We’ve written before about how big corporations have become increasingly important to financing green technology startups—on Oct. 10 for example, Google announced it was investing $103 million in a big solar power plant in California.

But the second-most active corporate dealmaker isn’t a “don’t be evil” Silicon Valley tech giant. Rather it’s a company from the Dr. No sector—oil multinational ConocoPhillips, according to a new report from research and advisory firm Cleantech Group.

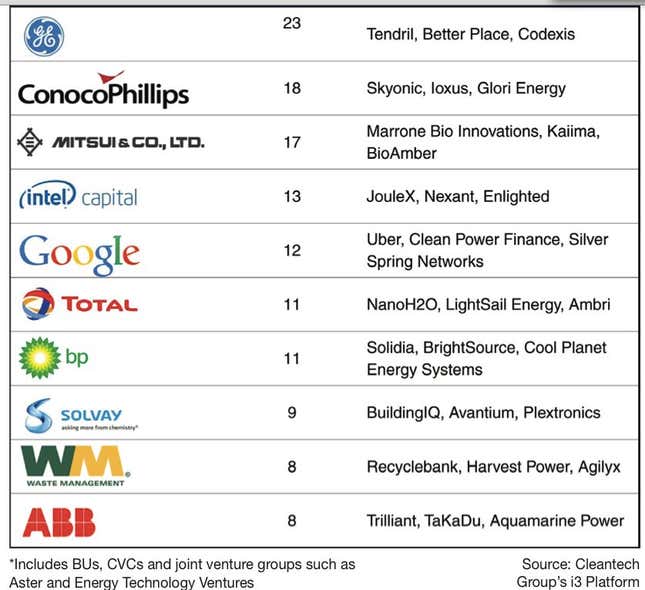

Between the third quarter of 2011 and the second quarter of 2013, ConocoPhillips invested in 18 deals, putting cash into startups such as Cool Planet, biofuels developer, and Skyonic, which has invented a technology to capture carbon dioxide from industrial emissions. French energy conglomerate Total ranked No. 6 with 11 deals, right behind Google with 12 deals. General Electric was the top dealmaker with 23 investments.

For startups, these partnerships obviously offer deep pockets and potential access to big markets as well as the possibility of being acquired. For their part, corporate investors get a sneak peak at technologies that might prove to be profitable—or a long-term threat. But the track record of such partnerships isn’t all that encouraging. According to the Cleantech Group, 40% of startups that scored corporate funding had “distressed exits.” In another word, failure.