Five years after the US financial crisis struck, American household incomes are still stuck.

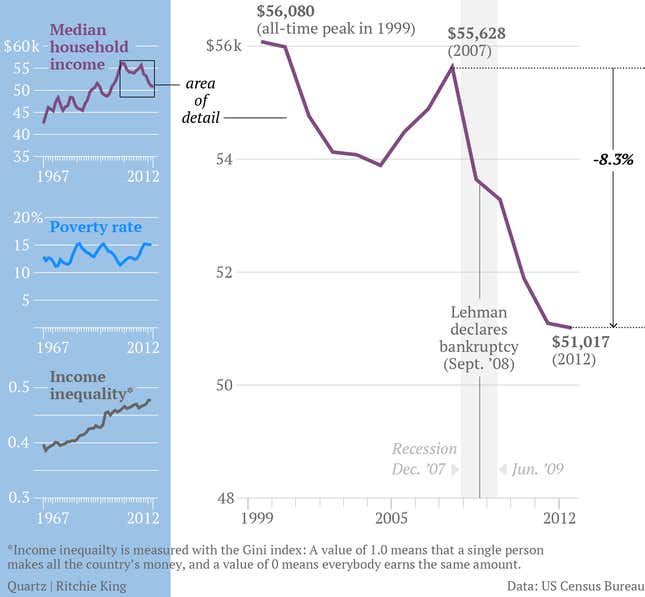

Median income for the typical American household was $51,017 in 2012, leaving it 8.3% lower than where it was in 2007, the year before the financial crisis hit. Median household income was roughly flat compared to 2011.

Those official, inflation-adjusted figures are fresh out of the US Census Bureau this morning. (See the full update here.) Median household income—which means half of American households earn more and half earn less than the figure—is one of the most closely watched and easily understood gauges of how American families are faring economically.

Things look even worse from a longer-term perspective. Since 1999, when US household incomes hit all time peak of $56,080, median household income has tumbled 9%.

For the record, there is one demographic trend to note in these numbers. Even if the economy were going gangbusters, the aging of the baby boom generation would be a weight on US income levels. Generally speaking older people have lower income levels, which can drag down overall median income. The number of households in which the head of the household was 65 or older rose by roughly 1.1 million in 2012, a 4% increase over the prior year.

Today’s census income data also included updates on other key metrics on the wellbeing of the American populace. The US poverty rate stayed flat at 15% in 2012, compared to the prior year. Some 46.5 million Americans were living at or below the poverty line in 2012.

And an important measure of income inequality, known as the gini index was flat when compared to 2011. But it continues to hover at its highest—or most unequal—level ever recorded, as earnings of more affluent households outpaced the rest of the country.

New numbers on American earnings add an important element to the current focus on how the country and the financial system are faring five years after the failure of Lehman Brothers sent the US financial system and the economy into a tailspin. (It also just happens to be the second anniversary of the start of the protests that became the Occupy Wall Street movement.) The data show many American families still haven’t pulled out of it.