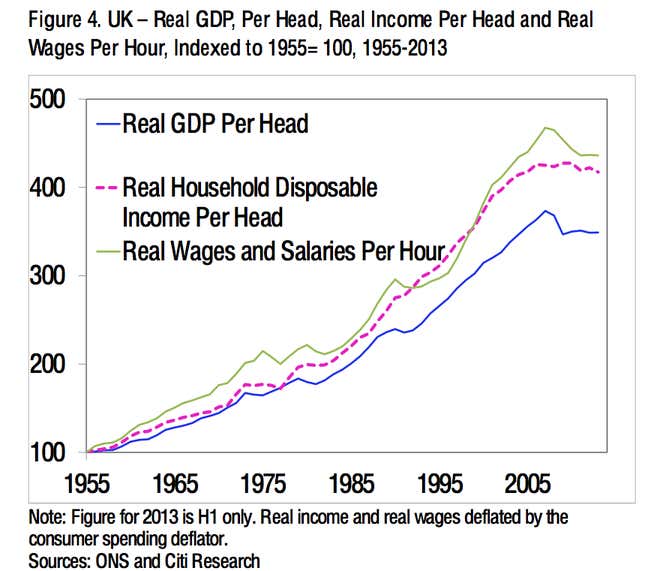

What’s good for the economy isn’t necessarily good for the people living in it. Case in point: The United Kingdom, where David Cameron’s Conservative-led coalition government is pushing forward with a popularly mandated overhaul of the country’s somewhat bloated public sector. Reforms might well be needed. But they’re clearly painful. In fact, according to Citi analysts, the UK is going through an “unprecedented squeeze on living standards,” thanks to falling incomes and rising costs of necessities like energy and utilities. Citi economists crunched a bunch of different gauges of “real” or inflation-adjusted measures of economic wellbeing. Here’s how they look.

Incomes are flat or falling…

Any way you slice them, the UK numbers are godawful:

- Real wages and salaries per hour are down 0.9% over the last year.

- Real wages and salaries per hour are down 7.9% since the fourth quarter of 2007.

- Real personal disposable in income remains 2% below where it was in the middle of 2007. That’s the first time on record that real income per capita has fallen over a five year period.

- In nominal terms, average household income fell 3% in 2012, compared to the prior year. That’s the first year-on-year decline since the start of data back in 1977.

- Real GDP per capita is 7.1% below the 2007 peak.

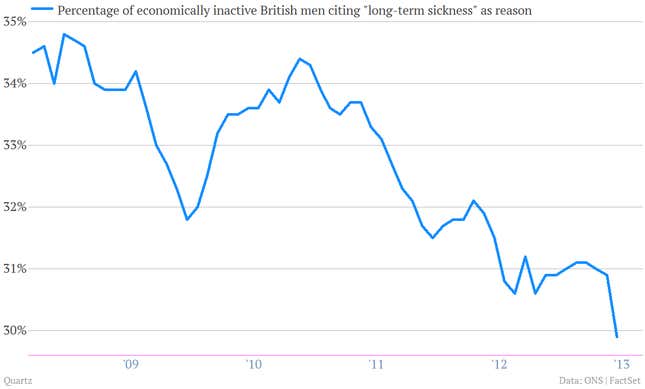

The labor force is growing…

Why are wages low? It’s pretty simple: high unemployment and an ample supply of workers. One source of those workers, comes from the decline in the number of Brits on the dole, as we’ve spotlighted before:

And also, costs of living are rising. (That’s a result of rising indirect taxes, energy and utility costs as well as a range of other semi-regulated prices, Citi analysts say, including gas, water, rail fares and university tuition.) So what’s the upshot?

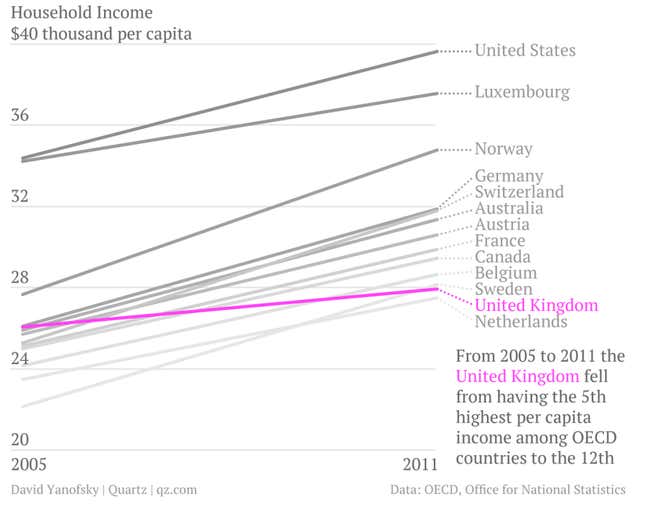

…and the UK is falling behind

Brits are losing quite a bit of ground compared to other developed countries in recent years. As we’ve told you before, by some measures they’re now poorer than the French, Swiss, Belgians, Swedes, Austrians, Aussies and Canadians.