America might have too much debt for its system to cope with.

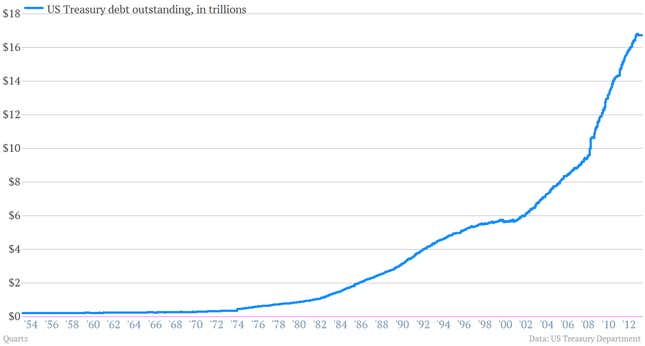

No, not the financial system. Sure, at $16.7 trillion, the US government has a lot of debt. But despite what you might hear, America is not bankrupt, any more than a homeowner with a mortgage is bankrupt. In fact, thanks to healthy buying from Japan, China and the US Federal Reserve—not to mention a worldwide scramble by investors in search of safe places to put money—the US can easily and cheaply borrow any money it needs to meet its obligations.

No, the system we’re talking about is not the financial system—it’s the democratic system. Maybe America’s awesome ability to take on debt is actually weakening the country’s willingness to pay it back. And maybe that’s why the nation’s hard-won reputation as a near-pristine borrower is starting to crumble in what may be an unsettling new chapter of America’s 223-year relationship with government debt.

Ability and willingness

First things first. A country’s reputation as a borrower is largely built on two things: ability to pay debts, and willingness to pay.

As we said above, the US has the ability to pay. But willingness? That’s a political issue.

Defaults by countries that were perfectly able to pay their debts have a long and rich history. A study of almost 170 government defaults dating back to the Napoleonic era showed almost 40% took place when economic growth was strong. That suggests that at least some were driven by politics rather than economics. “Many of these seemingly inexcusable defaults occurred when political upheavals brought new coalitions to power that favored default for opportunistic or ideological reasons,” the authors of the paper wrote.

There’s been just such an upheaval in the US, where a hardline Republican coalition—the Tea Party—gained influence after Barack Obama’s 2008 election. Brinkmanship driven by the Tea Partiers has repeatedly pushed the US closer to default than many would have ever thought possible. The last showdown, in the summer of 2011, prompted rating agency Standard & Poor’s to strip the US of its AAA rating. Fitch threatened to do the same this week, just before Republican leaders relented and allowed Congress to push through a bill to raise the debt ceiling and reopen the government.

For the record it’s only a small—albeit vocal—minority of Americans who don’t seem to recognize the obligation to repay debts the US has incurred throughout its history. When the Pew Research Center queried people during the US debt fight in the summer of 2011, some 23% of respondents said lawmakers who shared their political views—whatever those were—shouldn’t cave into pressure from the other side, even if it meant defaulting on the debt. A separate set of polling on attitudes toward default seems to put levels of support for default somewhere between 10% and 20%.

But with or without public support, the US seems to have embarked on a new path in its fiscal history that seem to threaten its cherished reputation as a borrower. “The repeated brinkmanship over raising the debt ceiling … dents confidence in the effectiveness of the U.S. government and political institutions, and in the coherence and credibility of economic policy,” wrote analysts with Fitch.

How did we get here? To figure that out, we have to take a look at America’s history as a debtor.

Blame the Dutch

The ability to establish long-term public debt is actually a cornerstone of a liberal democracy.

The two have been linked since at least the 1600s. That’s when the tiny Dutch Republic—a nation of an estimated 1.2 million people—was able to win its independence by outlasting the mighty Spanish monarchy, which ruled over 20 million, in the Eighty Years War. How? Good credit.

Strange but true. Lenders charged the rebellious, fledgling Dutch Republic much lower interest rates than the well-established—and heavily favored—global power that was the Kingdom of Spain, because kings—especially Spanish kings—were godawful borrowers.

The poster child for a potentate’s predilection for default is King Philip II, a war-loving Spanish sovereign who managed to declare at least three separate bankruptcies—or perhaps four, depending on how you count—during his reign (1556-1598). Philip II defaulted in 1557, 1575 and 1595. Successors Phils III and IV continued the royal tradition, stiffing creditors in 1607, 1627, 1647, 1652 and 1662.

Meanwhile, in the United Provinces of the Netherlands, citizens of Dutch city-states had been buying and selling municipal debt as investments for centuries as part of a long tradition of self-rule. During the war with Spain, a newly formed free assembly extended the Dutch municipal system to the provincial and national levels, imposing taxes to ensure debts were paid. (After all, the public assembly that approved the loans was often made up of wealthier citizens who were heavily invested.) A booming, open economy that attracted foreign capital—thanks in part to the state-chartered Bank of Amsterdam—also meant there was ample demand for safe places to put excess cash.

The result? Rock-bottom interest rates based on economic fundamentals and trust. That trust stemmed from the fact the Dutch were lending their money to themselves. That meant other lenders were likely to get paid back too.

“Since the country was united and the people trusted their government, it could pledge the nation’s credit effectively, ” wrote Sidney Homer and Richard Sylla in their giant treatise on interest-rate history. The Dutch system of government finance was refined further once it arrive in England with the establishment of the constitutional monarchy in 1688. And the low borrowing costs enjoyed by England’s constitutional monarchy—in which parliament needed to approve royal borrowing, and imposed taxes to ensure the creditors were repaid—helped it to prevail over its perpetual 18th-century enemy, absolutist France.

