Financial institutions are regaining trust lost in the wake of the financial crisis, according to analysis of millions of news and social media sources by Thomson Reuters.

Thomson Reuters’ TRust Index finds that trust sentiment in the world’s top 50 financial institutions held steady in Q3, maintaining last quarter’s return to levels last seen in the summer of 2008.

The TRust Index leverages proprietary data analytics, including Thomson Reuters ASSET4, Thomson Reuters Business Classification (TRBC), Thomson Reuters Datastream, Thomson Reuters I/B/E/S, and Thomson Reuters StarMine Quantitative Models, as well as news and social media sentiment analysis from Thomson Reuters News Analytics and MarketPsych Sentiment Indicators. Harnessing approaches from economics and psychology that support the global financial community in activities ranging from high-frequency trading, equity research, to wealth management, the TRust Index employs advanced algorithms in aggregating unstructured data from 50,000 news sites and 4 million social media channels to generate a score over time of the levels of trust in global banks.

These same tools are used to develop market insights around currencies, regions, commodities, political and weather events. Such insights enable financial professionals to “learn what is happening right now and how they can actually be ahead of the game,” said Asif Alam, global head of machine readable news at Thomson Reuters.

“What we do with data is convert it into a quantitative score and make it into a signal that can then be digested into charts, visuals, and many other forms,” Alam said.

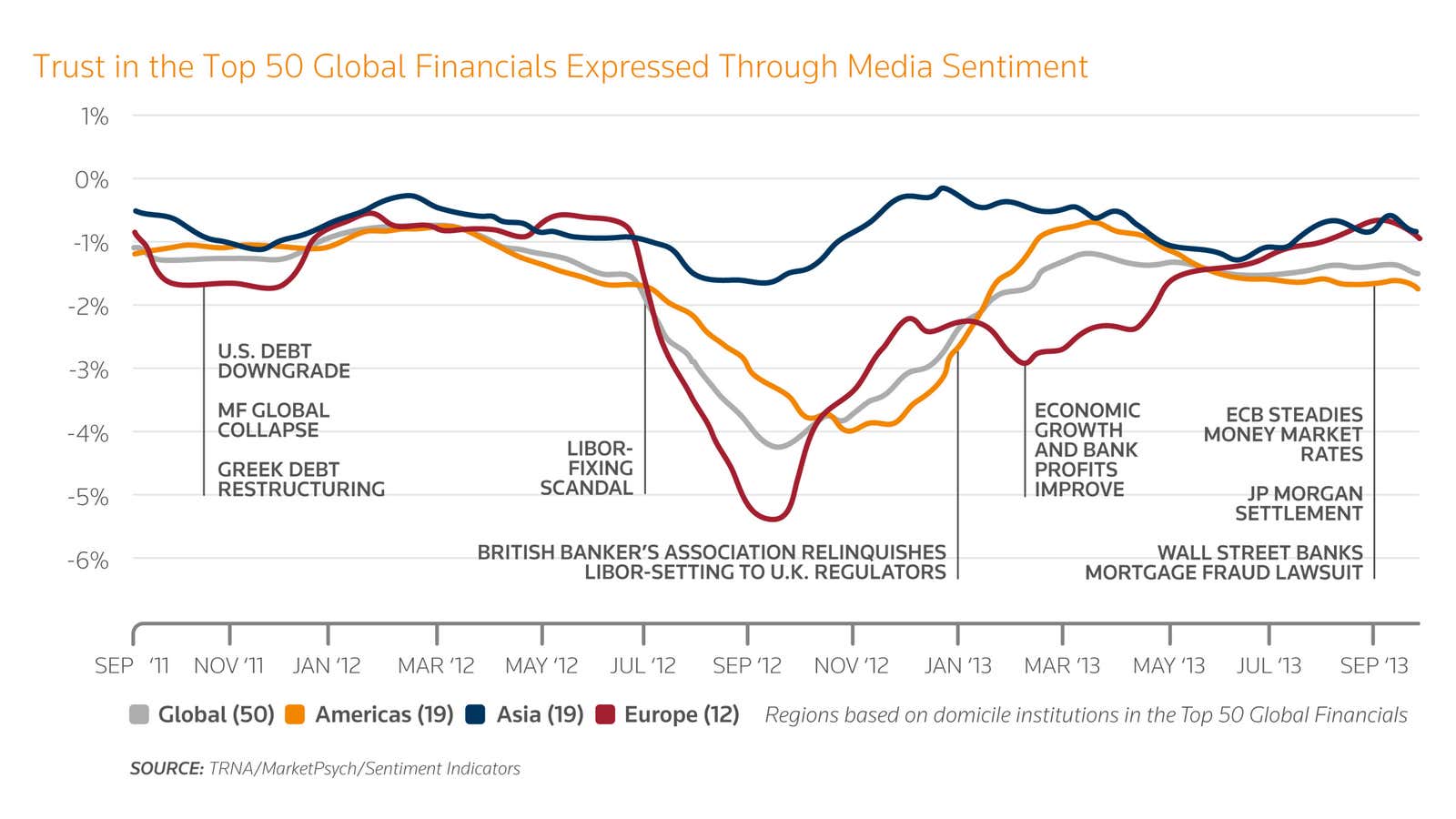

The Q3 trust score of -1.5% for global banks marks a significant improvement since it dipped below -4% following the 2012 LIBOR rate-fixing scandal. The index’s latest scores for the top 50 global financial institutions reflect a more positive outlook, driven by better earnings growth forecasts, stronger balance sheets, and a combined reduction in debt of over $3 trillion since 2008.

This quarter was also the first time since January that European banks–bolstered by signs that interest rates would remain low and a positive reaction to bank privatization in the United Kingdom–earned more favorable trust scores than their American counterparts. Trust in the 12 European financial institutions Thomson Reuters tracks reached -1.0% in the third quarter of 2013. This matches the overall trust score of 19 Asian institutions, which have consistently scored best this year, despite recent concerns about shadow banking in China and wavering economic growth.

Trust in American banks–weighed down by fraudulent mortgage business litigation against Bank of America and J.P. Morgan–remains lowest among the geographic regions measured on the Index at -1.6%.

Find out more about the Index’s findings on the continued proliferation of regulatory activity and read the full Q3 TRust Index report here.

This article was written on behalf of Thomson Reuters by the Quartz marketing team and not by the Quartz editorial staff.