A handful of hedge funds are boasting their best-ever returns in dollar terms in 2013 according to a recent report by LCH Investments (paywall). Stephen Mandel of Lone Pine Capital generated $5.2 billion in returns for his investors last year; with the fund currently worth some $22.7 billion, that’s a roughly 30% return. George Soros’s hedge fund-cum-family-office Quantum Endowment returned $5.5 billion, its second highest dollar figure in 40 years, about a 24% return.

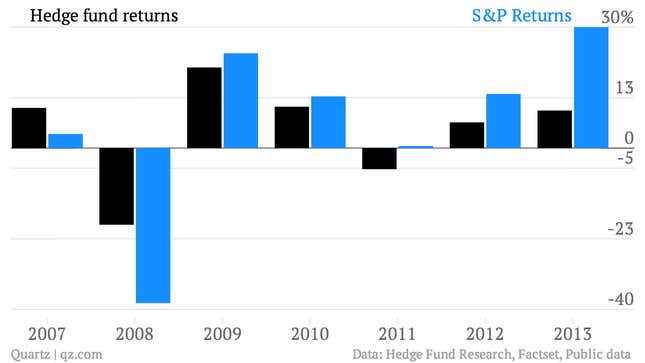

But on average, hedge funds returned only 9.3% in 2013, according to data compiled by Hedge Fund Research. (Though there are several hedge fund indexes that offer slightly different reads on how well the industry did last year.) That means they trailed the S&P 500, which returned roughly 30% last year, by the widest margins since 2005, according to Bloomberg. Bloomberg reported a 7.4% return for the hedge fund group last month, but noted that only 56% of the 2, 257 funds funds it tracks had reported returns, which may account for the difference in HFR’s return stats.

That means hedge fund investors might be better off throwing their money into an S&P 500 stock-tracking index or a similar basket of stocks. That way, investors could save themselves the roughly 2% management fees and 20% return fees that pricey managers charge to oversee client assets. Outside of heavyweights like Soros, lackluster hedge fund performance is more the norm than the exception over the past several years.