The euro zone’s largest economy is the strongest it has been in years. That’s at least the impression one gets from surveys of business managers in Germany.

The latest reading of the influential Ifo business climate survey, published today, beat market expectations and set the highest mark since the middle of 2011. It follows similarly robust surveys of purchasing managers and financial analysts released over the past week.

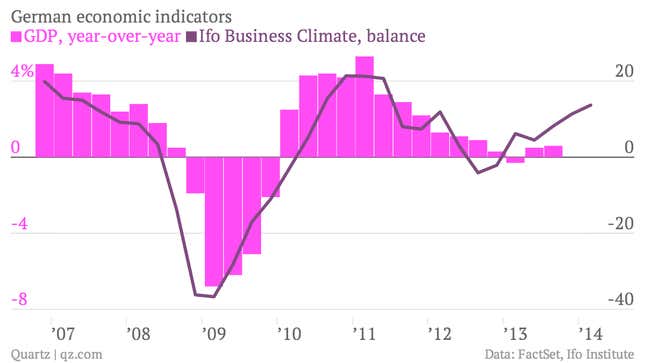

But against this cheery backdrop, actual economic growth in Germany looks remarkably weak. Here is a chart of GDP growth and the Ifo Institute’s index, which have diverged sharply in recent quarters:

There have been few times in recent history when a gap this large has opened up between the Ifo index and GDP growth. The German central bank reckons that economic growth last year was a mere 0.5% (pdf). Things are looking up this year, with growth projected to reach 1.7%, but even that result does not compare too favorably with the country’s recent growth record.

Germany’s export-heavy economy relies on the health of its main trading partners: Sputtering European economies explain much of Germany’s disappointing growth record in recent quarters, while the current jitters in emerging markets are ominous signs for the future. Many emerging markets rely on sophisticated machinery and high-value goods from Germany to power their own export-oriented industries.

Given these headwinds, analysts are warning against reading too much into the “soft” data provided by surveys versus the “hard” stats that measure actual activity. German executives “remain die-hard optimists,” according to one analyst reacting to today’s Ifo report. This either suggests an overdue surge in growth or, as seems to be the case in recent quarters, represents the triumph of hope over experience.