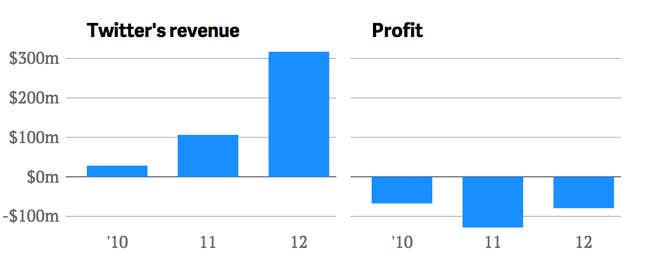

Twitter lost $79 million in 2012 and is on track to lose even more this year. But that hasn’t dampened enthusiasm for its shares, which are likely to start trading publicly next month.

Indeed, Twitter has plenty of company among technology startups going public this year: 68% were unprofitable at the time of their IPO, according to data compiled by Jay Ritter, a professor at the University of Florida. The statistics were reported today by the Wall Street Journal (paywall).

Twenty-eight technology companies have gone public this year, which is a similar pace as recent years. But performance has improved, averaging a 39% return in the first month following the IPO. That’s the best one-month return on new tech stocks since the dot-com bubble of 1999 and 2000.

Unprofitable tech startups are extremely common, but reasonable people might wonder why anyone would want to put money in them. Of course, an investment in a “pre-profitable” company, as they sometimes say in Silicon Valley, is a gamble that growth in users will translate into revenue down the line.

As a group, the IPOs of profitable tech companies are a better bet. Between 1990 and 2011, tech companies that were profitable at the time of their IPO returned an average of 55% in the first three years of trading, according to Ritter’s analysis. Unprofitable tech companies have posted three-year returns of 22% over the same period.

Twitter released just three years of financial data in its IPO filing, choosing to conceal two prior years under a new law. Its biggest loss was in 2011, at $164 million. It lost $67 million in 2010. It’s possible Twitter turned a small profit in 2009.

The filing also includes an unconventional accounting method it calls “adjusted EBITDA,” which excludes major expenses like the depreciating value of its assets and stock-based compensation. It’s not reasonable to ignore those expenses—a piece in Fortune recently called it “shady”—but Twitter says that its executives evaluate financial results that way.

Well, no surprise, but Twitter’s “adjusted EBITDA” shows it turning a profit of $21 million last year.