Who says mergers and acquisitions can’t create value?

Despite critics of M&A activity, who complain that mergers are often risky, unproductive and destined to fail, Goldman Sachs argues in a recent research note to clients that the best M&A creates a near-oligopoly, and that should be the bank’s goal.

Goldman analysts argue that oligopolies—you know, the ones that foster price strangleholds by whittling down the competition—are “the good kind” of merger. Here are some snippets from the bank’s research note from earlier this week:

“M&A is often assailed as a risky or value-destroying endeavor—e.g., management teams’ empire building, joining incompatible cultures or overpaying for growthy bolt-ons, to name a few common objections.”

“M&A that drives an industry toward oligopoly is the good kind.”

“An oligopolistic market structure can turn a cut-throat commodity industry into a highly profitable one. Oligopolistic markets are powerful because they simultaneously satisfy multiple critical components of sustainable competitive advantage—a smaller set of relevant peers faces lower competitive intensity, greater stickiness and pricing power with customers due to reduced choice, scale cost benefits including stronger leverage over suppliers, and higher barriers to new entrants all at once.”

Goldman’s M&A analysis is mainly arguing for mergers and acquisitions in mature industries, those in which prices are already relatively stable and scale matters more. Remind you of those choice lines from capitalist icon Gordon Gekko in the 1987 film Wall Street?

“Greed, for lack of a better word, is good. Greed is right. Greed works. Greed clarifies, cuts through, and captures, the essence of the evolutionary spirit.”

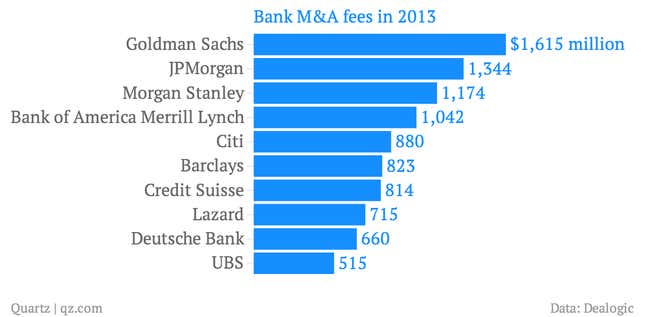

Goldman’s note comes as the global merger machine, which stalled in the aftermath of the global financial crisis, vies to pick up more M&A business this year from cash-flush corporations. No wonder the bank is rationalizing the move; it’s already the global leader in mergers.