The fuel cell industry has been the next big thing for nearly as long as it’s been around. Invented in the early 19th century, fuel cells are an efficient and clean way to produce energy. Hydrogen (the fuel) is pumped into a stack of various metals (the cell) in the form of natural gas or biogas. A chemical reaction produces electricity, water, heat and a negligible amount of carbon dioxide. Sounds great, right? That’s why over a dozen companies work in the industry. They make everything from multi-megawatt generators powering entire universities to little ones that power cars. Just last month eBay’s Utah data center went online, run entirely on fuel cells made by Bloom, a private company. The industry got another boost this week when Toyota unveiled a prototype of a fuel-cell-powered vehicle. Fuel-cell energy is, according to one estimate, a £12 billion market just waiting to be exploited.

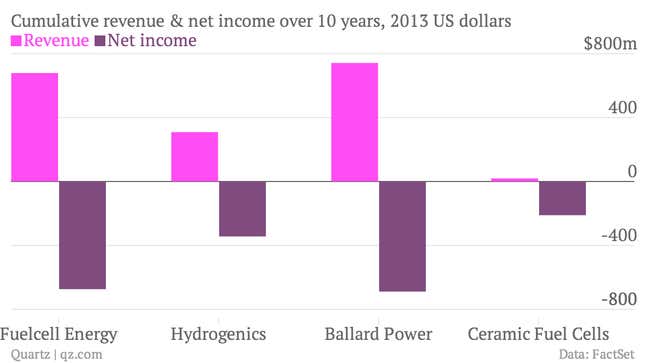

There’s just one problem: The fuel cell industry has never made any money—not a single public company has turned a profit and it is unlikely the private ones have either. And those fancy fuel cell cars? They’ve been around since at least 1966, when Chevrolet launched the Electrovan. It didn’t take off.

Enter the optimist

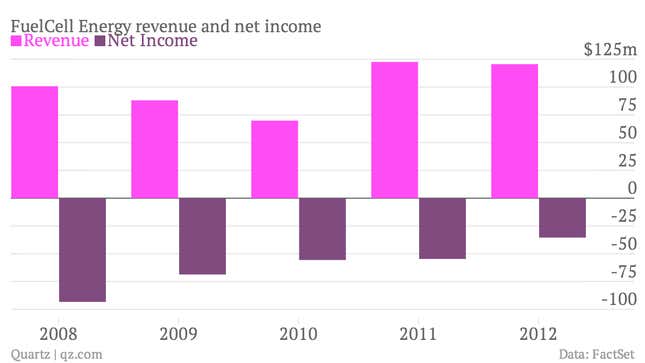

Chip Bottone joined FuelCell Energy, the largest fuel-cell company by market capitalization, in 2010 and a year later became its CEO. Bottone is sure he can make his company the first in the industry to turn a profit, at least for one quarter. Considering the sea of red soaking any fuel cell company’s balance sheet, that would be an achievement.

Bottone’s company does not do fuel cells for mobile applications such as cars. That market is five to 10 years away from being mature, says Olivier Vallee, an analyst with Natureo Finance, a research and consulting firm that looks at green tech. There exists neither the infrastructure to power these cars as they move around nor enough demand to make it viable. Instead, FuelCell Energy focuses on larger capacity, mostly above 1 megawatt (MW), enough to run roughly 1,000 homes.

FuelCell Energy will produce 60MW this year on average. Bottone says the company will achieve its goal of making more money than it spends when it produces 80MW in a calendar year or 20MW in a quarter. “It’s a ‘when’ question, not an ‘if’ question,” he told Quartz in an interview in London, where two developments—a skyscraper nicknamed the “Walkie Talkie,” most recently in the news for frying a Jaguar, and Quadrant 3 (pdf, p.26), a mixed-use building in the heart of London—are being fitted with fuel cells.

The reason fuel cells have singularly failed on their promise for decades is that they have been too expensive. The two London buildings, for instance, will pay more to generate their own power using fuel cells than they would by simply drawing it from the grid. But they signed up for reasons that include bolstering their green credentials and compliance with local planning laws. Fuel cells, with their low emissions, limited production and quiet running, are better suited to being installed in the middle of a city than traditional plants. They are also more reliable than solar panels (especially in London, where sunshine is a rare treat).

Still, the added expense of fuel cell energy is a burden. Electricity produced by fuel cells costs $0.14 to $0.15 per kilowatt-hour, the most commonly used measurement of energy prices. In contrast, coal-generated power costs between $0.07 and $0.15 while natural-gas power is cheaper yet at between $0.06 and $0.09. Bottone believes things will change for fuel-cell energy when it can bring costs down to between $0.09 and $0.11. He’s part of the way there. It now costs the company about a quarter of what it did in 2003 to produce energy. As production goes up, it will become even cheaper, he says. Bottone’s eventual target is to be producing 210MW of power annually.

The Korean connection

FuelCell Energy’s big moment came late last year when it inked a deal with POSCO energy, the largest private energy producer in South Korea and a subsidiary of one of the biggest steel producers in the world. The deal will see POSCO build a a plant that can produce 140MW annually, for which it will pay FuelCell a license fee as well as royalties on cells manufactured over the next 15 years. More importantly, POSCO has said that if FuelCell Energy goes bankrupt, it will cover the maintenance for all its products. Despite its small size, South Korea is an important market; it has a heavily built-up urban environment in which coal plants are impractical. It also has plenty of the natural gas needed to power fuel cells.

The deal helped build confidence in the company. Other deals in North America have also helped; NRG, America’s largest independent power producer, has agreed to sell FuelCell’s product to utilities. In addition, ”there is confluence of new management, timely technology, manufacturing maturity, and client base which is starting to send in orders,” says Vallee, the analyst. Though Bottone won’t commit to a timeframe, Vallee forecasts that a break-even quarter is likely as early as 2014. A survey of other analysts’ ratings reveals that FuelCell’s stock is rated as buy or hold by those who follow the company.

If Vallee is right and Bottone does manage to stop losing money, that would be a big deal not just for FuelCell Energy but also for fuel cell energy. After nearly two centuries, its time may yet come. Yet Bottone advises caution: “A lot of people have oversold this. Fuel cells at some point will be a good source of power and the market could be reasonably large. But it’s not for everybody. There’s lots of other solutions.”