The mutual love affair between China and bitcoin shows no signs of losing steam. Today two related venture capital firms invested $5 million in BTC China, the digital currency’s biggest trading platform, and the value of bitcoins surged to an all-time high, due in part to Chinese demand. But how long before Beijing turns an uneasy eye toward a currency that is explicitly designed to evade government control?

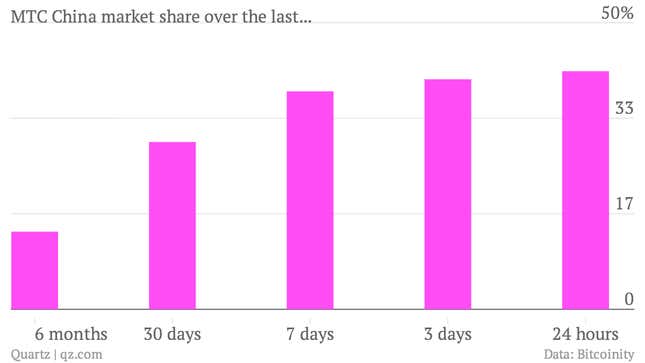

BTC China is the biggest player in what has quickly become the biggest bitcoin market in the world:

The currency itself has experienced volatile spikes and free-falls in the last few years. It suffered a 20% decline in October after the online black market Silk Road, where all trading was done in bitcoins, was taken down by US authorities. Since then, though, bitcoin has made huge gains. On Nov. 17, before news of the investment in BTC China, the price of a single bitcoin climbed from $490 to $569—a 16% increase—and had reached a new high of $608 this afternoon (Nov. 18) in Asia. Here’s its price and trading volume for the last 24 hours on Mt Gox, one of the biggest bitcoin exchanges:

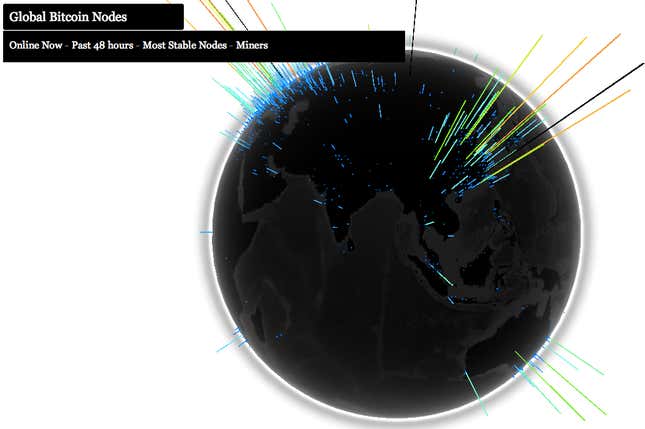

China now makes up more than 50% of the world’s daily bitcoin turnover, according to the data site Bitcoinity, and the eye-catching graphic at the top of this post shows that China is now a major locus of bitcoin nodes—the high-powered computers that serve as hubs for the decentralized network on which bitcoins are tracked and exchanged.

As Quartz has reported, China and bitcoin are an ideal match for a host of reasons. In particular, bitcoin appeals to Chinese investors who cannot freely trade the renminbi because of government regulations, and the hype has been fanned by positive state-run media reports about the currency—even after the collapse of a trading platform called Global Bond Limited, which turned out to be a swindle, as the New York Times reported today. There also aren’t many places yet to spend bitcoins in China, although online search firm Baidu accepts them, along with a Shanghai real estate developer.

The Chinese government is in the progress of rolling out financial reforms that could eventually allow Chinese investors to freely trade renminbi and make offshore investments. Bitcoin, however, threatens to short-circuit these gradual changes. Chinese bitcoin holders could conceivably use bitcoin to speculate on foreign currency and put their investments offshore.

But some argue that the Chinese government has more to gain from bitcoin’s rise than it has to lose. Jonathan Stacke, a writer for the digital currency research site The Genesis Block, wrote in May that bitcoin could conceivably chip away at the US dollar’s status as a reserve currency. That’s a long-held goal of the Chinese government, which gave bitcoin its de facto blessing with glowing reports on the state-run broadcaster CCTV and the Communist Party-controlled People’s Daily newspaper.

Whatever its true stance, China isn’t the only country conflicted about bitcoin. A US Senate committee is scheduled to consider the “potential promises and risks” of the digital currency in a hearing today, and the Department of Justice and Securities and Exchange Commission are planning to testify that decentralized payment systems like bitcoin “offer legitimate financial services.” That qualified endorsement is probably driving some of the recent bitcoin gains.

The US Federal Reserve Bank of Chicago concluded in a research paper earlier this month that bitcoin “is free of the power of the state, but it is also outside the protection of the state.” However, the scrutiny of the state—be it the US, China, or anywhere else—is steadily increasing.