The ability of a country to borrow cheaply to fight wars was a question of national life and death.

(For more on the history of “Dutch finance,” be sure to read James Macdonald’s excellent book, A Free Nation Deep in Debt.)

Hamilton’s blessing

In the newly independent United States, George Washington’s up-and-coming former aide-de-camp Alexander Hamilton had learned that history by heart. He knew that if the wobbly US was going to be able to defend itself by borrowing cash in a pinch, it would have to establish a solid reputation as a borrower. That’s why he pushed so hard for the federal government to assume the debts of the states after the war, which happened in 1790. (Assuming the debts also established the right of the federal government to levy taxes and customs duties to to pay off those debts.) Hamilton, who became the first Treasury secretary, effectively founded the US federal state, and he also gave birth to the federal debt that the US is still fighting about.

Debt without limits

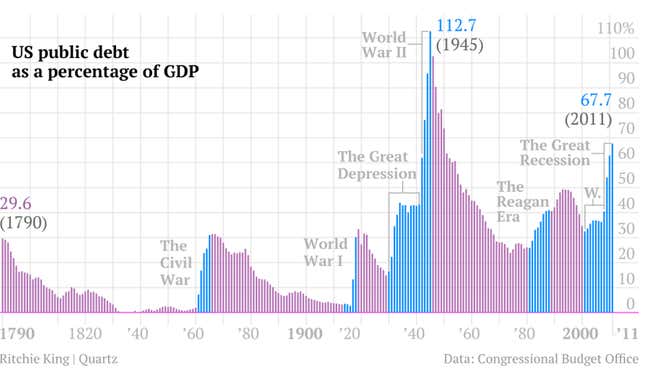

Now, as you can see from the charts above, the US debt—as a share of GDP—is pretty high at the moment. It’s also worth noting that while the debt-to-GDP ratio has risen and fallen over the last 100 years, that’s got more to do with the rise and fall of GDP. In dollar terms, US government debt has gone pretty much one way: Up.

In fact, the US hasn’t made a substantial effort to reduce the nominal level of debt since the aftermath of World War I. In 1919, the US had about $25 billion outstanding. That’s about $338 billion in today’s dollars. By 1930, that had been whittled down to just under $16 billion.

And that’s as low as it went. With the arrival of the Great Depression and president Franklin D. Roosevelt on the scene, everything changed. By 1939, the debt was up to $40.44 billion (about $680 billion in today’s money.) It exploded during World War II. By 1946 the US debt was $241.86 billion ($2.90 trillion today). And with the ascent of Keynesian economics after the war, the US opted to try to shrink the weight of the debt by growing out of it, rather than trying to pay it off.

What’s more, the US’s reputation as a safe haven only encourages it to issue more debt. When S&P downgraded the US in 2011, it unnerved global markets and sent investors scurrying for safety—which meant they bought even more US Treasurys, because despite the downgrade, those were the still the safest thing around. That made it even cheaper for the US to borrow. Basically, there’s no incentive for the US to cut down its debt.

Can pay, won’t pay?

As we noted above, one thing that made the Dutch Republic a good borrower was that a public assembly approved the borrowing, conferring a modicum of popular legitimacy on the debt. And it was willing to raise taxes to make sure the debt was paid.

Has that happened in the US? Well, technically, yes. But raising taxes further, especially to pay off debt, has become anathema to a large slice of the political spectrum. And when Congress votes to raise the debt ceiling, it isn’t just raising it for its own spending plans. It has inherited the bill for pretty much every federal undertaking in the last 70 years. The invasion of Normandy. The moon landings. The Vietnam War. Everything. It’s all in there. The US hasn’t actually paid for any of it. It’s merely refinancing those debts in perpetuity.

So it’s possible that when debts grow so large—and the memories of the programs and events they financed so distant—they start to chip away at a country’s willingness to pay back creditors. Here’s how a former Banque de France deputy governor explained the process in a paper last year:

Debt is a legacy of the past and, somehow, it prevents us from thinking positively about the future. High levels of debt have a corrosive effect on the social fabric of our societies. Debt fuels anxiety and erodes confidence. Debt also amplifies existing concerns on fairness and income distribution. Political compromises on fiscal adjustments become more difficult to reach and, overall, the willingness to repay debts diminishes as the sums accumulate.

Other factors may be adding to Congress’s reluctance to tolerate the debt. For one thing, a larger and larger chunk of debt is held by foreign creditors. Governments tend to be much more willing to stiff foreigners than the people that could vote them out of office. And the rise of financial intermediaries such as mutual and pension funds—which own large chunks of US government debt—might obscure to Americans just how much government debt they themselves own. Nor should we discount plain partisan politics. The Republicans hate president Barack Obama, and the debt is the best terrain they have for staging an attack.

But what it all adds up to is that the easier it has become for the US to issue debt, the greater the reluctance among some Americans—or at least their representatives—to keep paying it off. The ability to pay and the willingness to pay are moving in opposite directions.

And if that leads to the erosion of trusted institutions of democracy—think about the retiree who doesn’t get his social security check on time, the soldier who isn’t paid—well, then what made the debt possible in the first place starts to unravel. ”It’s not that tomorrow we’re going to start dismantling state structures that, for good or bad, have been built over 200 years,” said Daron Acemoglu, a professor of economics at MIT and co-author of Why Nations Fail, a study of the importance of state institutions. “But the fight has reached previously unseen proportions, and the question is whether it’s going to start a process with unintended consequences.”