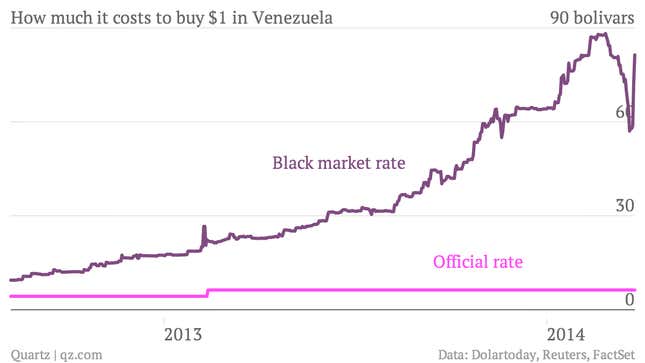

Venezuela’s new, legal currency market, the Sicad II foreign exchange platform, was supposed to curb the country’s appetite for illegal US dollars, but so far, it seems to be doing just the opposite. The rate for buying black market US dollars fell from nearly 90 bolivars to the dollar to about 58 over the past month, but it has jumped by almost 40% since the new way to buy greenbacks was launched yesterday morning. Buying US dollars in Venezuela is actually fairly complicated. There are at least four different official rates (pdf): one for exchanging money to be used while traveling abroad; another for corporations; another, using the new currency market, for individuals hoping to save using US dollars; and then the country’s official rate, which is used for essential imports, and over 85% of the country’s foreign exchange needs.

It’s the fifth rate—the black market rate—for US dollars that’s most important to monitor, since it’s the best indicator of what Venezuelans actually think their currency is worth. The falling black market rate in the last month indicates some excitement about the launch of the new currency market, but that excitement seems to have run dry, perhaps because the trade hasn’t been as free as expected.

“The only way to make the black market disappear is to allow free legal trading in dollars,” Henkel Garcia, director of Caracas-based consultancy Econometrica, told Bloomberg. “It appears the government is placing some restrictions on the operation of the new platform, which is fueling demand for the black dollar again.”

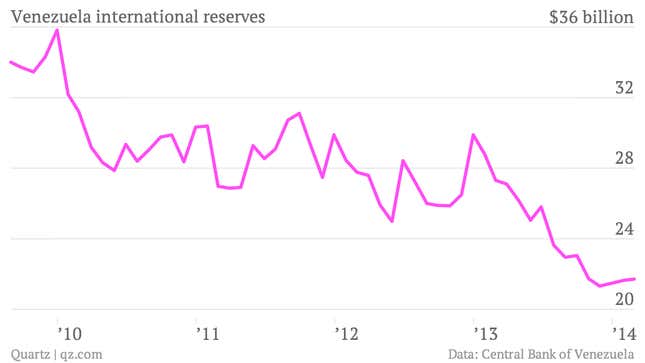

Allowing locals to buy US dollars at will is easier said than done in Venezuela, because the country is running dangerously low on American currency. The country’s international reserves have tumbled from nearly $35 billion in 2009 to barely $20 billion today (for comparison, Colombia has nearly $45 billion). The scarcity of dollars in Venezuela has both led to and exacerbated a number of problems, including sporadic hyperinflation, rampant basic goods shortages, and even the withholding of billion of dollars from international airlines.