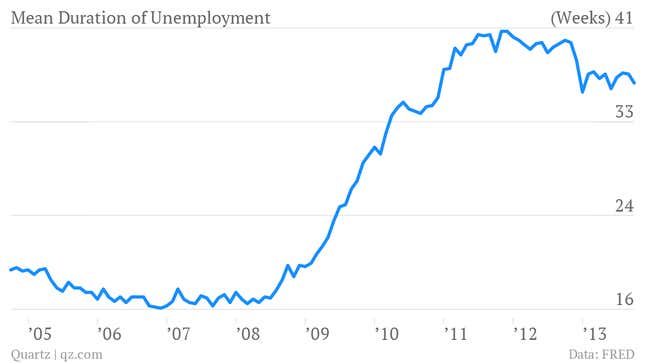

In its recent minutes, it appears that the US Federal Reserve has been preparing to taper. Yet given the outsize role the Fed has played in supporting the recovery, that would almost certainly be a mistake. Unemployment has been ticking down, yet long-term unemployment is still very high and labor force participation is still low. While the recovery has made progress, it is still not guaranteed, and the Fed’s accommodation will be critical if the economy is to secure the gains it has made.

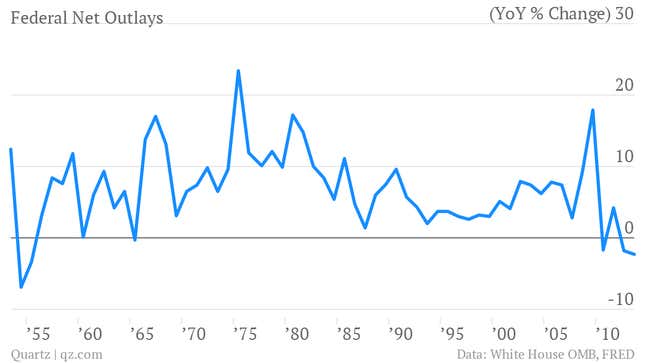

The key to understanding the argument is to understand a concept central to economic analysis: the counterfactual. Counterfactuals are alternative histories of what could have been. In military history they are the answers to questions like “What would have happened if Napoleon had won the battle of Waterloo?” In this case, the key counterfactual is “What would have happened to the economy if the Fed hadn’t done quantitative easing?” Throughout this recovery, the federal government has been tightening its belt. Indeed, as MKM Partners chief economist Michael Darda has repeatedly noted, net government outlays have fallen for two consecutive quarters during this recovery, making the recent bout of austerity the biggest since the Korean War demobilization. Had the Fed not offset such a large contraction in spending, the US almost certainly would have been sent into another recession.

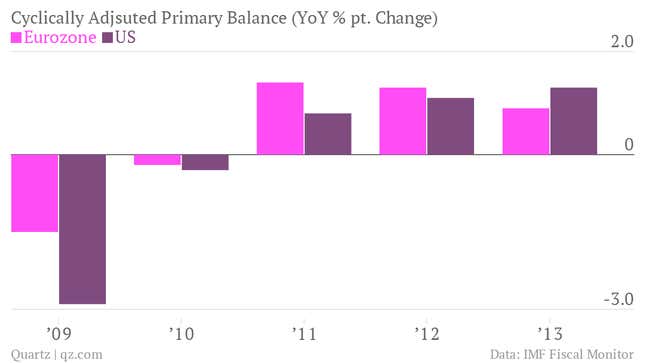

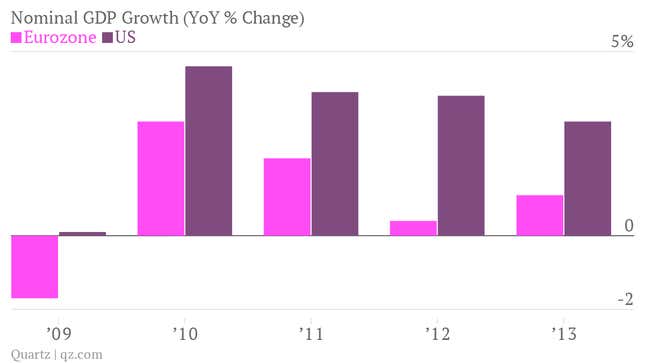

To get an idea of how bad it could have been, one need only look to the Euro zone. As measured by changes in Cyclically Adjusted Primary Balances, a measure of whether of government spending that adjusts for the business cycle, both the US and Europe have endured savage government austerity. Yet nominal GDP growth in the US has been steady while Europe’s has collapsed.

The biggest difference? Monetary policy. While the Fed been a proponent of holding down interest rates throughout the recovery, the European Central Bank actually raised rates in response to inflation fears in 2011, and just recently lowered its benchmark interest rates to 0.25%.

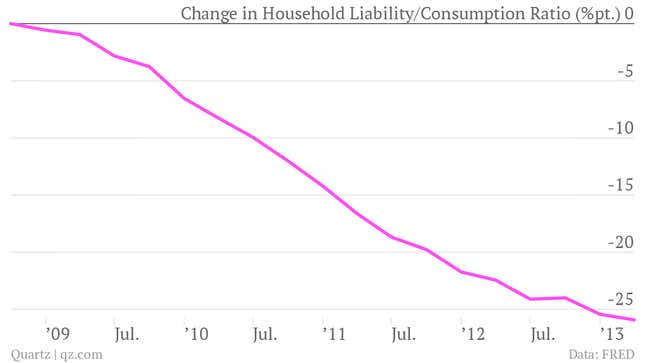

This experience has also shown that deleveraging isn’t a roadblock to monetary policy. From the peak of the crisis, the ratio of household liabilities to annual consumption fell around 26 percentage points from its peak of 1.44 in the second quarter of 2004. Theoretically, this should have meant that the drawdown in federal spending should have been a double whammy—both by directly lowering spending as well as hurting balance sheets. Yet the recovery barely budged, showing that even when people are paying down their debts, monetary policy can still help.

During Janet Yellen’s confirmation hearings, many Republican senators asked questions along the lines of “hasn’t the Fed done enough?” But the real question should be: “Why hasn’t the Fed done more?” The Fed has done enough to keep the economy above water, but more is needed for the labor markets to absorb the long-term unemployed.

The fact that the economy has done so well despite widespread deleveraging and a drawdown in government spending is a testament to the power of the Fed, even when it has been unable to use its favored tools. But given that power, the Fed has the responsibility to support the recovery with continued monetary easing.