthy) companies at higher interest rates. Some of those non-bank lenders are likely weak manufacturers that aren’t making money in their core business. Assuming those companies have little of their own business to invest in, they’re probably borrowing to cover old debts. And that’s a lending business that can’t last.