Everything but the essential bits of the US government powered down this morning. And yet, the markets don’t really seem to care.

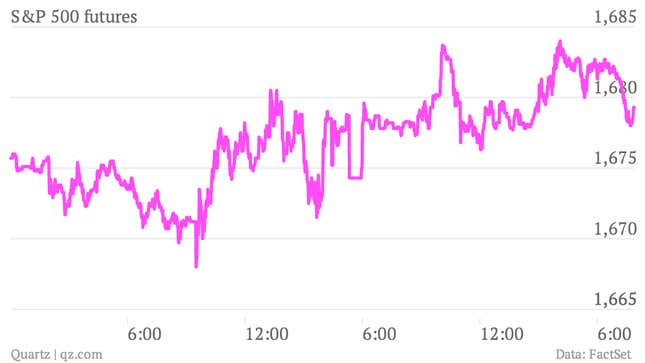

S&P 500 futures are hovering around 1680, up about 0.3%.

Meanwhile, in the bond market yields are up a bit, but there are few signs of a collapse in confidence in America’s ability to govern itself. Yields on the US 10-year note are about 2.65%. US crude oil is flat. And the dollar is down slightly, but nothing terrifying.

So what’s with the market’s shrug? Essentially, investors have become somewhat inured to the political standoffs and brinkmanship that have characterized the US in recent years. After examining the stock market performance during government shutdowns going back to 1976, Tom Lee of J.P. Morgan wrote in a note to clients: “Equities have fallen 0.2% during the shutdown period (median) but it seems that the longer the shutdown, the greater the decline. This is intuitive as longer periods add uncertainty and put greater risk on economic outcomes.”

As for the economic impact of the shutdown, Barclays analysts aren’t concerned. “Insofar as a government shutdown is temporary, the effect on growth will be modest and we expect any sell-off in market risk appetite to be small,” they wrote in a client note this morning.

Of course, as with anything in the markets, past performance is no guarantee of future returns. And just because past shutdown showdowns haven’t sent the economy over the edge, doesn’t mean that the current wrangling won’t go horribly wrong. After all, to a certain extent, policy makers in Washington look to the financial markets for some sort of cue as to when their shenanigans have gone too far. And if investors remain too nonchalant, that could embolden DC diehards and result in serious damage to the US economy.

At any rate, we’ll find out soon enough, when the government will start bumping up against the debt ceiling later this month. (The Treasury has said Oct. 17 is the date the US debt ceiling must be raised by.) In fact, many investors see the shut down as a prelude to the more important debt ceiling fight. The “shutdown could lead to a sharp increase in the public disapproval of Congress’s handling of fiscal matters and allow for a smoother agreement on the debt ceiling issue. Or on the flip side, it could embolden both sides to become more entrenched in their positions. In so far as the probability of a debt ceiling breach is affected by the government shutdown, we believe it will be market moving,” wrote Barclays analysts.