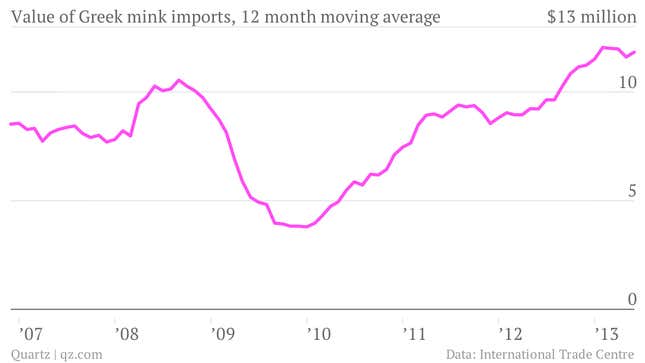

Even with its struggling economy Greece has consistently been one of the world’s largest buyers of raw mink. Since 2010, imports of raw mink have more than doubled.

During peak season in 2013—April—Greece was the fourth-largest importer of American mink and the sixth-largest importer of world mink, according to data compiled by the International Trade Centre. Greece imported $144 million worth of mink in 2012. That was 0.05% of all its imports, about the same value of the t-shirts it imports. In September 2012, during the off season, Greece was the largest importer of American mink.

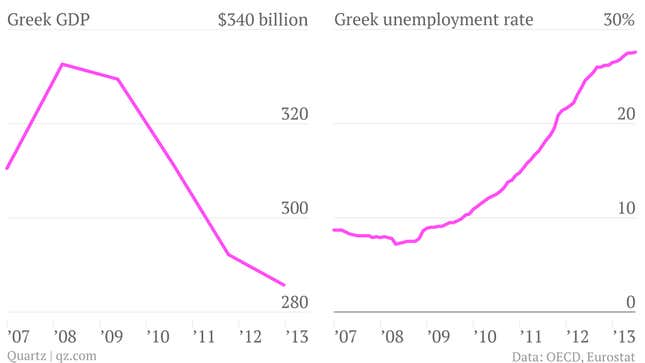

With the nation’s unemployment rate near 30% and a 14% decline in GDP over the last five years, it’s hard to imagine million-dollar demand for expensive coats. So what gives?

The US mink industry has been feeling the effects of Chinese demand for years. Michael Whelan, the executive director of Fur Commission USA—a trade group representing hundreds of US mink farmers—says Chinese buyers have buoyed up the US mink industry from feeling any effects of the recession following the financial crisis.

But Greek exports go to a different buyer—Russia. Whelan says the Greeks are a major supplier for the Russian market, turning the raw mink pelts they buy at auctions in Seattle and Toronto into finished garments.

In 2012, Russia bought $139 million worth of fur apparel from Greece, according to export statistics, accounting for 45.1% of Greece’s exported fur garments. (Another 37% is exported to buyers in the United Arab Emirates.) By contrast, Russia buys only 1.7% of Greek exports overall.

Russia is buying up fur from all over, as its GDP has grown 20.8% since 2008. In 2012 the country imported 1,339 tons (1,215 metric tons) of it from 54 countries.