We’re looking at you, Russia.

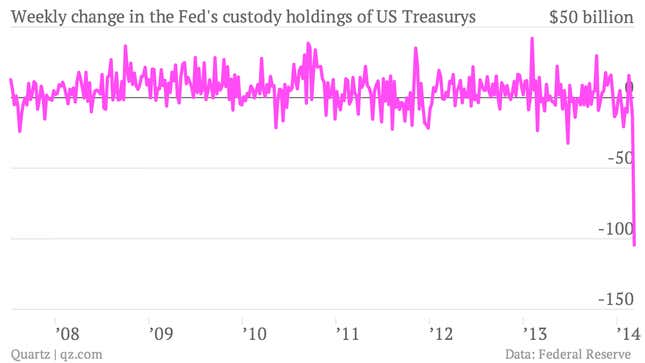

Somebody just yanked $105 billion dollars worth of US government bonds out of the Federal Reserve, according to the latest data from the US central bank.

As you can see, a withdrawal of that scale is pretty much unprecedented. By way of background, the Fed does a lot of things. It sets monetary policy. It regulates banks. And it also is a bank. In fact, the Fed acts something like a trust bank for other foreign central banks, basically taking care of the Treasury bonds and other investments that those foreign central banks want to leave in the US. (That’s what “custody holdings” are.)

But there are times when a country might not want to leave all its assets in the US. Like, say, it’s involved in a major geopolitical standoff and there’s plenty of chatter about freezing assets belonging to its wealthiest citizens. (Note that in the Fed’s custody holdings, though, we’re talking about Russian state assets, not private ones.)

Now it’s important to note that just because these assets were pulled from the Fed doesn’t mean that they were actually sold. If they had been, we’d probably have noticed. Liquid though the US bond market is, if someone dumped more than $100 billion of bonds on it, it would cause a pretty good ripple, which likely would have pushed up government bond yields sharply. Nothing like that has happened over the last week.

So it’s more likely that these Treasurys were just transferred to another, perhaps more neutral, bank. Maybe just for safe-keeping, until all this unpleasantness blows over. Anyway, there’s plenty of speculation along those lines at the moment.