Google and the National Football League met recently, reigniting speculation that Google will disrupt cable and satellite television providers. By constructing its ultra high-speed Google Fiber internet service in Kansas City, Austin and Provo to create a next-generation internet test bed, Google has unintentionally reinforced public opinion that its wants to compete with pay TV.

Sorry to disappoint the disruption freaks, but it just ain’t so.

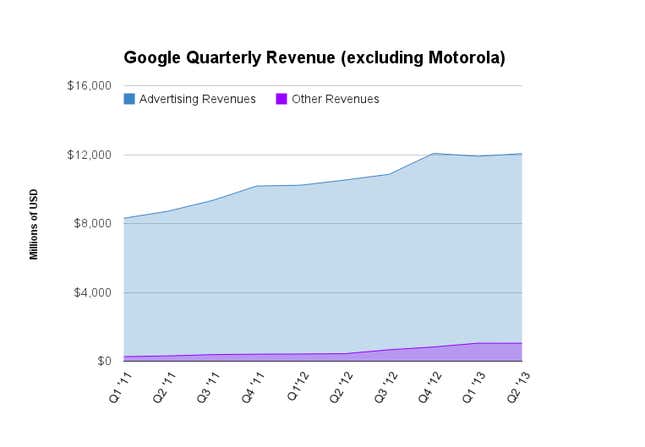

The casual Google observer is easily distracted by everything from the Android to the company’s self-driving cars, but here, Google’s raison d’etre is quite simple: Advertising.

The NFL meeting and construction of Google Fiber is more of the same. Google won’t acquire or replicate existing business models that don’t fit “Google scale,” meaning organizing internet information on the scale of hundreds of millions, hundreds of billions or even larger, so its customers can advertise more effectively. Google advertisers can analyze and measure the results of digital advertising with fine-grained accuracy per user, per impression. Google’s rumored bid for the exclusive Sunday TV rights from the NFL doesn’t make sense because it lacks the scale of a Google business; likewise, thinking that Google Fiber would adopt anything resembling Comcast’s 40-year-old pay TV business model is just silly.

Google Fiber is a red herring. Google sources say the company discovered a direct relationship between increased internet speeds and increased internet usage. With faster connections, consumers searched more and watched more YouTube—all of which Google could monetize with more advertising. Google Fiber is bundled with pay TV because consumers almost always buy these two services together. So in this way, Google Fiber’s pay TV offering is indistinguishable from any other premium television offerings.

But Google Fiber is differentiated by internet speeds of up to a hundred times faster than the US average. It’s a test bed for an internet without limits. The goal here is to change the average consumer’s internet performance expectation to 1-Gbps speeds, decrease the cost of deploying this new technology and accelerate the adoption of 1-Gbps internet across the US by competing ISPs. When that happens, users will use Google services more, and Google makes more money through—you guessed it—advertising. Most casual observers assume a complicated cross-industry takeover strategy out of Google Fiber, but that’s because they’re not thinking as long term as Google itself: Google Fiber is an incredibly long play towards the most basic answer. Again, for those of you not paying attention, that would be advertising revenue.

So the question arises: If a bid for Sunday football rights and restructuring the pay TV business are not on Google’s agenda, what could have been discussed at the meeting with the officials governing America’s favorite sport?

Google Fiber was most likely a point of discussion among Google CEO Larry Page, YouTube content boss Robert Kyncl, and NFL commissioner Roger Goodell. But why talk about a decade-long plan for Google Fiber to reach a fraction of US households when you can broach the far more compelling topic of how 1-Gbps internet speeds will reinvent the NFL viewing experience?

Another probable discussion topic: how YouTube could increase engagement. Imagine the engagement possibilities should fans have the ability to tweet replays in real time via short YouTube videos. People already tweet along with their favorite shows, so fostering an extra level of participation by letting fans obsess together over highlights or controversial calls as the game progresses seems like a no-brainer.

Goodell’s visit to Google might have included a Chromecast demo. Chromecast, Google’s recently introduced $35 device that plugs into a television and makes streaming from Netflix and YouTube dead simple, would appear to be the perfect platform for streaming NFL football games too. Google could spend billions of dollars to acquire the rights to stream NFL football. But a better alternative for Google is to enable the NFL to create its own streaming service using Chromecast. The NFL is much better positioned to negotiate with its existing NFL broadcasters and teams to carve out an over-the-top NFL television streaming service that increases overall league revenues. Google could monetize and share in this new offering with its much superior analytics and digital advertising. Also it is much more capital efficient for Google not to spend upfront capital to acquire content and let the many content owners such as the NFL, news publishers and reality TV shows to choose Chromecast and sell them Google’s core strengths in analytics and digital advertising.

Also a likely discussion topic: last year’s team effort between the NFL and Google to integrate Google Plus Hangout multiuser video chat with NFL fantasy football. Hangouts are part of Google Plus, the company’s social network with more than 235 million unique active monthly users, which happens to be in the middle of an upgrade to 720-pixel high definition video. Just in time for the football season.

Those rumors of a Google bid for NFL Sunday Ticket doesn’t fit with the definition of Google business scale. Sunday Ticket gives subscribers access to any Sunday NFL game played anywhere in the US. According to Bruce Leichtman, principal analyst at Leichtman Research, “Sunday Ticket is for bars, restaurants, gamblers and the misplaced fans that have moved to a state where their hometown team isn’t televised by local affiliates. One third of its approximately two million subscribers are commercial locations.”

Two million non-digital subscribers is not Google’s kind of business.

More in line with its strategy: Stream NFL Sunday Ticket games as an over-the-top television service. But this would put Google in direct competition with existing NFL broadcasters (CBS, NBC, ESPN and Fox) that currently pay the NFL a combined $18 billion a year. Most importantly, no matter how much people like the idea of disrupting pay TV, Google’s core business structure is simply unprepared to monetize an over-the-top football season.

No doubt, of course, that Google is attracted to the huge television advertising budgets. But Google will approach television differently, at Google scale, giving the content owners and advertisers a deeper data-driven understanding of their viewers, fine-grained advertising measurement that today’s TV ads lack and more personalized advertising. What it won’t do is spend billions of dollars to create a television content portfolio just to then turn around and stream it as an over-the-top version of Comcast. We can all agree that Google dreams bigger than that.