For millions of fans, the agonizing wait for the return of the hit detective show Sherlock is over. The BBC broadcast the first episode of the third season at 9pm (GMT) on Jan. 1. A few hours later, Sherlock hit the Chinese internet via Youku, China’s biggest online streaming site. In less than 24 hours, it’s gotten 4.72 million views (link in Chinese). But US fans half way around the world aren’t as lucky: The show’s US premiere is set for Jan. 19.

Why is the show giving preference to Chinese fans? Probably because Youku and the BBC need to beat the Chinese pirates. Illegal streaming sites in China can upload a just-aired show within hours of its international premier. Once viewed on those sites, users have little reason to visit Youku.

This strategy is actually becoming fairly standard practice. In July 2013, Youku aired Lionsgate’s Orange is the New Black just 24 hours after it went live on US Netflix.

Sherlock’s swift debut was even more critical than the newer show Orange is the New Black. “Curly Fu” and “Peanut,” as Sherlock and Watson are nicknamed by adoring fans, have already won a massive Chinese following, including reams of gay-themed fan fiction, as this Foreign Policy article explains.

Even the speediest pirates couldn’t upload an illegally downloaded recording of the episode in time to draw desperate viewers away from Youku. BBC is likely keen to cooperate because China is a key part of its international licensing strategy; if it loses Youku contracts, there are few other candidates with the money needed to license its shows.

That’s an alignment of interests that eludes Hollywood film studios. The government protects domestic films by allowing only 34 foreign films a year to be screened for a percentage of ticket sales. Government-run distributors take a hefty cut of ticket sales (and sometimes refuse to pay) and have minimal incentive to prevent stores from selling pirated DVDs or merchandise.

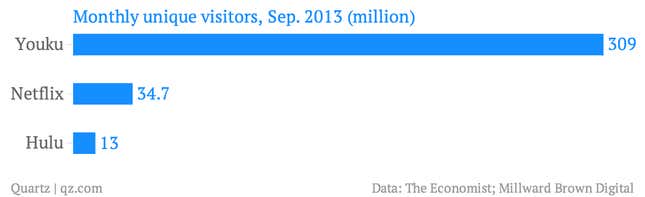

The strategy forged by Youku and its foreign TV studio partners seems to be working. The site gets an insane amount of traffic, in no small part because Youku viewers have thronged to shows like Masters of Sex, Downton Abbey, Walking Dead, Homeland and Vampire Diaries. (Besides Western shows it’s also licensed wildly popular shows from Taiwan, Hong Kong and South Korea.)

To attract advertisers, Youku needs to keep that traffic up—even if it hurts margins. “Companies like Youku have spent a lot of money on purchasing American or English TV shows,” Yi Zongting, an analyst at Beijing-based Entgroup, told the Hollywood Reporter, “but the goal is to accumulate the audience [now]—the profit is still a long-term bet.”

And not at all a sure one, particularly given that Youku currently faces little competition. If, for example, China’s rigidly controlled TV content started offering more compelling options, that could change. For now, though, Youku and its foreign partners are in the clear. Chinese TV channels feature a sedative array of costume dramas, screwball comedies and usually lame reality shows. Hardly a match for Curly Fu and his “cute wife.”