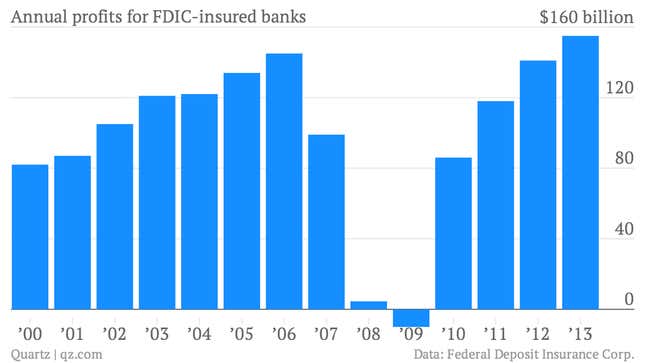

Looking at this key gauge of bank profitability, it’s hard to believe the US banking industry just suffered through the worst economic crisis in a generation.

In fact, American banks are faring better than they ever have, according to data released today by the Federal Deposit Insurance Corp.

America’s banks rang up profits of $154 billion last year. That’s nearly 10% more than the $141 billion in profits reported in 2012. It’s also 6% higher than the pre-crisis peak of $145 billion in profits, which banks posted in 2006.

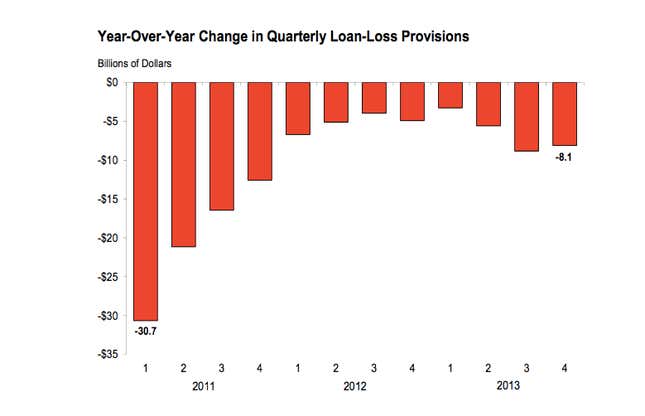

In a prepared statement, FDIC chairman Martin Gruenberg noted that the robust profit recovery was partly driven by financial institutions releasing cash previously earmarked to protect against potential problem loans. Such reserve releases were the “single largest component of the improvement in industry earnings,” he said.

Of course, banks still face headwinds. For example, the boomlet in mortgage refinancing, which generated significant fees for US banks, has lost steam as mortgage rates moved higher in 2013. JP Morgan Chase CEO Jamie Dimon, the head of the largest US bank by assets, seems less than enthused about the prospects (paywall) for economic growth this year.

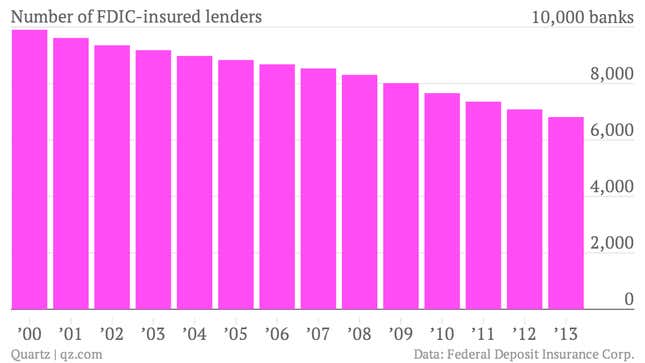

Of course, even if the size of the financial pie isn’t growing exceptionally fast, there are fewer banks to share it. For example, the solid 2014 profit performance comes even as the number of the banks regulated by the FDIC has shrunk dramatically. In other words, despite all the blustering and outrage over too-big-to-fail institutions, fewer lenders control more assets and are ringing up more—even record—profits.