Can we trust any financial indexes any more? This morning Swiss regulators announced an investigation into potential manipulation of foreign currency exchange rates. They are “coordinating closely with authorities in other countries as multiple banks around the world are potentially implicated,” according to a statement. British regulators launched their own probe into the market in June.

The Swiss move calls into question the integrity of benchmarks in another of the world’s largest financial markets—more than $5 trillion is traded every day in foreign-exchange markets. This adds to ongoing investigations into manipulation of Libor, with four banks and brokers fined nearly $3 billion thus far, and more settlements reportedly on the way; an EU probe into the Euribor rate-setting process; European investigations into global crude oil pricing benchmarks; and US regulators asking questions of indexes for interest rate swaps.

For those keeping score: That means the world’s key price benchmarks for interest rates, energy and currencies may now all be compromised.

The burgeoning foreign-exchange scandal shares many of the same characteristics as the other allegedly rigged indexes. Unusual trading activity around the so-called “fix” for certain spot rates—the one-minute window at 4pm London time when trades are observed for the widely-followed WM/Reuters benchmarks, for example—hints at attempts to game the system, as detailed in a recent investigation by Bloomberg. To calculate the WM/Reuters benchmarks, WM and Reuters watch trades for 30 seconds on either side of 4pm and use the median of those prices to determine the rate. Others aren’t so sure that this implies misconduct, but the Swiss and British watchdogs have clearly spotted something that they think is amiss.

Although currency rates are set by measuring actual trades—unlike the hypothetical borrowing rates that banks submit to Libor’s administrators—the predictability of the timing of the daily fix opens up the system to potential abuse, with traders (in theory) gaming the one-minute fixing window to produce a daily benchmark rate that benefits their other positions.

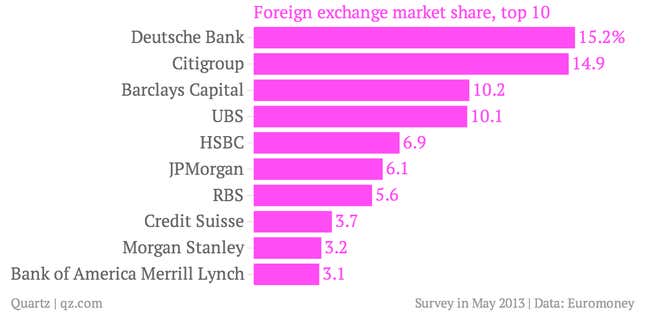

Some of the remedies suggested to improve the integrity of Libor (pdf) are relevant in this regard; randomizing rate submissions and varying the time of data collection may limit the scope for manipulation. But we still don’t know much about the details of the foreign-exchange probes beyond that they exist; the relevant regulators and suspected banks involved are all tight-lipped about the nature of the investigations. Some 50% of the foreign-exchange market is controlled by four banks, according to Euromoney: Deutsche Bank, Citigroup, Barclays and UBS.