The most common use of the vast amounts of digital slime trail we leave as we crawl across the web is for the purposes of ad targeting. Rajesh Ramanand, a former PayPal executive, figured that it can also help e-commerce merchants figure out the authenticity of online transactions. Yesterday, he launched Signifyd, a service that allows e-commerce merchants to verify a cardholder’s identity before approving the transaction. It generally takes less than a second, he says, to collect and analyze up to 120 data points about a person.

Payments processors are a notoriously cautious crowd, thanks to the way in which liability works. If you buy something by physically using your card, any liability for a false transaction lies with the card issuer. But for payments when the card is not physically present, liability for fraudulent transactions generally rests with the merchant. If they can be sure you’re who you claim to be, they will be more likely to accept the payment. According to Signifyd, e-commerce loses about 1% of business annually to fraud and another 3% to declined transactions. “What we’re trying to do is reduce the number of declineds. It’s okay to let a few frauds in but you don’t want to block out a lot of the good people,” Ramanand told Quartz.

Not your mother’s maiden name

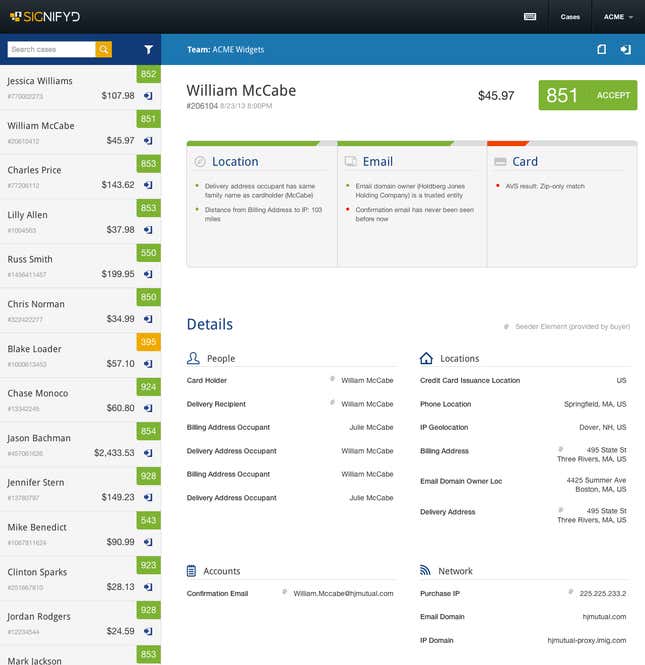

Here’s how it works: when you try to make an online payment with your card, Signifyd will check to see what device the transaction has come from, the browser, the physical location, whether the email address used for the purchase ties in with those used for the same name on Facebook, Twitter or LinkedIn, whether the address given is registered to the same person, whether the owner of the phone number given matches the name on the card, and several other data points. Not every transaction requires all 120 factors, say Ramanand. A few matches are generally enough.

Fraud prevention is a focus for many security and financial technology companies. Where Signifyd focuses only on e-commerce, similar cross-verification methods are in the works in the physical world as well. For example, ValidSoft, a British firm, correlates the transaction’s IP address location with the physical location of the cardholder’s mobile phone by checking which tower it is connected to. If they match, there is a high likelihood the transaction is legitimate. Though such services are aimed at card issuers and online merchants, they could make life easier for people who travel frequently or those locked out of the commercial web because they live in countries with high rates of fraud. And it’s certainly a better use of your data than badly targeted ads.