Lloyds of London chairman John Nelson issued an eerie warning on Wednesday. The huge amounts of money flowing into the insurance industry right now “on a scale not seen before” (paywall), he suggested, could pose a systemic risk to the financial system. ”We all vividly remember the systemic problems that arose in the banking industry, where capital became detached from the underlying transaction of risk,” Nelson said. “The insurance industry must avoid these traps.” So is this the dawn of a (potentially catastrophic) insurance bubble?

It’s little surprise that money is flowing into reinsurance, the business of buying up the debt of an insurance company. Essentially, reinsurance is a bet that a segment of the companies or individuals being insured (by investors or other insurance companies) won’t file claims during a certain time period. It’s an attractive area for several reasons: Money managers have had a hard time gaming the equity markets; for example, hedge funds haven’t convincingly beat the S&P 500 since 2009. Low interest rates and monetary easing around the world have left investors desperate for yield. And many investors have mistimed investments thanks to erratic moves by central bankers and policymakers.

In a murky market environment, investing in disaster can seem like a smarter bet. Investing in reinsurance debt securities like catastrophe bonds (which bet that homeowners or companies won’t file claims that exceed a certain amount of money) can yield as much as 7% to 8% for three years, compared to the approximately 3% you might earn investing in US Treasurys now for the next 10 years.

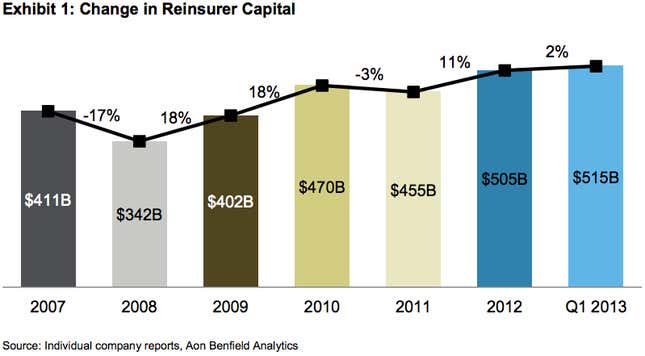

“Reinsurers have begun the process of incorporating these new capital flows into their capital structures and we expect the pace of these activities to increase,” Aon Benfield, one of the world’s largest reinsurers, said in its June to July 2013 update on the insurance market. Capital invested in reinsurance increased by 2% in the first quarter of 2013 alone, and increased by 11% over the course of 2012. Hedge funds and pension funds alone invested $35 billion in the last 12 months.

The worry is that new investors won’t understand the risks that accompany investing in insurance, and that they’ll invest far more money into it than they should. Individuals and companies—particularly those affected by disasters—do occasionally file claims en masse. Investors who become convinced that these investments aren’t that risky could be in for big losses.

But would this distortion in risk produce losses that rival the financial crisis? It’s unclear. First, it would take serious losses—perhaps a series of big catastrophes—for investors to lose a lot of money from reinsurance. It’s also worth noting that the size of the global reinsurance industry is about a quarter of the size of the market for US mortgage-backed securities. But the more the world grapples with rising seas, harsher weather and an unprecedented number of natural disasters, the likelier big losses become.