You might have heard that Twitter isn’t profitable. But that’s not what its executives are telling investors as the company hawks its IPO at meetings that began today in New York.

Twitter has invented an accounting metric that, after ignoring some of its largest expenses, shows the company is turning a profit. Mike Gupta, the chief financial officer, focused on that metric in his presentation kicking off Twitter’s “road show” for investors ahead of its initial public offering next month.

“We have maintained our profitability over the last six quarters,” Gupta said.

The metric he’s using is “adjusted EBITDA.” EBITDA (earnings before interest, taxes, depreciation, and amortization) is a common, if disputed, way to calculate profits because it excludes items that are often based on the company’s history rather than current operations. But Twitter took things a step further with adjusted EBITDA, which also excludes the stock it gives to employees.

That is quite a thing to ignore. Twitter spent more than $79 million on stock-based compensation in the first nine months of this year, or more than 14% of all its expenses. It also has nearly $200 million in unrecorded costs for stock that was promised to employees and will vest over the next three years. Not to mention that Twitter intends to pay its executives largely in stock. (CEO Dick Costolo only makes a base salary of $14,000 a year, for instance.)

So it’s no wonder that, once you ignore those expenses, the company turns profitable, making $21.2 million last year and $30.7 million in the first three quarters of this year. In reality, when all expenses are taken into account, Twitter lost $79.4 million and $133.9 million in those respective periods.

Twitter says its management team prefers adjusted EBITDA as a way of assessing the company’s performance because the metric can “help identify underlying trends in our business that could otherwise be masked” by expenses like stock-based compensation.

OK! But Twitter doesn’t ignore the cash salaries it pays to employees or the expense of feeding its flock in the company’s well-stocked cafeteria. Stock is just another form of compensation—and for tech companies like Twitter, an enormous expense. The company’s use of adjusted EBITDA has been deemed “shady” by Fortune and a “baloney number” by Bloomberg.

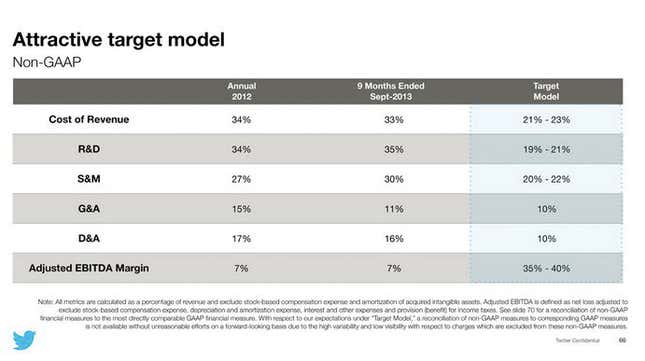

But that’s not stopping Gupta, who told investors that Twitter aims to increase its adjusted EBITDA margin from 7.3%, where it stands now, to between 35% and 40% over an unspecified period. That would be impressive growth, but it doesn’t necessarily mean the company would be out of the red by any reasonable measure.