The sell-off in emerging markets is not an omen of a prolonged economic contraction. Although capital flows were also turbulent after the 2008 financial crisis, growth in emerging markets continued. Nor is this a sign of financial crisis. “One thing most people seem to agree on is that this is not a replay of the late 1990s,” writes Ryan Avent in the Economist. A combination of exchange rate flexibility and low external debt means that emerging markets are unlikely to experience the same level of carnage as was seen in the 1997. Rather, the sell-off is a statement about how monetary policy has been unable to stabilize output in emerging markets and the importance of monetary reform.

Broadly speaking, economies open to international trade have three main policy goals: a stable exchange rate, a sovereign monetary policy, and an open capital account. A stable currency facilitates easier trade, a sovereign monetary policy means the central bank can keep moderate inflation and low unemployment, and an open capital account allows capital to take advantage of the best investment opportunities, both at home and abroad.

Unfortunately, only two are possible at a time. This is known as the “impossible trinity.” If a country wants to peg its currency, but also have free flows of capital, then its central bank can no longer conduct monetary policy. If unemployment spikes and the central bank lowers interest rates to ease monetary policy, this will depreciate the currency and jeopardize the peg. But to maintain the fixed exchange rate, the central bank can only raise interest rates and tighten monetary policy. So under a free flow of capital and an open capital account, the central bank that tries to peg the exchange rate loses the ability to stabilize the domestic economy with monetary policy.

This is not just of theoretical interest—it succinctly describes the current emerging market dilemma. Since all capital controls eventually leak, emerging markets can commit to stabilizing either the exchange rate or domestic output—not both. Economists Joshua Aizenman, Menzie Chinn, and Hiro Ito (pdf) have shown that this tradeoff is real. In the 1972 to 2006 time period, “Greater monetary independence [was] associated with lower output volatility while greater exchange rate stability [implied] greater output volatility.”

Between these two options, the answer should be clear. Central banks in emerging markets need to focus on domestic output, and not the exchange rate.

In doing so, emerging markets would avoid amplifying their business cycles. The largest fluctuations that emerging market economies face are fluctuations in demand for their exports. Therefore, most recessions are triggered by deteriorating trade conditions. Because there is less demand for exports, the currency also tends to depreciate. Foreigners who used to demand goods no longer have a need for the currency. In this scenario, if the central bank were to try and defend the original exchange rate, it would have to tighten monetary policy to keep capital from flowing abroad. However, this is the exact opposite of what a recession-fighting central bank should be doing. As a result, targeting the exchange rate leads to even more output volatility.

We can see this in action by looking at the recent monetary policy response of Brazil. Even though the taper has caused capital to flow out and the Brazilian Bovespa to collapse, the Central Bank of Brazil recently chose instead to raise the policy rate by 50 basis points to 9% in an attempt to stabilize the exchange rate and inflation. Even now, the Central Bank of Brazil is signaling that it will raise rates even further. Yet this is precisely the wrong policy for a country undergoing a demand shock.

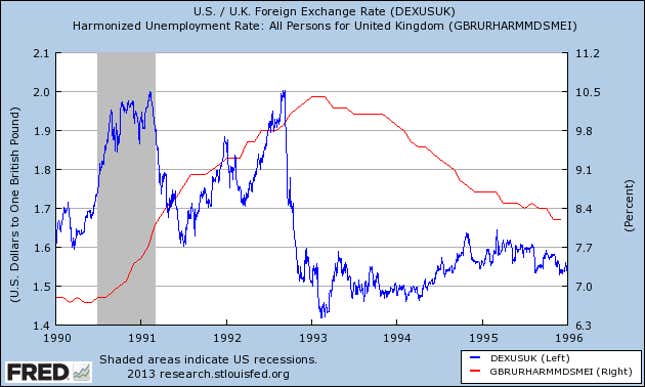

History also suggests that focusing on domestic output is the only sustainable strategy. The measures required to limit exchange rate volatility are far too painful to be sustained. In 1992, the Bank of England, a leading monetary institution of the day, was struggling to prevent a depreciation of the pound. Even though the Bank of England brought the British economy to its knees and allowed unemployment to rise from a mere 6.8% at the start of 1990 to 9% on September of 1992, it was not enough. Democratic opposition to tight money was too strong. Eventually, the power of speculative capital forced the Bank of England to bow out and let the pound depreciate.

