Mexicans aren’t feeling the love from their friends and family living abroad.

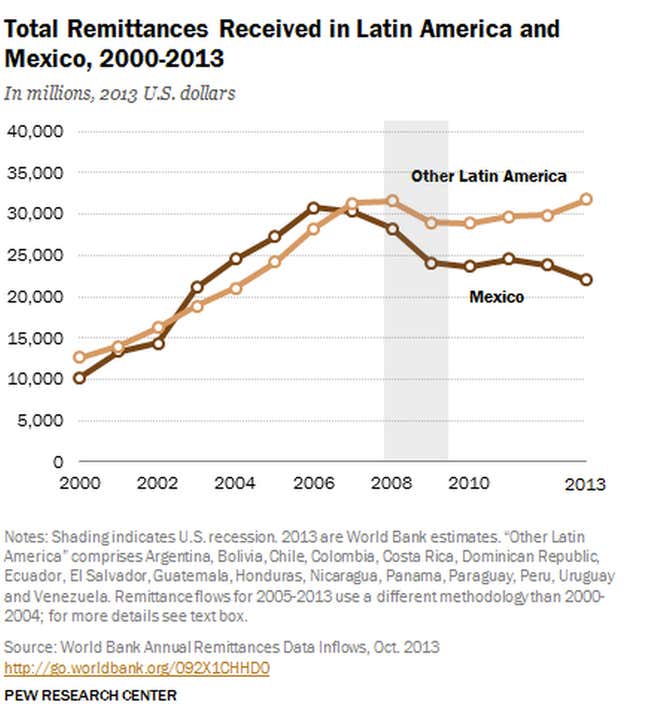

Remittances to Mexico have fallen by 29% since 2006, according to a report released by Pew Research and based on World Bank data. This bucks the trend for the rest of Latin America, where remittances have recovered after dropping during the recession.

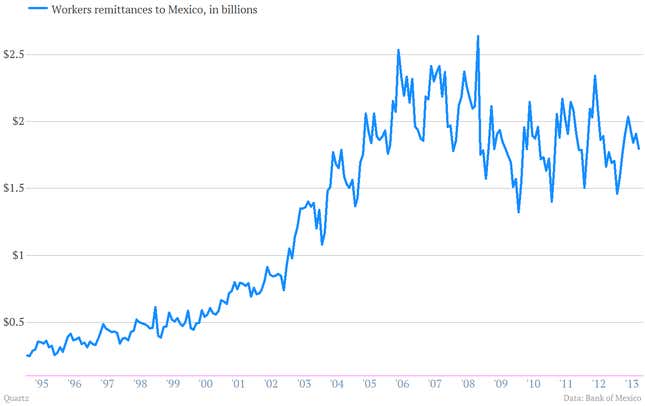

The dwindling cash flow is heavily tied to the US economic slump. US residents are responsible for 98% of remittances to Mexico, according to the report. When the financial crisis hit, a handful of affected industries like construction that lean on Mexican immigrant labor dragged on the cash flowing back to Mexico. Have a look at what has happened to remittances since 2008:

Lately the tie between housing starts and remittances has eased, but it’s still substantial. That could be because former construction workers are moving to other industries (unemployment among Mexican migrants has been falling).

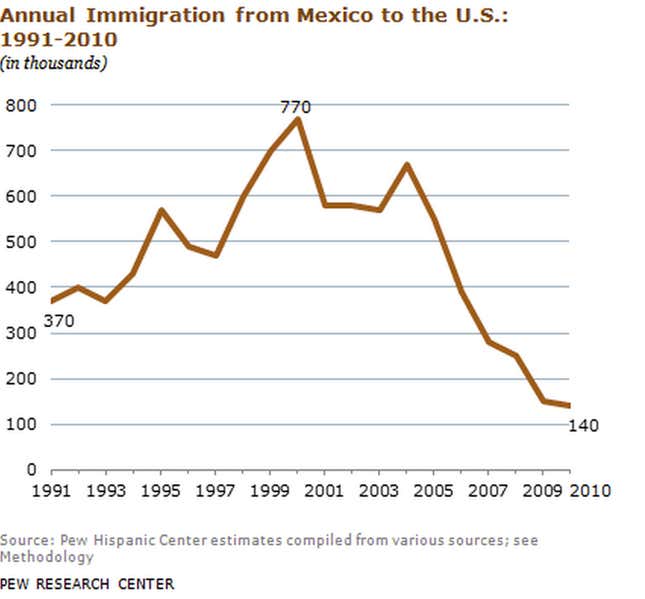

The flow of money to Mexico is also affected by a longer-term migratory shift. The number of Mexicans moving to the US has dropped sharply since the early 2000s. In fact, more people may be headed in the opposite direction, from the US to Mexico.

Remittances to Mexico, which will total an estimated $22 billion in 2013, have traditionally helped fund a number of industries at home. In 2003, they contributed more to Mexico’s economy than tourism or foreign direct investment. And they are key drivers of consumption in the country. But that doesn’t mean the trend is necessarily bad; Mexican GDP has nevertheless grown considerably since 2006. More Mexicans staying home could mean that they see more potential in the opportunities offered by their own economy.