Billionaire hedge fund manager Bill Ackman has staged a two-year war against Herbalife, betting that authorities in the US and other countries like China would ultimately determine the health-products retailer to be an illegal pyramid scheme.

Today Herbalife revealed that it had received a “civil investigative demand” from the Federal Trade Commission (FTC). The regulatory agency’s web site says it uses civil investigative demands to look into possible “unfair or deceptive acts or practices.”

The mere announcement is a much-needed shot in the arm for Ackman’s Pershing Square fund, which has spent nearly $1.2 billion shorting Herbalife shares (i.e., betting that the price will decline). The stock, which was up some 40% since Ackman first announced he was shorting it in 2012, tumbled sharply after the news broke, ending about 7% down on the day’s trading. Herbalife defended itself in a statement on its site:

Herbalife welcomes the inquiry given the tremendous amount of misinformation in the marketplace, and will cooperate fully with the FTC. We are confident that Herbalife is in compliance with all applicable laws and regulations. Herbalife is a financially strong and successful company, having created meaningful value for shareholders, significant opportunities for distributors and positively impacted the lives and health of its consumers for over 34 years.

The fight over Herbalife has been an oftentimes acrimonious battle between Ackman and other prominent investors who have bet that the stock would rise instead of falling. They include Carl Icahn, Dan Loeb (who held his stake for just two weeks) and George Soros (who trimmed his stake recently).

The contentious scene is eerily similar to Ackman’s six-year campaign against speciality insurance companies MBIA and Ambac back in 2007. Ackman eventually scored a $1.1 billion win on those deals, as documented in the book Confidence Game by former Bloomberg reporter Christine Richard.

Today’s news also comes seven months after Ackman threw in the towel on one of his biggest investments, a bullish bet on retailer JC Penney. That cost him nearly $500 million and dinged his reputation.

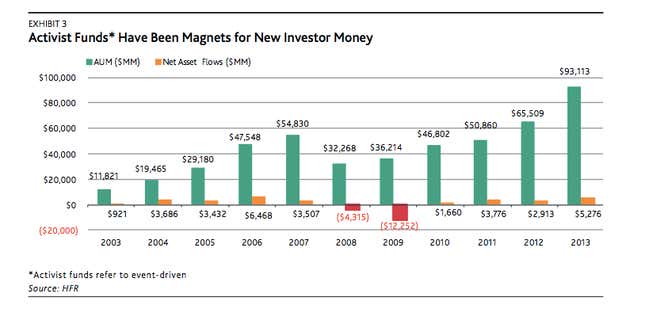

The high-profile jousting of billionaire hedge fund managers may look juvenile, but their antics are bringing the money flooding in. According to a recent Moody’s report, assets under management for activist funds—those that, like Ackman’s, put pressure on companies in an attempt to bring about changes that affect the share price—increased by 42% last year, to $93 billion from $65.5 billion in 2012.