The time-honored Silicon Valley trajectory of the California technology entrepreneur who scores funding from a fabled Sand Hill Road venture capital firm and then becomes Zuckerberg-wealthy in a Twitter-worthy initial public offering is so 1999 when it comes to green tech.

In a new study of green tech investing in California between 2003 and 2013, Next 10, a San Francisco non-profit, found that venture capitalists like Kleiner Perkins Caufield & Byers still play a key role in clean energy startups. But their corporate counterparts increasingly provide the billions it can take, say, to get a solar power plant built.

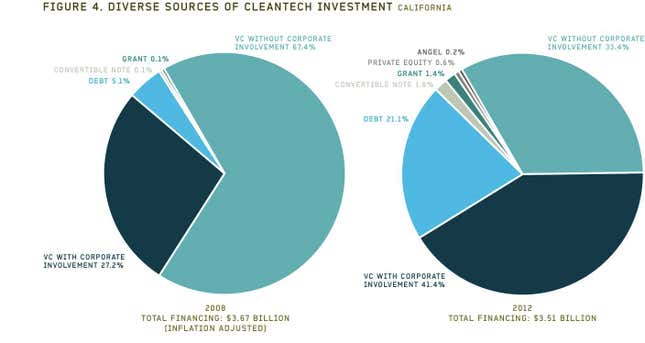

In 2008, venture capitalists put up more than two-thirds of $3.67 billion in green-tech funding without any assist from corporate investors like Google Ventures, Siemens Venture Capital or General Electric. By 2012, that had shrunk to 33.4%. And 41.4% of $3.51 billion in funding was joint deals between VC firms and corporate investors.

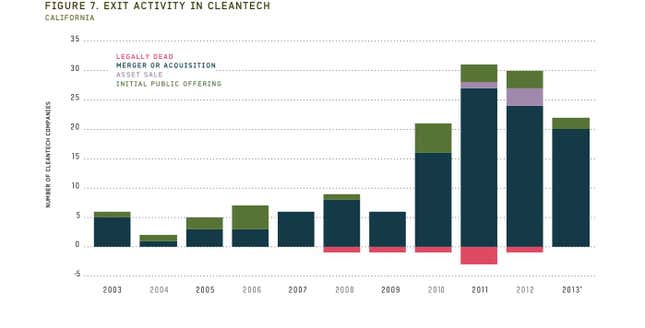

Forget about the big IPO. Only 10% of green tech companies paid back their investors by going public. Rather, getting acquired—sometimes by a corporate backer—was the ticket for 79% of clean tech startups with an exit.

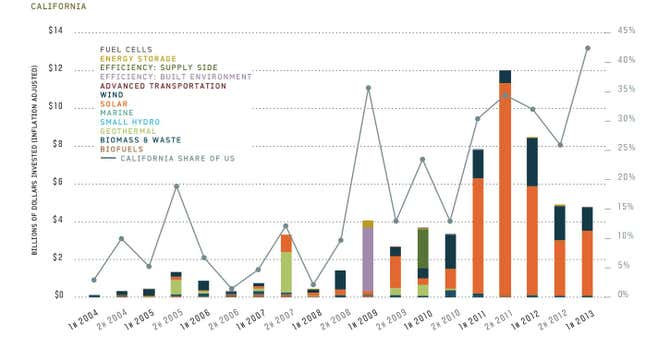

Those startups often need to tap very deep pockets to build industrial infrastructure like an algae biofuels plant, and California captures the biggest chunk of green-tech project financing in the US—40% of the total in the first half of 2013.

Expect the trend of corporate investing to continue as those startups of 2003 commercialize their technologies in the years ahead. “Corporations are well suited for the clean-tech sector, providing strategic market power, longer-term investment horizons, and critical investment capital,” the reports states. “Many clean-tech startups are trying to penetrate existing, well established markets, such as building infrastructure or energy production.”