US president Barack Obama asked corporations to “do what you can to raise your employees’ wages” in his annual agenda-setting State of the Union speech on Jan. 28. Japan’s prime minister, Shinzo Abe, has spent the last year asking businesses there to pay workers more.

Neither leader has seen much traction, for obvious reasons: Higher salaries for workers eat into corporate profits, and with high unemployment in the US and low labor force participation in Japan, there isn’t the labor scarcity needed to force companies to pay their workers better. So why are they pursuing this quixotic task?

In a word: deflation.

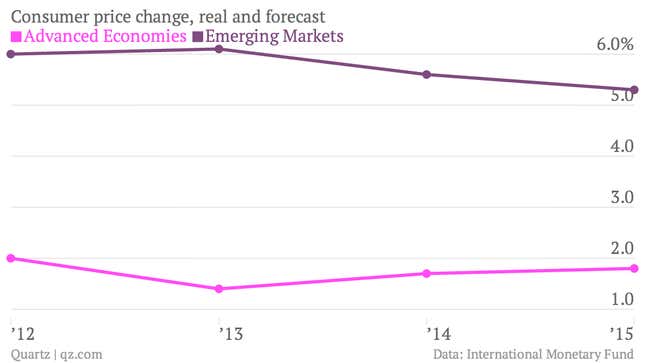

The advanced economies, of which the US and Japan are the two largest, are in the midst of a bout of low inflation—below the 2% target set by both countries’ central banks—that has economists warning of a need for change. The International Monetary Fund’s Christine Lagarde has been beating this drum for the last several months, fearful that slowing inflation will exacerbate the large debt burdens carried by advanced economies and make it harder for corporations to finance their operations. Neither one has good implications for ongoing global growth, especially as emerging markets appear to be the losers in the global hot money game.

Wage increases would help create positive inflation, but equally important, they would ameliorate stagnant incomes seen in both Japan and the US in recent years and goose domestic demand. Japanese wages have been falling since 2000, while US wages still haven’t come close to regaining their pre-crisis highs.