This could really be the year. After years of post-crisis malaise, the stars look to be aligning for the US economy in 2014. Here’s why, according to Wall Street’s economy watchers.

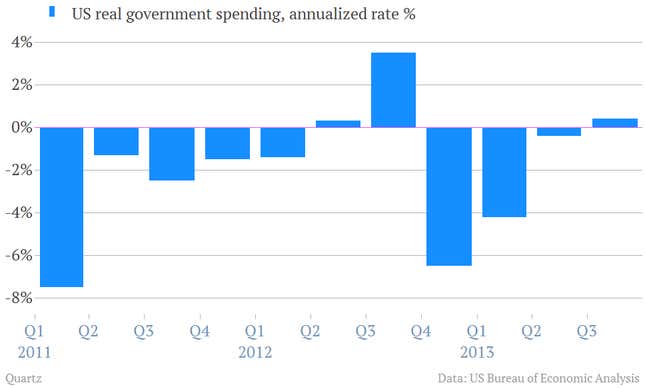

1. Government austerity won’t be as much of a drag on growth.

“The impact of higher tax rates and sequestered government spending was a headwind to the economy in 2013, but should prove less onerous this year. That alone should give the private sector more breathing room to push forward the expansion.”

-J.P. Morgan Economic Research

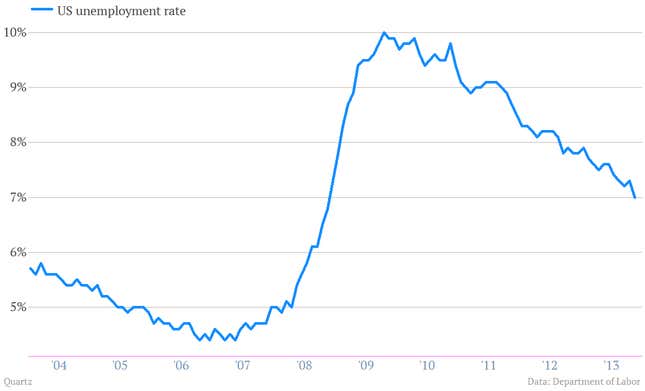

2. Interest rates will stay low by historical standards.

“The Federal Reserve is likely to conclude its QE3 program in late 2014. But we still see no hikes in short-term interest rates until early 2016 … Reasons for a continued low-rate policy include below-target inflation [and] significant labor market slack beyond the headline unemployment rate…”

-Goldman Sachs Economics Research

3. The US labor market is showing real momentum.

“Our baseline forecast is associated with monthly gains in nonfarm payrolls averaging 175,000 to 200,000, on net, over that period and an unemployment rate that drifts down to 6-1/2 percent on the cusp of Q4 2014 and 6.0 percent by mid-2015.”

-Morgan Stanley US economics

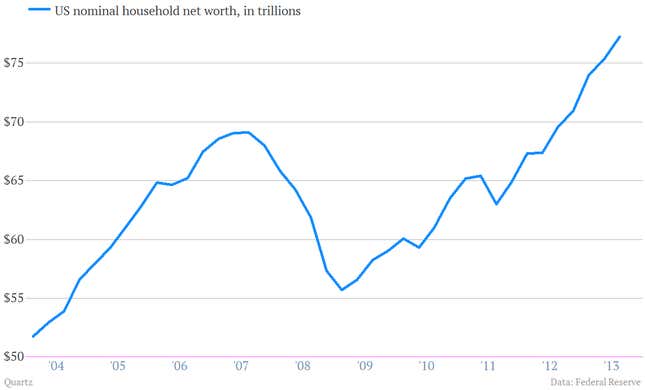

4. Americans are feeling wealthier…

“Perhaps the largest upside risk to the US outlook however comes from the astounding estimated $8.2 trillion surge in household wealth, partly from booming equities but also owing to a strong 12% gain in house prices. Half of this increase has come in 2H13 and so, given typical lags, will likely continue providing a significant boost to spending in early 2014.”

-J.P. Morgan Economic Research

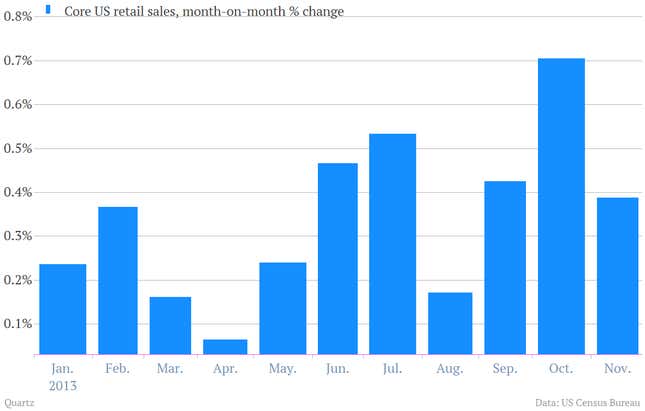

5. And they look like they want to spend.

“In the US, we look for real consumer spending growth to improve in 2014 as the negative effects on spending of the 2013 tax increases fade and the positive effects of recent gains in household wealth become more pronounced.”

-Barclays Economics Research