One way to reform emerging market monetary policy towards stabilizing domestic output is through “pegging the export price.” This policy, developed by Harvard economist Jeffrey Frankel, is designed specifically for export economies. This policy would call central banks to stabilize the price level of exports, as denominated in the domestic currency. For example, it would have the Indonesian central bank conduct policy so as to maintain a steady growth in the rupiah denominated price of its key exports: energy and agricultural products. So when slowing international demand causes the prices of coal and petroleum products to fall, the central bank should expand the money supply until the price of those products, when denominated in rupiah, returns to the previous trend. This provides key export industries with a monetary boost just as they get hit by a global demand shock. Therefore, in addition to maintaining the health of export businesses, overall output volatility is reduced.

In addition to protecting the emerging market economy from trade shocks, such a monetary policy also contains the impact of capital flows. When an economy is losing foreign capital, the last thing that it needs is a tightening monetary environment. To tighten in this situation makes it even harder to keep distressed businesses running. Rather, easing monetary policy and depreciating the currency makes it easier for the domestic economy to recover and adapt to external conditions.

This policy also captures the inflation-fighting benefits of exchange rate targeting. Countries such as Argentina and Brazil originally pegged their currencies to the dollar in order to demonstrate that they would no longer pursue inflationary monetary policies. Pegging the export price would also accomplish this because the prices of most commodity exports are very transparent. Therefore, central banks could demonstrate their ability to limit inflation without the other negative effects of an exchange rate peg.

For an example of how this would work, look to Australia. In recent years, Australia has been a very large commodity exporter. And so when commodity prices collapsed during the Great Recession, the Reserve Bank of Australia (RBA) responded by letting the Aussie dollar depreciate almost one-for-one. It did so in spite of higher inflation that resulted from the weaker currency. In doing so, the RBA stabilized aggregate demand and, as a result, the domestic economy.

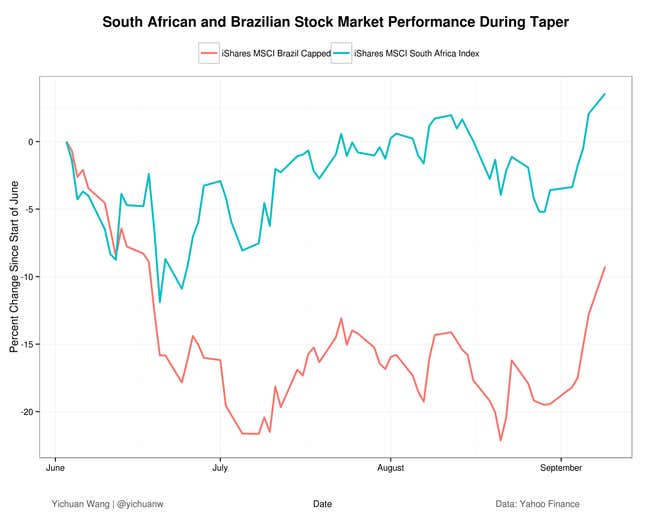

Among the major emerging markets, Brazil would especially benefit from such a policy. When external conditions deteriorated, the Central Bank of Brazil decided to tighten policy. Compare this to the response of the South African Reserve Bank. While South African officials are also concerned about the depreciating Rand, it has signaled that it is unwilling to tighten policy due to weak domestic conditions. And as a result, the South African MSCI index has made it through the taper much stronger than Brazil’s.

Indonesia would benefit as well. Indonesia, like Brazil, raised its policy rate in response to the taper and is expected to raise rates even further. By switching to a monetary policy that focuses on domestic growth, Indonesia would avoid such a self-desctructive response.

Now, this may very well increase exchange rate volatility. When the exchange rate falls in a recession, a policy of pegging the export price would have the central bank driving it lower as it expands the money supply. However, this volatility in external conditions is just the flip side of more stable domestic incomes, which should be the overriding stabilization objective. Moreover, because external debt levels are much lower than in the late ’90s, these exchange rate fluctuations are unlikely to trigger a balance sheet crisis.

The recent effect of capital outflows on emerging markets should serve as a reminder that, although emerging markets have come far, there is still much left to be done. To the extent that emerging markets have come under stress, this suggests that the next step of development for these economies is to reform their monetary policies to focus on the domestic economy. And if the emerging markets manage to master this new policy act, we may soon drop the moniker of “emerging” and find that a new wave of advanced economies has emerged.