You’d think by now the markets would get the message.

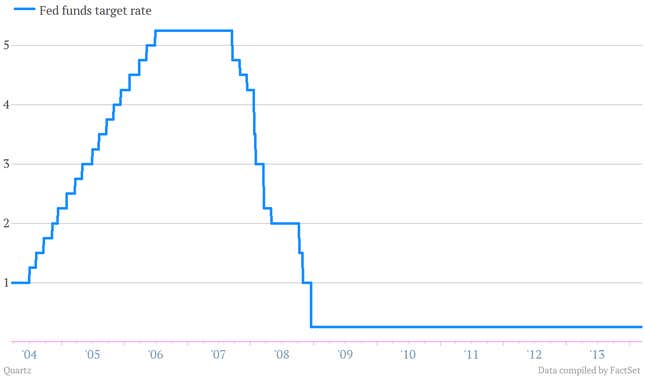

After all, the Fed funds target rate has been parked at almost zero for the last five years.

Still, the US central bank has had to find any number of ways to keep convincing the markets that interest rates are not going to rise for a long, long, long time.

- It started by saying, way back in December 2008, that interest rates would remain exceptionally low “for some time.”

- In March of 2009, it tweaked that language, changing it to “for an extended period.”

- In August 2011, the Fed got a bit more specific, saying that the economy was so weak that it was “likely to warrant exceptionally low levels for the federal funds rate at least through mid-2013.”

- In January 2012, “mid-2013” became “late 2014.”

- In September 2012, “late 2014” morphed into “mid-2015.”

- And in December 2012, the Fed told the markets to forget about the calendar and watch the unemployment rate, declaring that low rates would be needed “at least as long as the unemployment rate remains above 6.5%.”

And now that unemployment has fallen to 6.7% and is expected to keep falling, the Fed is today expected to find yet another way to explain to the markets that interest rates will remain low.

Why? Despite the relatively rapid fall in unemployment recently, the Fed—and the millions of under-and-unemployed—think the economy is still too weak. The signs are everywhere. Low inflation. Sluggish wage increases. And growth still isn’t gangbusters. In other words, the US economy still needs low interest rates, even if we hit that 6.5% unemployment target sometime soon.

And so the Fed will likely find some way to tweak its language, perhaps removing the reference to an unemployment target rate altogether. Here’s a smattering of informed opinion on what the Fed might do.

Deutsche Bank: ”We expect the Fed to abandon its numerical threshold on the unemployment rate and inflation and instead adopt a more qualitative approach toward forward guidance on future interest rate increases.”

J.P. Morgan: ”The statement could begin to reference a desire to see lower levels of part-time employment for economic reasons and in measured marginal attachment to the labor force, such as discouraged workers— in effect, U-6.” (U6 is the broadest measure of unemployment, which includes the underemployed and people not seeking work.)

Goldman Sachs: ”We expect the Committee to move toward a more qualitative description of its forward guidance. We see two options for doing so. The first would be to retain the 6.5% unemployment threshold and add a qualitative description of the Committee’s policy intentions thereafter. The second option would be to switch entirely to qualitative guidance and drop the 6.5% threshold. Either option is possible in our view.”

Barclays: ”We believe the outcome is likely to be something more qualitative, with reference to the need for policy to remain accommodative until there is a more general improvement in labor market conditions, especially while inflation remains below target.”

Jefferies: “We think that that FOMC is headed toward providing guidance that is based on a more holistic approach to the labor market that is devoid of dates or hard numerical threshold levels and, consequently, will be very subjective in nature. This will also give the FOMC significant flexibility.”

As you can see, there’s any number of ways the Fed can tinker with the wording. But after a half decade of low interest rates, the message should be crystal clear: They’re staying.