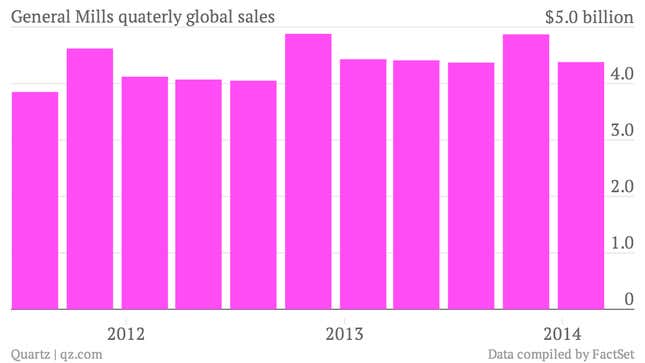

The numbers: Not great. Global cereal giant General Mills reported third-quarter profits of $410.6 million, roughly 3% more than the same period last year. But sales fell 1.2% to $4.38 billion.

The takeaway: Cold weather is bad for cereal makers, too. General Mills specifically blamed this year’s winter for pinching its third-quarter productivity. ”We lost 62 days of production…Trucks could not move, and the rail system becomes less efficient,” CEO Ken Powell explained in the company’s earnings call. Unlike restaurants and eateries, which typically bemoan poor weather because it keeps people at home and away from their menus, cereal and snack companies like General Mills don’t like cold stints because it hurts them on the back end. But the problem is compounded by the fact that General Mills actually needs the traffic to stores and restaurants too, so outlets can sell its cereal, snack bars, and other food products. Powell cited ”fewer trips to restaurants; and then of course in schools and universities which were closed, they are just serving fewer meals in cafeterias—and those sales are clearly lost.”

What’s interesting: The US market seems to be souring a bit on cereal. General Mills’ revenue fell by nearly 2% in the US. Part of that is weather-related. “This year’s severe winter weather dampened sales performance across the food industry, and third-quarter results for our U.S. Retail and Convenience Stores and Foodservice segments reflect that disruption,” Powell said in a statement. But part of that is also due to weaker demand, which has been particularly poor in developed markets, like the US. General Mills isn’t the only breakfast behemoth to feel the strain; Kellogg’s, the world’s largest maker of breakfast cereal, noted a similar struggle earlier this month. After the company’s US morning foods business sales fell 4% in the fourth quarter, CFO Ronald Dissinger told investors he expects “that the sales trends we’ve seen in several of our businesses in 2013 will continue into 2014 and first-quarter sales could be down slightly.”