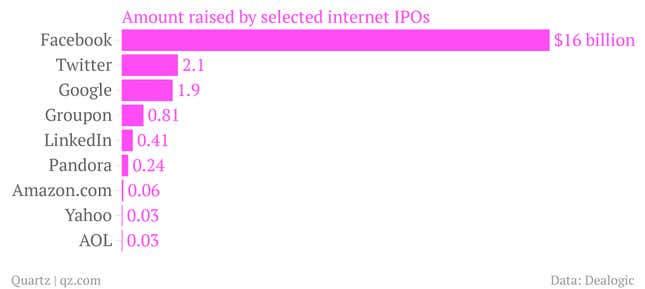

It’s official: Twitter’s initial public offering was the second largest in history for a US internet company, in terms of the amount of money raised.

Twitter’s underwriting banks exercised their option to sell an additional 10.5 million shares in the IPO, in addition to the 70 million already planned, according to a source involved in the offering. The shares were sold for $26 each.

That brings Twitter’s total proceeds to $2.09 billion, more than the $1.9 billion that Google raised in 2004, though still much less than Facebook’s IPO, which raised $16 billion last year. (However, if you take inflation into account, Google’s IPO raised $2.36 billion, maintaining its place as the second-largest internet IPO in the US.)

The additional shares sold in Twitter’s IPO are known as the “green shoe” or over-allotment option. The Wall Street Journal has a good explanation of how that works.